Answered step by step

Verified Expert Solution

Question

1 Approved Answer

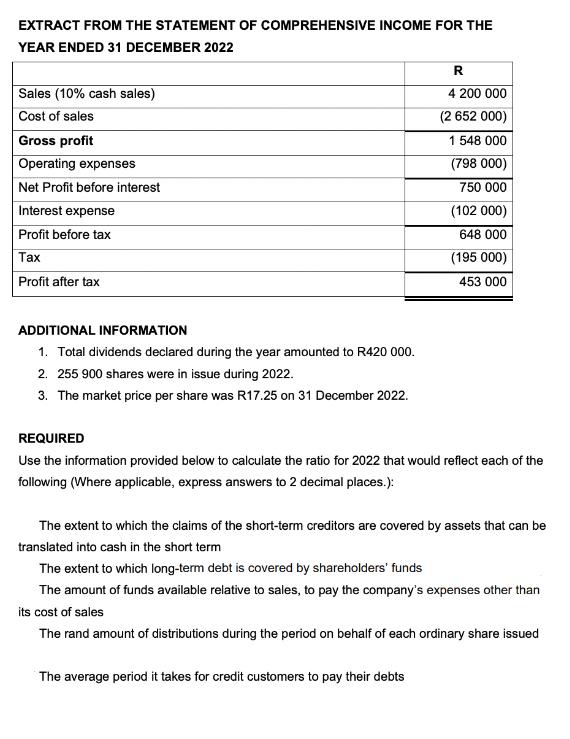

EXTRACT FROM THE STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2022 Sales (10% cash sales) Cost of sales Gross profit Operating

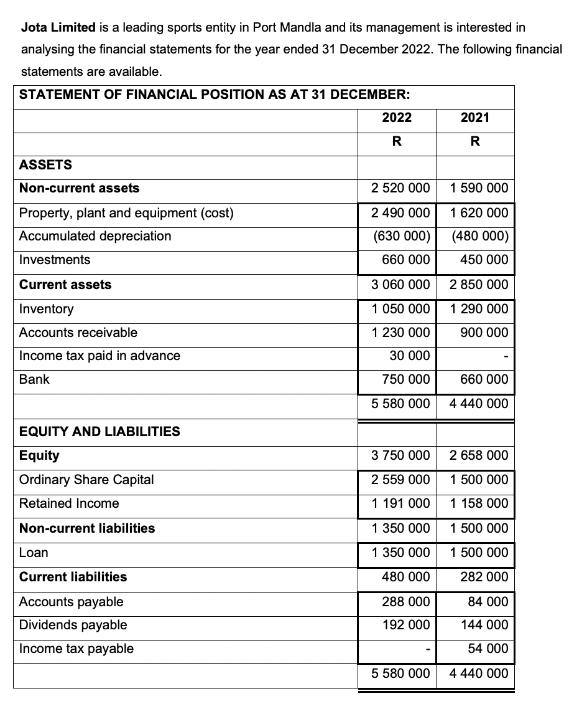

EXTRACT FROM THE STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2022 Sales (10% cash sales) Cost of sales Gross profit Operating expenses Net Profit before interest Interest expense Profit before tax Tax Profit after tax R 4 200 000 (2 652 000) 1 548 000 (798 000) 750 000 (102 000) 648 000 (195 000) 453 000 ADDITIONAL INFORMATION 1. Total dividends declared during the year amounted to R420 000. 2. 255 900 shares were in issue during 2022. 3. The market price per share was R17.25 on 31 December 2022. REQUIRED Use the information provided below to calculate the ratio for 2022 that would reflect each of the following (Where applicable, express answers to 2 decimal places.): The extent to which the claims of the short-term creditors are covered by assets that can be translated into cash in the short term The extent to which long-term debt is covered by shareholders' funds The amount of funds available relative to sales, to pay the company's expenses other than its cost of sales The rand amount of distributions during the period on behalf of each ordinary share issued The average period it takes for credit customers to pay their debts Jota Limited is a leading sports entity in Port Mandla and its management is interested in analysing the financial statements for the year ended 31 December 2022. The following financial statements are available. STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER: ASSETS 2022 2021 R R Non-current assets 2 520 000 1 590 000 Property, plant and equipment (cost) 2 490 000 1 620 000 Accumulated depreciation (630 000) (480 000) Investments 660 000 450 000 Current assets 3 060 000 2 850 000 Inventory Accounts receivable 1 050 000 1 290 000 1 230 000 900 000 30 000 Income tax paid in advance Bank EQUITY AND LIABILITIES 750 000 5 580 000 660.000 4 440 000 Equity 3 750 000 2 658 000 Ordinary Share Capital 2 559 000 1 500 000 Retained Income 1 191 000 1 158 000 Non-current liabilities 1 350 000 1 500 000 Loan 1 350 000 1 500 000 Current liabilities 480 000 282 000 Accounts payable 288 000 84 000 Dividends payable Income tax payable 192 000 144 000 - 54 000 5 580 000 4 440 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started