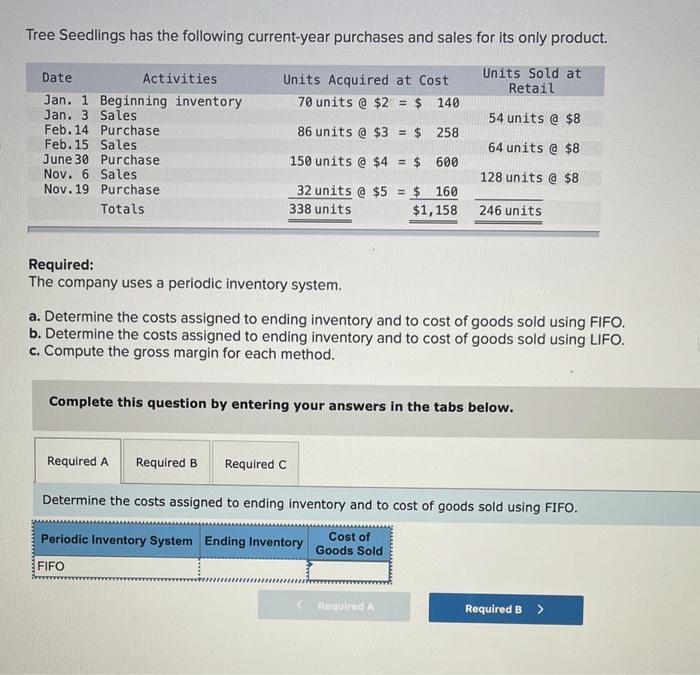

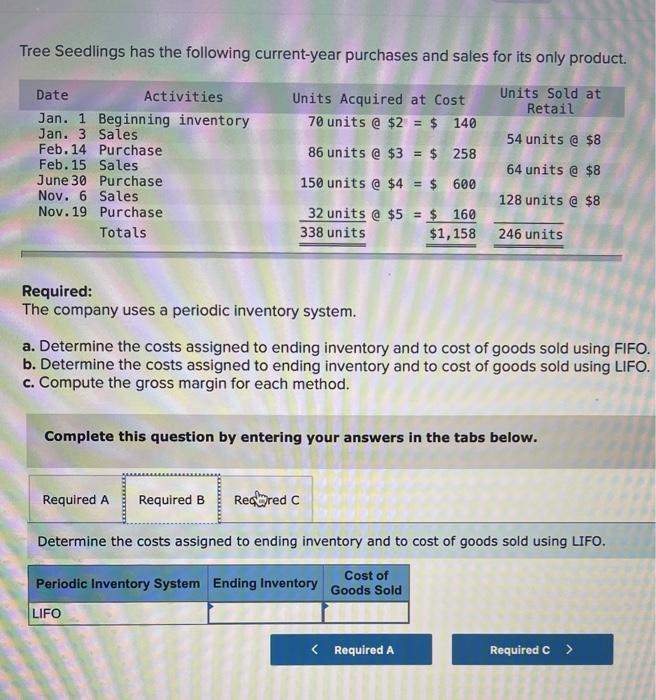

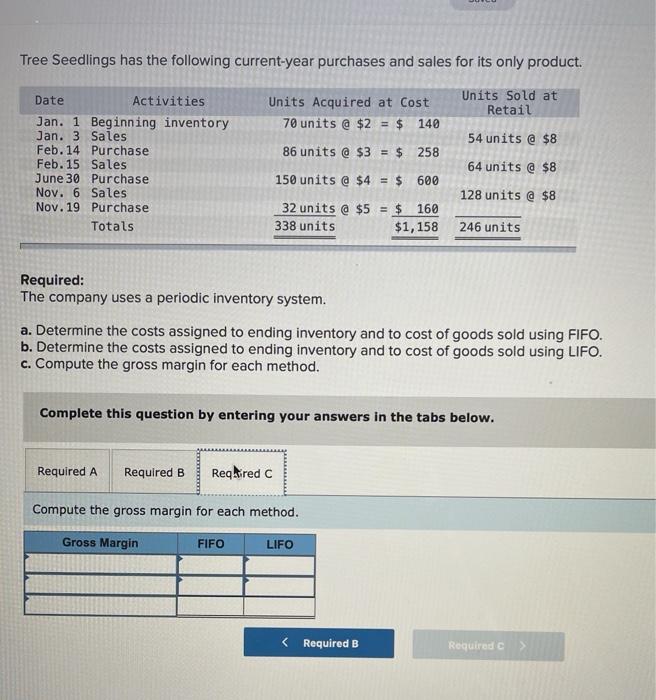

Tree Seedlings has the following current-year purchases and sales for its only product. Units Acquired at Cost 70 units @ $2 = $ 140 Units Sold at Retail 54 units @ $8 86 units @ $3 = $ 258 Date Activities Jan. 1 Beginning inventory Jan. 3 Sales Feb. 14 Purchase Feb. 15 Sales June 30 Purchase Nov. 6 Sales Nov. 19 Purchase Totals 64 units @ $8 150 units @ $4 = $ 600 128 units @ $8 32 units @ $5 338 units $ 160 $1,158 246 units Required: The company uses a periodic inventory system. a. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. b. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. c. Compute the gross margin for each method. Complete this question by entering your answers in the tabs below. Required A Required B Required C Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. Periodic Inventory System Ending Inventory Cost of Goods Sold FIFO Required Required B Tree Seedlings has the following current-year purchases and sales for its only product. Date Activities Jan. 1 Beginning inventory Jan. 3 Sales Feb. 14 Purchase Feb. 15 Sales June 30 Purchase Nov. 6 Sales Nov. 19 Purchase Totals Units Acquired at Cost 70 units @ $2 = $ 140 86 units @ $3 = $ 258 150 units @ $4 = $ 600 32 units @ $5 = $ 160 338 units $1,158 Units Sold at Retail 54 units @ $8 64 units @ $8 128 units @ $8 246 units Required: The company uses a periodic inventory system. a. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. b. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. c. Compute the gross margin for each method. Complete this question by entering your answers in the tabs below. Required A Required B Reclared C Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. Periodic Inventory System Ending Inventory Cost of Goods Sold LIFO Tree Seedlings has the following current-year purchases and sales for its only product. Units Acquired at Cost 70 units @ $2 = $ 140 Units Sold at Retail 54 units @ $8 86 units @ $3 = $ 258 Date Activities Jan. 1 Beginning inventory Jan. 3 Sales Feb. 14 Purchase Feb. 15 Sales June 30 Purchase Nov. 6 Sales Nov.19 Purchase Totals 64 units @ $8 150 units @ $4 = $ 600 128 units @ $8 32 units @ $5 338 units = $ 160 $1,158 246 units Required: The company uses a periodic inventory system. a. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. b. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. c. Compute the gross margin for each method. Complete this question by entering your answers in the tabs below. Required A Required B Reqired C Compute the gross margin for each method. Gross Margin FIFO LIFO