Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Transfer to spouse. Your client Irene owns shares of ABC Co. that have a FMV of $140,000 and an ACB of $99,000. They wish to

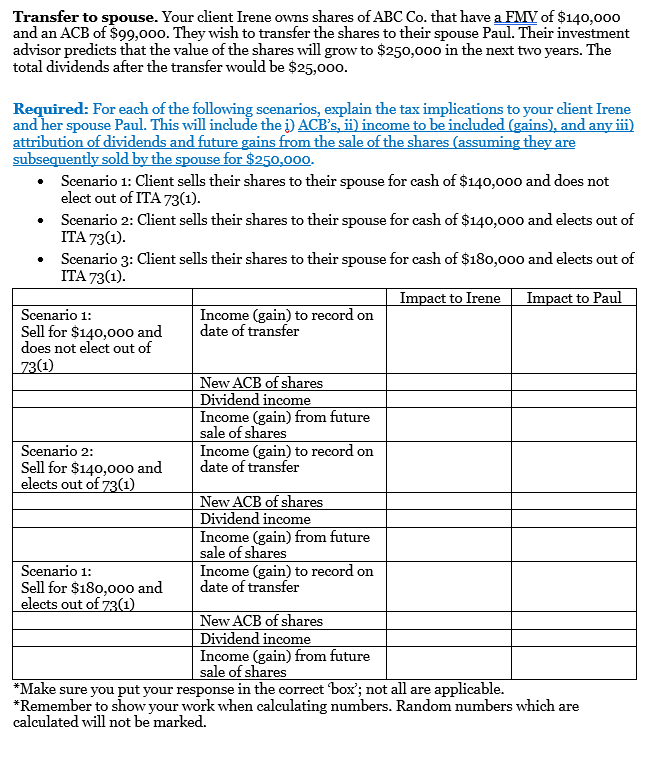

Transfer to spouse. Your client Irene owns shares of ABC Co. that have a FMV of $140,000 and an ACB of $99,000. They wish to transfer the shares to their spouse Paul. Their investment advisor predicts that the value of the shares will grow to $250,000 in the next two years. The total dividends after the transfer would be $25,000. Required: For each of the following scenarios, explain the tax implications to your client Irene and her spouse Paul. This will include the j) ACB's, ii) income to be included (gains), and any iii) attribution of dividends and future gains from the sale of the shares (assuming they are subsequently sold by the spouse for $250,000. - Scenario 1: Client sells their shares to their spouse for cash of $140,000 and does not elect out of ITA 73(1). - Scenario 2: Client sells their shares to their spouse for cash of $140,000 and elects out of ITA 73(1) - Scenario 3: Client sells their shares to their spouse for cash of $180,000 and elects out of ITA 73(1). calculated will not be marked. Transfer to spouse. Your client Irene owns shares of ABC Co. that have a FMV of $140,000 and an ACB of $99,000. They wish to transfer the shares to their spouse Paul. Their investment advisor predicts that the value of the shares will grow to $250,000 in the next two years. The total dividends after the transfer would be $25,000. Required: For each of the following scenarios, explain the tax implications to your client Irene and her spouse Paul. This will include the j) ACB's, ii) income to be included (gains), and any iii) attribution of dividends and future gains from the sale of the shares (assuming they are subsequently sold by the spouse for $250,000. - Scenario 1: Client sells their shares to their spouse for cash of $140,000 and does not elect out of ITA 73(1). - Scenario 2: Client sells their shares to their spouse for cash of $140,000 and elects out of ITA 73(1) - Scenario 3: Client sells their shares to their spouse for cash of $180,000 and elects out of ITA 73(1). calculated will not be marked

Transfer to spouse. Your client Irene owns shares of ABC Co. that have a FMV of $140,000 and an ACB of $99,000. They wish to transfer the shares to their spouse Paul. Their investment advisor predicts that the value of the shares will grow to $250,000 in the next two years. The total dividends after the transfer would be $25,000. Required: For each of the following scenarios, explain the tax implications to your client Irene and her spouse Paul. This will include the j) ACB's, ii) income to be included (gains), and any iii) attribution of dividends and future gains from the sale of the shares (assuming they are subsequently sold by the spouse for $250,000. - Scenario 1: Client sells their shares to their spouse for cash of $140,000 and does not elect out of ITA 73(1). - Scenario 2: Client sells their shares to their spouse for cash of $140,000 and elects out of ITA 73(1) - Scenario 3: Client sells their shares to their spouse for cash of $180,000 and elects out of ITA 73(1). calculated will not be marked. Transfer to spouse. Your client Irene owns shares of ABC Co. that have a FMV of $140,000 and an ACB of $99,000. They wish to transfer the shares to their spouse Paul. Their investment advisor predicts that the value of the shares will grow to $250,000 in the next two years. The total dividends after the transfer would be $25,000. Required: For each of the following scenarios, explain the tax implications to your client Irene and her spouse Paul. This will include the j) ACB's, ii) income to be included (gains), and any iii) attribution of dividends and future gains from the sale of the shares (assuming they are subsequently sold by the spouse for $250,000. - Scenario 1: Client sells their shares to their spouse for cash of $140,000 and does not elect out of ITA 73(1). - Scenario 2: Client sells their shares to their spouse for cash of $140,000 and elects out of ITA 73(1) - Scenario 3: Client sells their shares to their spouse for cash of $180,000 and elects out of ITA 73(1). calculated will not be marked Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started