Answered step by step

Verified Expert Solution

Question

1 Approved Answer

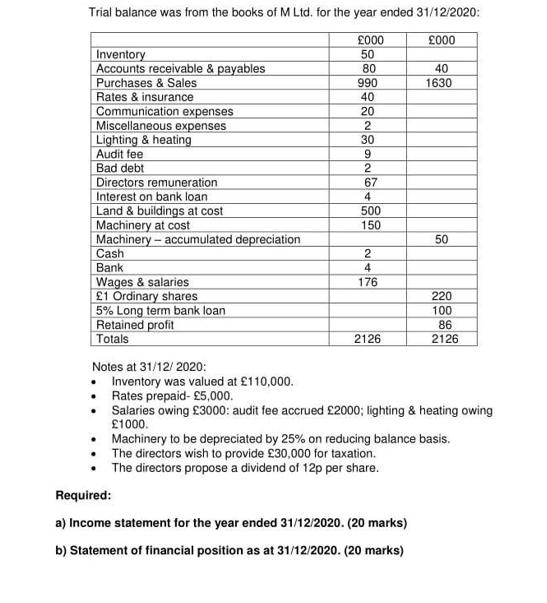

Trial balance was from the books of M Ltd. for the year ended 31/12/2020: 000 000 50 Inventory Accounts receivable & payables Purchases &

Trial balance was from the books of M Ltd. for the year ended 31/12/2020: 000 000 50 Inventory Accounts receivable & payables Purchases & Sales Rates & insurance Communication expenses Miscellaneous expenses Lighting & heating Audit fee Bad debt Directors remuneration Interest on bank loan Land & buildings at cost Machinery at cost Machinery-accumulated depreciation Cash Bank Wages & salaries 1 Ordinary shares 5% Long term bank loan Retained profit Totals Notes at 31/12/2020: Inventory was valued at 110,000. 80 990 40 20 2 30 JAN HOGNO 500 150 176 2126 40 1630 50 Required: a) Income statement for the year ended 31/12/2020. (20 marks) b) Statement of financial position as at 31/12/2020. (20 marks) 220 100 86 2126 Rates prepaid- 5,000. Salaries owing 3000: audit fee accrued 2000; lighting & heating owing 1000. Machinery to be depreciated by 25% on reducing balance basis. The directors wish to provide 30,000 for taxation. The directors propose a dividend of 12p per share.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculations Inventory adjustment 110000 50000 60000 Rates prepaid adjustment Rates prepaid adjustme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started