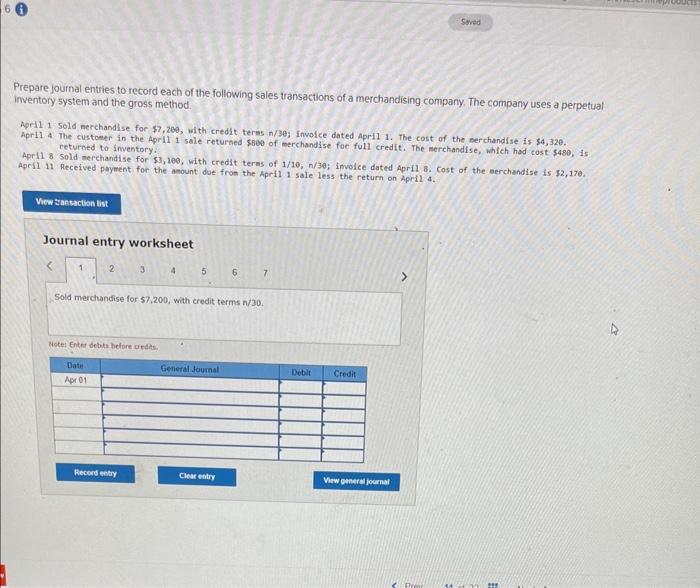

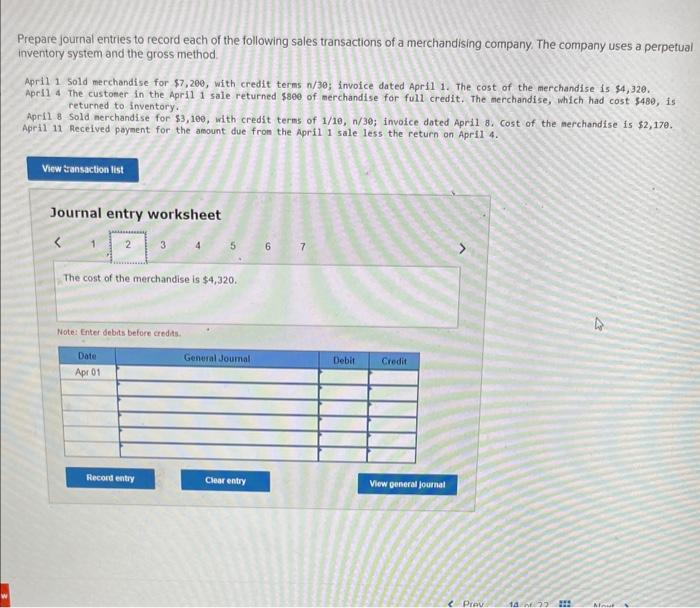

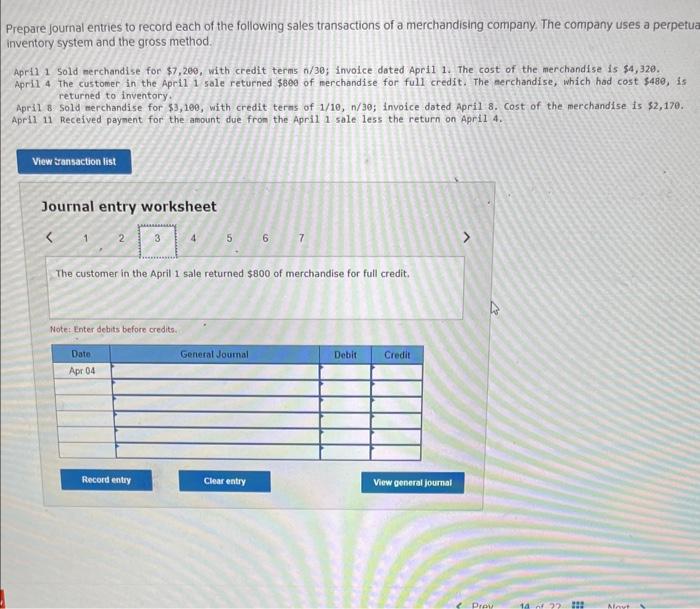

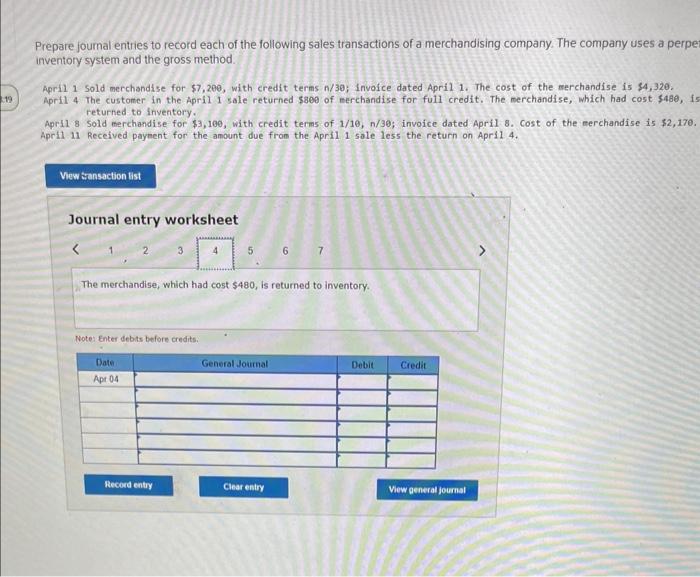

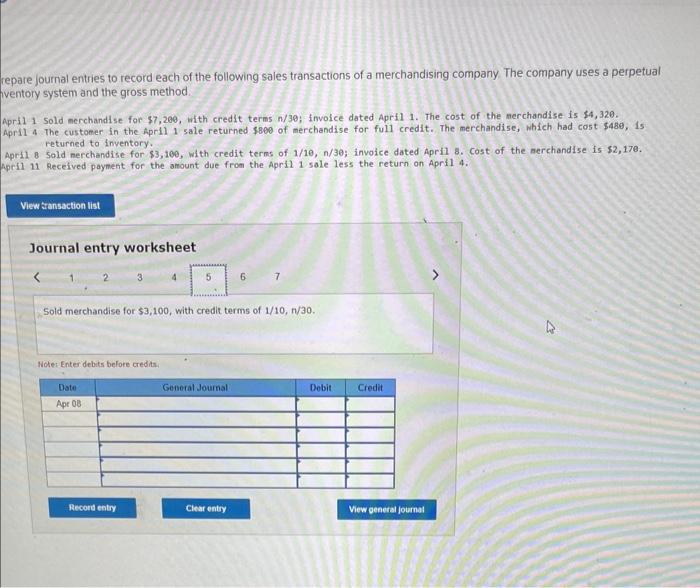

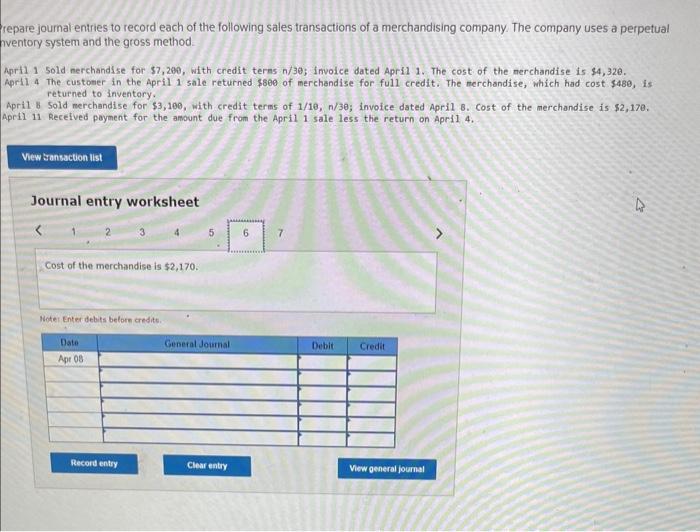

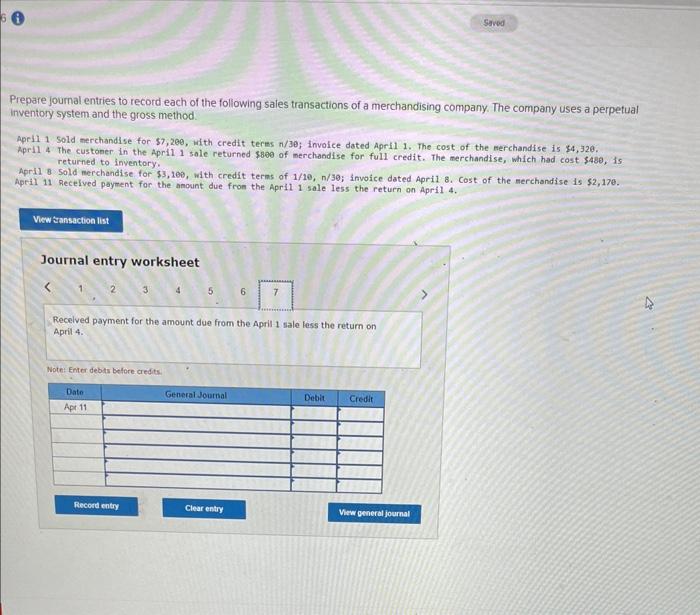

Trepare joumal entries to record each of the following sales transactions of a merchandising company. The compary uses a perpetual mventory system and the gross method. April 1501d nerchandise for 57,289 , with credit terms n/30; involce dated April 1. The cost of the nerchandise is s4,32e. Apr11 4 The customer in the AprI1 1 sale returned $800 of merchandise foe full credit. The merehandise, which had cost $480, is returoed to inventory. Apri1 8 Sold merchandise for 53,100 , with credit terms of 1/10,n/30; involce dated April 8. Cost of the aerchandise is 52,170. April 11 Received peyment for the amount doe from the April 1 sale less the return on April 4. Journal entry worksheet 34567 Sold merchandise for $7,200, with credit terms n/30. Hotel Enter debla toliore urdits Prepare journal entries to record each of the following sales transactions of a merchandising company. The company uses a perpetual inventory system and the gross method. April 1 sold merchandise for $7,200, with credit terms n/30; invoice dated Apri1 1. The cost of the merchandise is $4,32. ApeIl 4 The custoner in the April 1 sale returned $800 of merchandise for full credit. The merchandise, which had cost 5480 , is returned to inventory. April 8 Sold nerchandise for $3,100, with credit terms of 1/18, n/30; invoice doted April 8. Cost of the merchandise is $2,17e. April 11 Received payment for the amount due from the April 1 sale less the return on April 4. Journal entry worksheet Prepare journal entries to record each of the following sales transactions of a merchandising company. The company uses a perpetua inventory system and the gross method. Apri1 1 sold nerchandise for $7,200, with credit terms n/30; invoice dated April 1. The cost of the merchandise is $4,328. April 4 the customer in the April 1 sale returned $800 of nerchandise for full credit. The aerchandise, which had cost $480, is returned to inventory. April 8 sold eerchandise for $3,100, with credit teras of 1/10,n/30; invoice dated April 8. Cost of the merchandise is 32,170 . Apri1 11 Received payment for the amount due from the April 1 sale less the return on April 4. Journal entry worksheet