Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What would the journal entries be for this? Journal Entries and adjusted journal entries, please! PANE IN THE GLASS CO. Pane in the Glass Co.opened

What would the journal entries be for this? Journal Entries and adjusted journal entries, please!

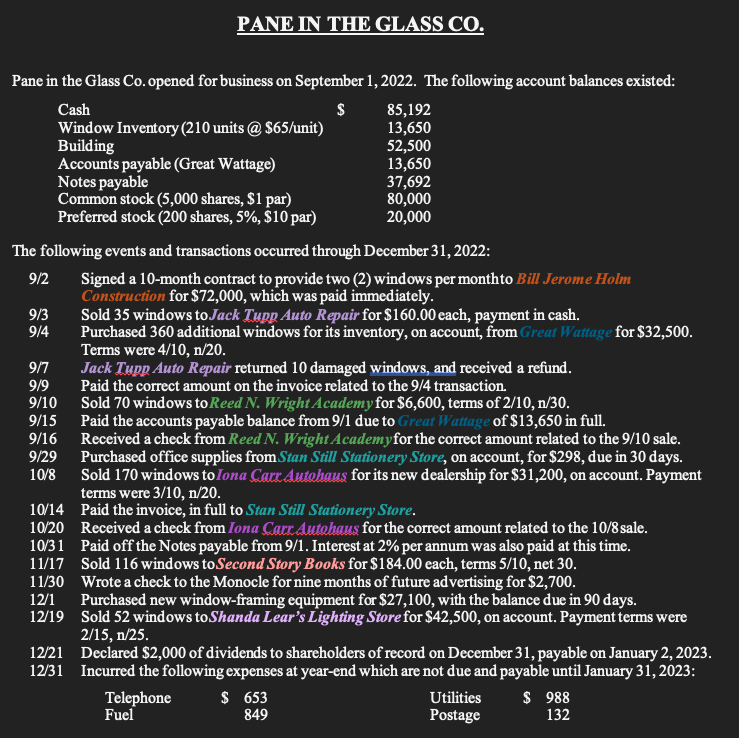

PANE IN THE GLASS CO. Pane in the Glass Co.opened for business on September 1, 2022. The following account balances existed: Cash $ 85,192 Window Inventory (210 units @ $65/unit) 13,650 Building 52,500 Accounts payable (Great Wattage) 13,650 Notes payable 37,692 Common stock (5,000 shares, $1 par) 80,000 Preferred stock (200 shares, 5%, $10 par) 20,000 The following events and transactions occurred through December 31, 2022: 9/2 Signed a 10-month contract to provide two (2) windows per monthto Bill Jerome Holm Construction for $72,000, which was paid immediately. 9/3 Sold 35 windows to Jack Tupp Auto Repair for $160.00 each, payment in cash. 9/4 Purchased 360 additional windows for its inventory, on account, from Great Wattage for $32,500. Terms were 4/10, n/20. 9/7 Jack Tupp Auto Repair returned 10 damaged windows, and received a refund. 9/9 Paid the correct amount on the invoice related to the 9/4 transaction. 9/10 Sold 70 windows to Reed N. Wright Academy for $6,600, terms of 2/10, n/30. 9/15 Paid the accounts payable balance from 9/1 due to Great Wattage of $13,650 in full. 9/16 Received a check from Reed N. Wright Academyfor the correct amount related to the 9/10 sale. 9/29 Purchased office supplies from Stan Still Stationery Store, on account, for $298, due in 30 days. 10/8 Sold 170 windows to Iona Carr Autohaus for its new dealership for $31,200, on account. Payment terms were 3/10, n/20. 10/14 Paid the invoice, in full to Stan Still Stationery Store. 10/20 Received a check from Iona Carr Autohaus for the correct amount related to the 10/8 sale. 10/31 Paid off the Notes payable from 9/1. Interest at 2% per annum was also paid at this time. 11/17 Sold 116 windows to Second Story Books for $184.00 each, terms 5/10, net 30. 11/30 Wrote a check to the Monocle for nine months of future advertising for $2,700. 12/1 Purchased new window-framing equipment for $27,100, with the balance due in 90 days. 12/19 Sold 52 windows to Shanda Lear's Lighting Store for $42,500, on account. Payment terms were 2/15, n/25. 12/21 Declared $2,000 of dividends to shareholders of record on December 31, payable on January 2, 2023. 12/31 Incurred the following expenses at year-end which are not due and payable until January 31, 2023: Telephone $ 653 Utilities $ 988 Fuel 849 Postage 132Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started