tried posting 2 better ones, the quality degrades when pisting.

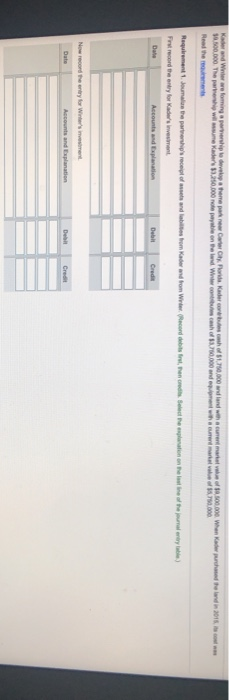

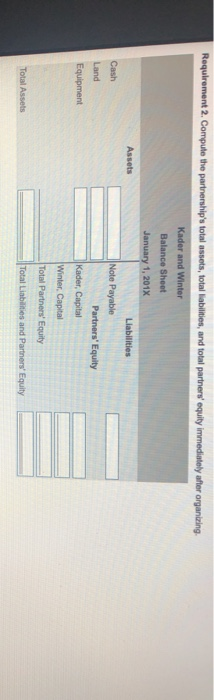

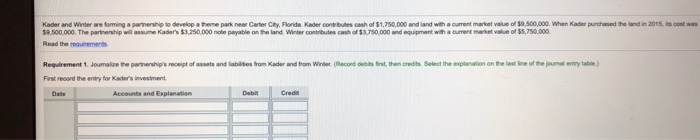

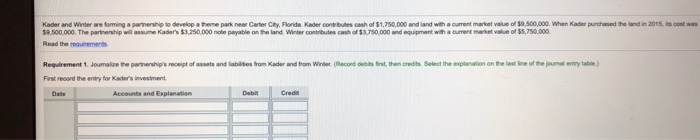

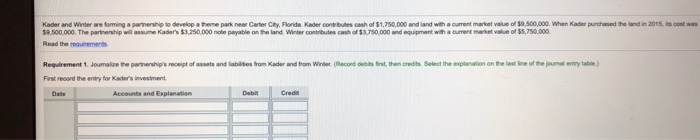

Kader and Winter w forming permite develop a theme parkeriyorida Kadecorhof 1.750,000 and and with a current market value of 0.500.000. When Kader purchased the land in 2015. a.com 50.500.000 There wil mars 20.000 de payable on the land Winter cocho 3.750.000 and with a smart value of 2.000 Requirement Jaume the partnership's recipes and be from Kader and from We Records, then creation on the line of the raly) First record the entry for Kader's Investment Date Account and Explanation Deb Now record the entry for Wissent Account and Explanation De Creo Requirement 2. Computo the partnership's total assets, total liabilities, and total partners' equity immediately after organizing Kader and Winter Balance Sheet January 1, 2018 Assets Liabilities Cash Note Payable Land Partners' Equity Equipment Kader, Capital Winter, Capital Total Partners' Equity Total Assets Total Liabilities and Partners' Equity Kader and Winter reforming a partnership to develop a theme park new Carter Chy, Florida Kater contribuisch 51,750,000 and and with a current market value of 0.500,000. When Kader purchased the land in 2015, its cool was $9,500,000. The partnership will assume Kader's $3,250,000 note payable on the land Winter contributes cash of $3.750.000 dent with a current market value of $6.750,000 Read the Requirement 1. Joumalize the partnerships receipt of assets and tables from Kader and from Winter (Records, the credits Select the explanation on the last line of the journal entry table.) Kader and Winter are forming a partnership to develop a theme park near Carter City, Florida. Kader contributes cash of $1,750,000 and land with a current market value of $9,500,000. When Kader purchased the land in 2015, in cont was $2.500.000. The partnership will assume Kader's $3.250.000 note payable on the land Winter contrbules cash of $3,750,000 and equipment with a current market value of $5,750,000 Read the requirements Requirement 1. Joumalize the partnerships receipt of assets and liabilities from Kader and from Winter Recond det fint, then credits. Select the explanation on the last line of the journal entry table) First record the entry for Kader's investment Accounts and Explanation Date Debit Credit Kader and Winter w forming a partnership to develop a theme park near Carter City Florida. Kader contributes cath of $1,750,000 and land with a current market value of $9.500.000. When Kader purchased the land in 2015, is cost was $9,500,000. The pership wil mume Kader's 53.250,000 note payable on the land Winter contributes cash of $3,750,000 and equipment with a current market value of $5,750,000 Requirement 1. Jumalize the partnerships receipt of sets and abilities from Kater and from Winter (Record debitstrot, the credits Select the explanation on the lastne of the journal entry table) First record the entry for Kader's investment Accounts and Explanation Debit Credit Date Now record the entry for Winter's investment