Answered step by step

Verified Expert Solution

Question

1 Approved Answer

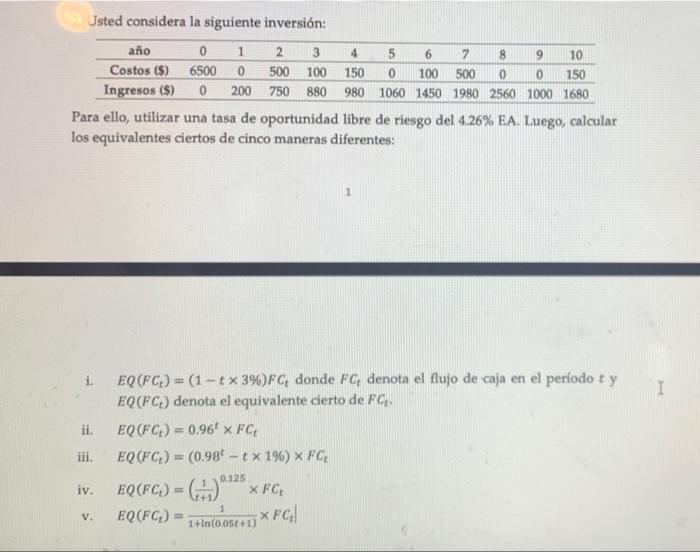

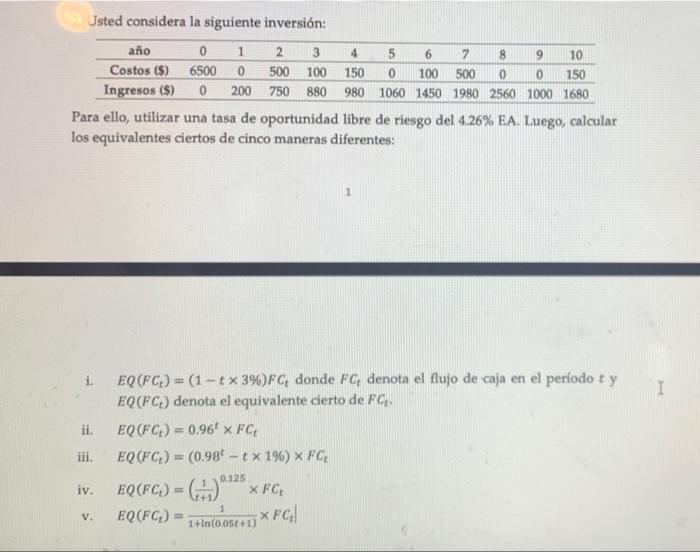

translation: You consider the following investment: year 0 1 2 3 4 5 6 7 8 9 10 Costs ($) 6500 0 500 100 150

translation: You consider the following investment:

Usted considera la siguiente inversin: 6 100 0 ao 0 1 2 3 4 5 7 8 9 10 Costos (8) 6500 0 500 150 0 100 500 0 150 Ingresos ($) 0 200 750 880 980 1060 1450 1980 2560 1000 1680 Para ello, utilizar una tasa de oportunidad libre de riesgo del 4.26% EA. Luego, calcular los equivalentes ciertos de cinco maneras diferentes: 1 i. I ii. EQ (FC) = (1 - + x3%)FC donde FC, denota el flujo de caja en el periodo ry EQ(FC) denota el equivalente cierto de FC EQFC) = 0.96' x FC EQ (FC) = (0.98' - year 0 1 2 3 4 5 6 7 8 9 10

Costs ($) 6500 0 500 100 150 0 100 500 0 0 150

Income ($) 0 200 750 880 980 1060 1450 1980 2560 1000 1680

To do this, use a risk-free opportunity rate of 4.26% EA. Then calculate the true equivalents in five different ways:

EQ (FC_t) = (1-t 3%) FC_t where FC_t denotes the cash flow in period t and EQ (FC_t) denotes the true equivalent of FC_t.

EQ (FC_t) = 0.96 ^ t FC_t

EQ (FC_t) = (0.98 ^ t-t 1%) FC_t

EQ (FC_t) = (1 / (t + 1)) ^ 0.125 FC_t

EQ (FC_t) = 1 / (1 + ln (0.05t + 1)) FC_t

pls show how to solve in excel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started