Answered step by step

Verified Expert Solution

Question

1 Approved Answer

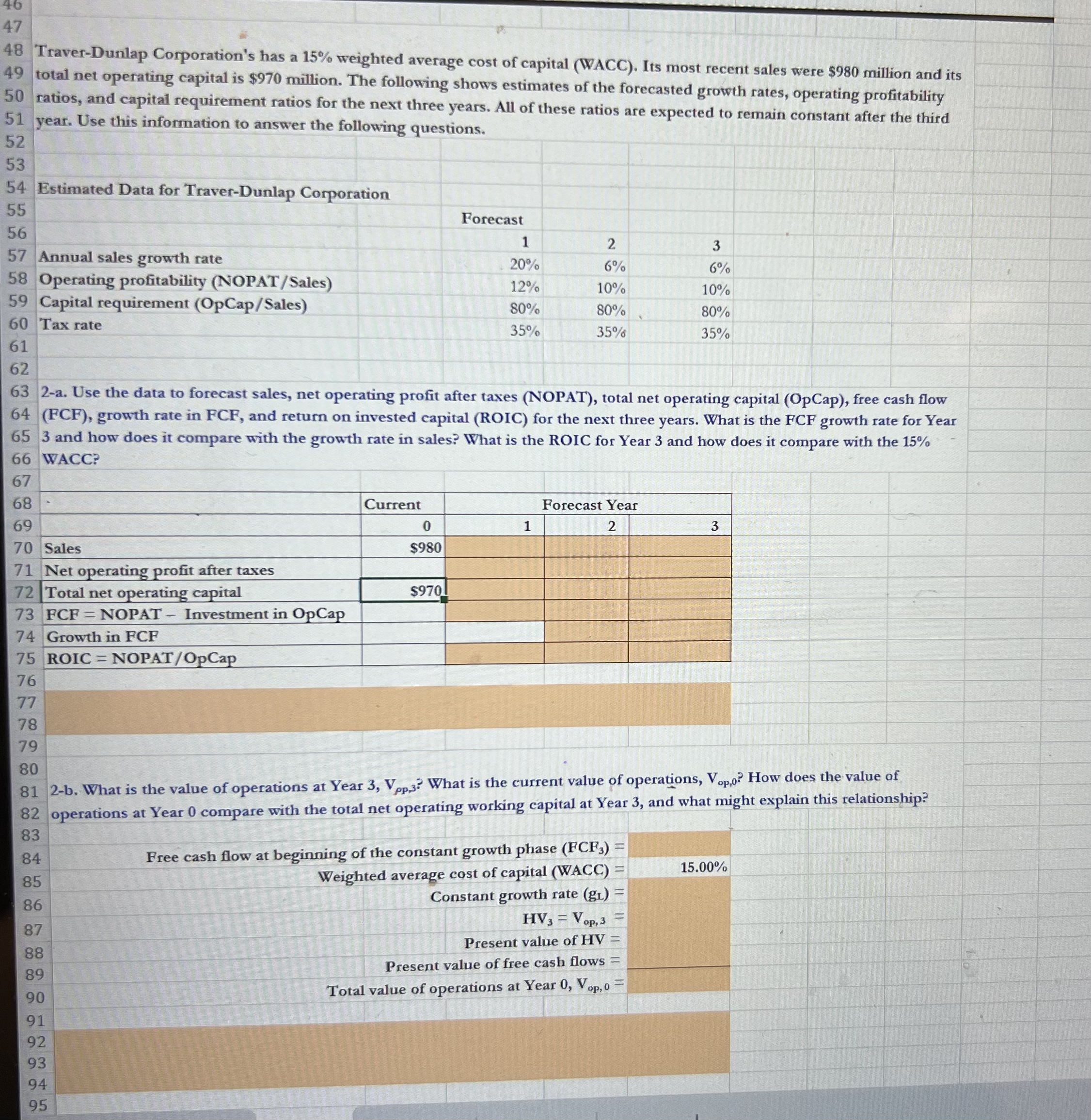

Traver - Dunlap Corporation's has a 1 5 % weighted average cost of capital ( WACC ) . Its most recent sales were $ 9

TraverDunlap Corporation's has a weighted average cost of capital WACC Its most recent sales were $ million and its

total net operating capital is $ million. The following shows estimates of the forecasted growth rates, operating profitability

ratios, and capital requirement ratios for the next three years. All of these ratios are expected to remain constant after the third

year. Use this information to answer the following questions.

Estimated Data for TraverDunlap Corporation

a Use the data to forecast sales, net operating profit after taxes NOPAT total net operating capital OpCap free cash flow

FCF growth rate in FCF and return on invested capital ROIC for the next three years. What is the FCF growth rate for Year

and how does it compare with the growth rate in sales? What is the ROIC for Year and how does it compare with the

WACC?

b What is the value of operations at Year What is the current value of operations, How does the value of

operations at Year compare with the total net operating working capital at Year and what might explain this relationship?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started