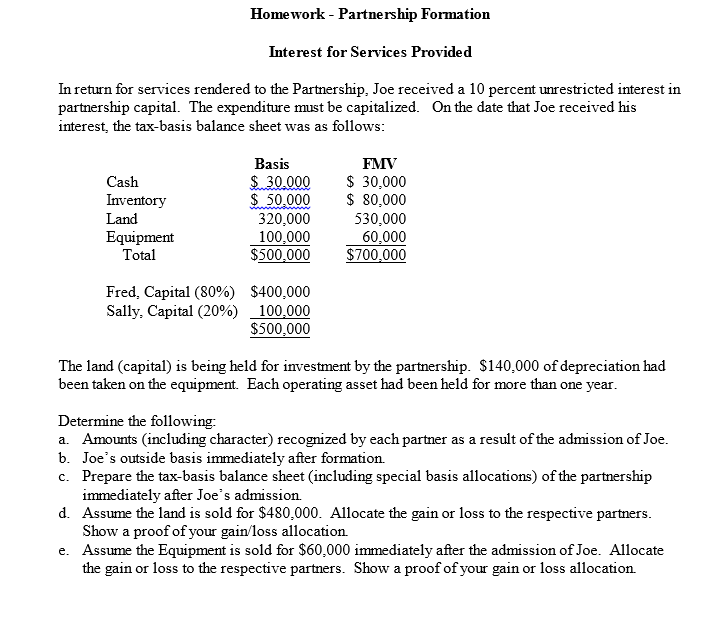

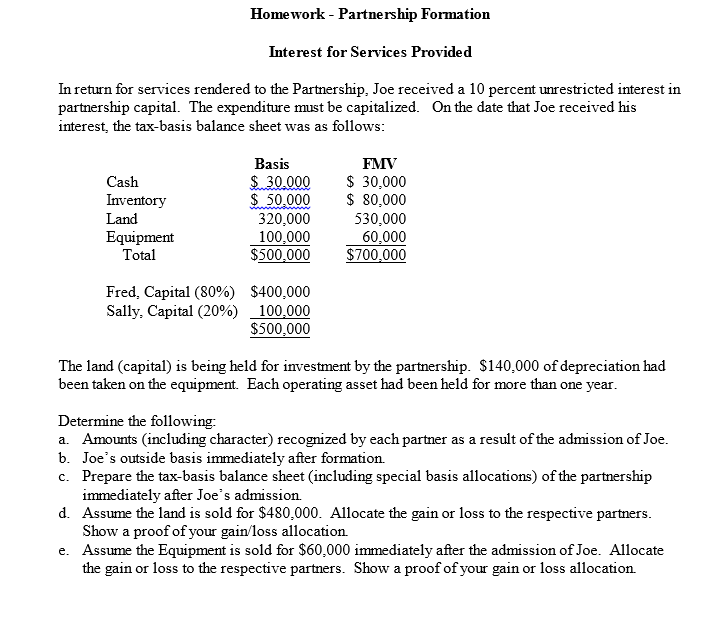

Homework - Partnership Formation Interest for Services Provided In return for services rendered to the Partnership, Joe received a 10 percent unrestricted interest in partnership capital. The expenditure must be capitalized. On the date that Joe received his interest, the tax-basis balance sheet was as follows: Cash Inventory Land Equipment Total Basis $ 30.000 $ 50,000 320,000 100,000 $500,000 FMV $ 30,000 $ 80,000 530,000 60,000 $700.000 Fred. Capital (80%) $400,000 Sally, Capital (20%) 100,000 $500,000 The land (capital) is being held for investment by the partnership. $140,000 of depreciation had been taken on the equipment. Each operating asset had been held for more than one year. Determine the following: a. Amounts (including character) recognized by each partner as a result of the admission of Joe. b. Joe's outside basis immediately after formation. c. Prepare the tax-basis balance sheet (including special basis allocations) of the partnership immediately after Joe's admission d. Assume the land is sold for $480,000. Allocate the gain or loss to the respective partners. Show a proof of your gain/loss allocation. e. Assume the Equipment is sold for $60,000 immediately after the admission of Joe. Allocate the gain or loss to the respective partners. Show a proof of your gain or loss allocation Homework - Partnership Formation Interest for Services Provided In return for services rendered to the Partnership, Joe received a 10 percent unrestricted interest in partnership capital. The expenditure must be capitalized. On the date that Joe received his interest, the tax-basis balance sheet was as follows: Cash Inventory Land Equipment Total Basis $ 30.000 $ 50,000 320,000 100,000 $500,000 FMV $ 30,000 $ 80,000 530,000 60,000 $700.000 Fred. Capital (80%) $400,000 Sally, Capital (20%) 100,000 $500,000 The land (capital) is being held for investment by the partnership. $140,000 of depreciation had been taken on the equipment. Each operating asset had been held for more than one year. Determine the following: a. Amounts (including character) recognized by each partner as a result of the admission of Joe. b. Joe's outside basis immediately after formation. c. Prepare the tax-basis balance sheet (including special basis allocations) of the partnership immediately after Joe's admission d. Assume the land is sold for $480,000. Allocate the gain or loss to the respective partners. Show a proof of your gain/loss allocation. e. Assume the Equipment is sold for $60,000 immediately after the admission of Joe. Allocate the gain or loss to the respective partners. Show a proof of your gain or loss allocation