Answered step by step

Verified Expert Solution

Question

1 Approved Answer

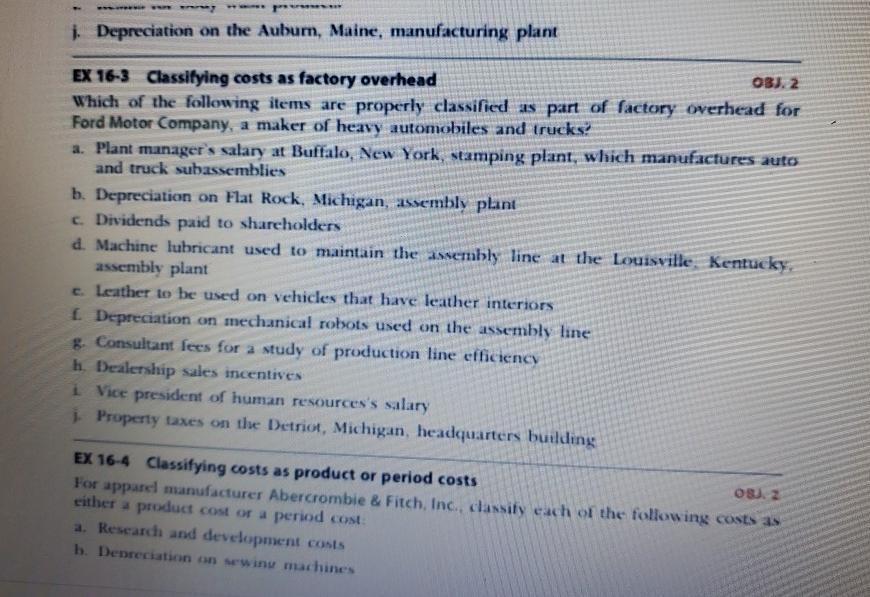

j. Depreciation on the Auburn, Maine, manufacturing plant EX 16-3 Classifying costs as factory overhead OBJ. 2 Which of the following items are properly

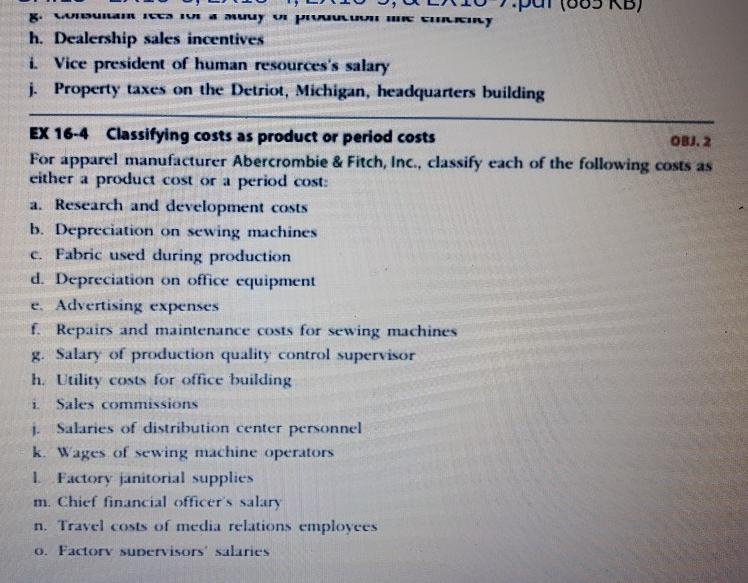

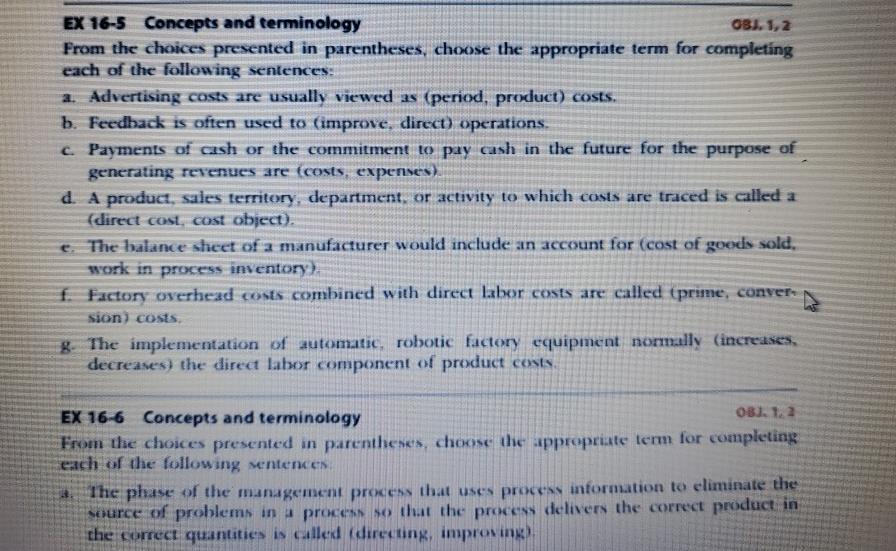

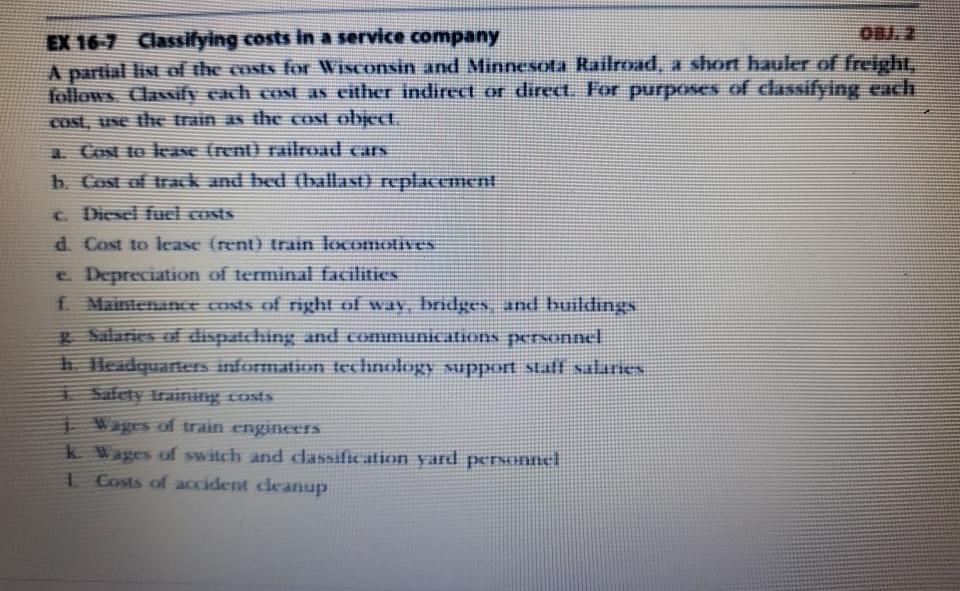

j. Depreciation on the Auburn, Maine, manufacturing plant EX 16-3 Classifying costs as factory overhead OBJ. 2 Which of the following items are properly classified as part of factory overhead for Ford Motor Company, a maker of heavy automobiles and trucks? a. Plant manager's salary at Buffalo, New York, stamping plant, which manufactures auto and truck subassemblies b. Depreciation on Flat Rock, Michigan, assembly plant c. Dividends paid to shareholders d. Machine lubricant used to maintain the assembly line at the Louisville, Kentucky, assembly plant e. Leather to be used on vehicles that have leather interiors f. Depreciation on mechanical robots used on the assembly line g. Consultant fees for a study of production line efficiency h. Dealership sales incentives i Vice president of human resources's salary j. Property taxes on the Detriot, Michigan, headquarters building EX 16-4 Classifying costs as product or period costs OBJ. 2 For apparel manufacturer Abercrombie & Fitch, Inc., classify each of the following costs as either a product cost or a period cost: a. Research and development costs b. Depreciation on sewing machines 8. Consumana y pro HIRE CHRIRY h. Dealership sales incentives i. Vice president of human resources's salary j. Property taxes on the Detriot, Michigan, headquarters building EX 16-4 Classifying costs as product or period costs OBJ. 2 For apparel manufacturer Abercrombie & Fitch, Inc., classify each of the following costs as either a product cost or a period cost: a. Research and development costs b. Depreciation on sewing machines c. Fabric used during production d. Depreciation on office equipment e. Advertising expenses f. Repairs and maintenance costs for sewing machines g. Salary of production quality control supervisor h. Utility costs for office building L Sales commissions j. Salaries of distribution center personnel k. Wages of sewing machine operators 1 Factory janitorial supplies m. Chief financial officer's salary n. Travel costs of media relations employees o. Factory supervisors' salaries EX 16-5 Concepts and terminology OBJ. 1,2 From the choices presented in parentheses, choose the appropriate term for completing each of the following sentences: a. Advertising costs are usually viewed as (period, product) costs. b. Feedback is often used to (improve, direct) operations. c. Payments of cash or the commitment to pay cash in the future for the purpose of generating revenues are (costs, expenses). d. A product, sales territory, department, or activity to which costs are traced is called a (direct cost, cost object). The balance sheet of a manufacturer would include an account for (cost of goods sold, work in process inventory). f. Factory overhead costs combined with direct labor costs are called (prime, conver sion) costs. g. The implementation of automatic, robotic factory equipment normally (increases, decreases) the direct labor component of product costs. EX 16-6 Concepts and terminology OBJ. 1. 2 From the choices presented in parentheses, choose the appropriate term for completing each of the following sentences. The phase of the management process that uses process information to eliminate the source of problems in a process so that the process delivers the correct product in the correct quantities is called (directing, improving). EX 16-7 Classifying costs in a service company OBJ. 2 A partial list of the costs for Wisconsin and Minnesota Railroad, a short hauler of freight, follows Classify each cost as either indirect or direct. For purposes of classifying each cost, use the train as the cost object. a. Cost to lease (rent) railroad cars b. Cost of track and bed (ballast) replacement c. Diesel fuel costs d. Cost to lease (rent) train locomotives e. Depreciation of terminal facilities f. Maintenance costs of right of way, bridges and buildings g. Salaries of dispatching and communications personnel h. Headquarters information technology support staff salaries Safety training costs Wages of train engineers k. Wages of switch and classification yard personnel I Costs of accident cleanup

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To provide you with a detailed stepbystep answer for each exercise in the images I will go over each section one by one EX 163 Classifying costs as factory overhead We will classify the costs based on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started