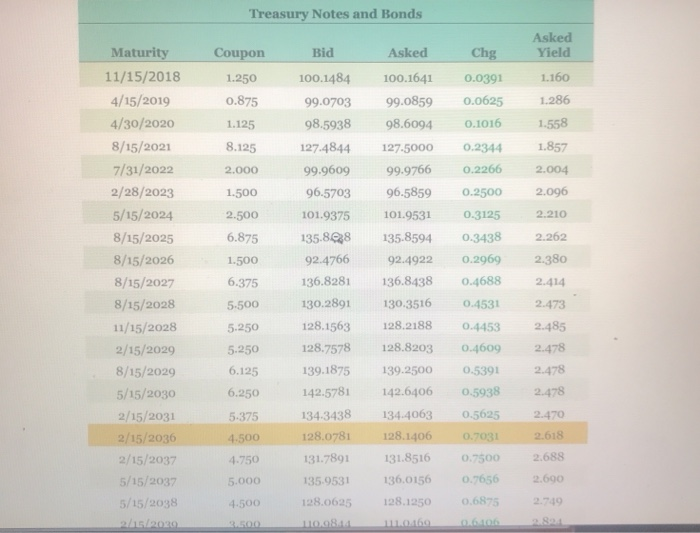

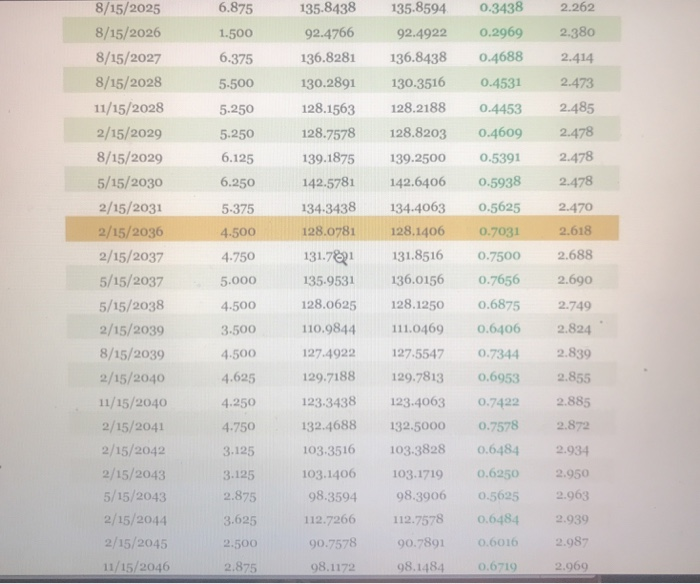

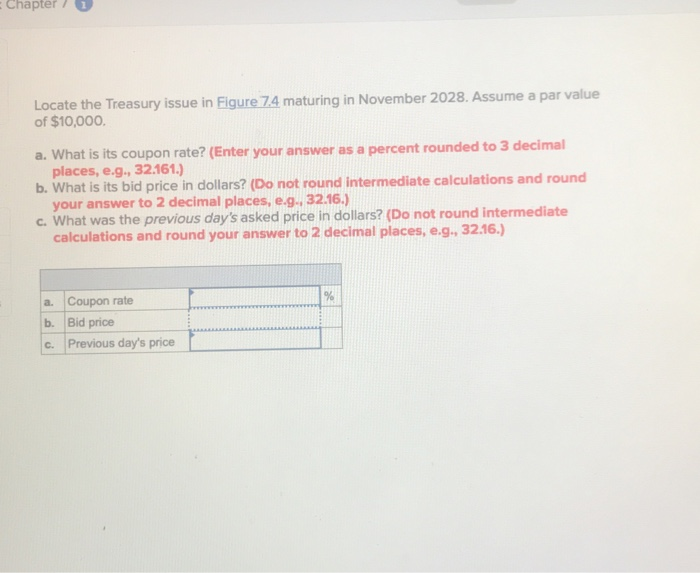

Treasury Notes and Bonds Asked Yield Maturity Bid Asked Chg Coupon 11/15/2018 100.1484 100.1641 1.160 1.250 0.0391 4/15/2019 0.875 0.0625 1.286 99.0859 99.0703 4/30/2020 98.6094 0.1016 1.558 98.5938 1.125 8/15/2021 8.125 1.857 127.4844 0.2344 127.5000 7/31/2022 99.9766 99.9609 0.2266 2.004 2.000 2.096 2/28/2023 96.5703 96.5859 1.500 0.2500 5/15/2024 101.9375 0.3125 2.210 2.500 101.9531 8/15/2025 6.875 135.8@8 135.8594 0.3438 2.262 8/15/2026 92.4766 0.2969 2.380 92.4922 1.500 136.8281 136.8438 0.4688 8/15/2027 6.375 2.414 8/15/2028 130.2891 130.3516 O.4531 2.473 5-500 128.1563 128.2188 2.485 11/15/2028 0.4453 5-250 128.8203 128.7578 0.4609 2.478 2/15/2029 5-250 139.1875 0.5391 2.478 8/15/2029 6.125 139.2500 142.6406 2.478 142.5781 0.5938 5/15/2030 6.250 134-4063 0.5625 134-3438 2/15/2031 2.470 5-375 128.1406 0.7031 2.618 2/15/2036 128.0781 4-500 131.8516 2.688 2/15/2037 131.7891 0.7500 4.750 0.7656 2.690 136.0156 5/15/2037 135-9531 5.000 128.1250 o,6875 5/15/2038 128.0625 2.749 4-500 2.824 2/15/2029 110.0844 0.6406 111.0469 3.500 8/15/2025 6.875 135.8594 0.3438 2.262 135.8438 8/15/2026 0.2969 2.380 92.4766 1.500 92.4922 8/15/2027 136.8438 0.4688 6.375 136.8281 2.414 8/15/2028 130.3516 130.2891 2.473 5-500 0.4531 11/15/2028 2.485 128.1563 128.2188 5.250 O.4453 2/15/2029 2.478 128.7578 128.8203 0.4609 5.250 8/15/2029 2.478 6.125 139.1875 0.5391 139.2500 0.5938 2.478 5/15/2030 142.6406 6.250 142.5781 2/15/2031 134-4063 0.5625 134.3438 2.470 5.375 2/15/2036 128.0781 128.1406 2.618 0.7031 4-500 131.781 131.8516 2.688 2/15/2037 4-750 0.7500 136.0156 5/15/2037 0.7656 2.690 5.000 135-9531 128.1250 0.6875 5/15/2038 128.0625 4-500 2.749 110.9844 2.824 2/15/2039 111.0469 0.6406 3-500 8/15/2039 2.839 127.5547 0.7344 4-500 127.4922 129.7188 129.7813 o.6953 2.855 2/15/2040 4.625 123-3438 2.885 11/15/2040 123.4063 0.7422 4.250 2/15/2041 132.4688 0.7578 2.872 4.750 132.5000 103.3828 2/15/2042 103.3516 0.6484 2.934 3.125 2/15/2043 0.6250 103.1406 103.1719 2.950 3.125 98.3906 0.5625 2.963 5/15/2043 2.875 98.3594 2/15/2044 0.6484 3.625 112.7578 112.7266 2.939 2/15/2045 2.987 90.7578 90.7891 0.6016 2.500 2.969 11/15/2046 2.875 98.1484 o,6719 98.1172 :Chapter Locate the Treasury issue in Figure 7.4 maturing in November 2028. Assume a par value of $10,000. a. What is its coupon rate? (Enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.) b. What is its bid price in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c.What was the previous day's asked price in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Coupon rate Bid price b. Previous day's price c