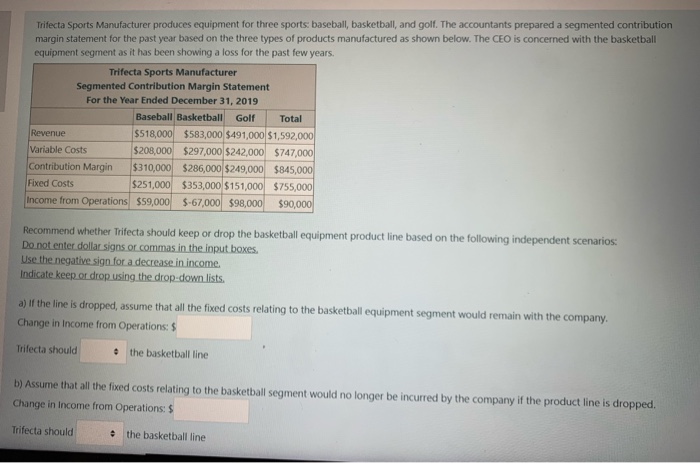

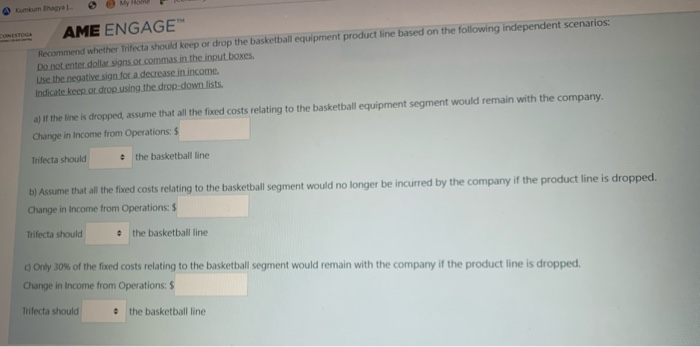

Trifecta Sports Manufacturer produces equipment for three sports: baseball, basketball, and golf. The accountants prepared a segmented contribution margin statement for the past year based on the three types of products manufactured as shown below. The CEO is concerned with the basketball equipment segment as it has been showing a loss for the past few years. Trifecta Sports Manufacturer Segmented Contribution Margin Statement For the Year Ended December 31, 2019 Baseball Basketball Golf Total Revenue $518,000 $583,000 $491,000 $1,592,000 Variable Costs $208,000 $297,000 $242,000 $747,000 Contribution Margin $310,000 $286,000 $249,000 $845,000 Fixed Costs $ 251,000 $353,000 $151,000 $755,000 Income from Operations $59,000 $-67,000 $98,000 $90,000 Recommend whether Trifecta should keep or drop the basketball equipment product line based on the following independent scenarios: Do not enter dollar signs or commas in the input boxes Use the negative sign for a decrease in income. Indicate keep or drop using the drop-down lists a) If the line is dropped, assume that all the fixed costs relating to the basketball equipment segment would remain with the company. Change in Income from Operations: $ Trifecta should the basketball line b) Assume that all the fixed costs relating to the basketball segment would no longer be incurred by the company if the product line is dropped. Change in Income from Operations: $ Trifecta should the basketball line AME ENGAGE Recommend whether Trifecta should keep or drop the basketball equipment product line based on the following independent scenarios Do not enter dollar signs or commas in the input boxes. Use the negative sign for a decrease in income Indicate keep or drop using the drop-down lists. a) If the line is dropped assume that all the fixed costs relating to the basketball equipment segment would remain with the company. Change in Income from Operations: $ Trifecta should the basketball line b) Assume that all the fixed costs relating to the basketball segment would no longer be incurred by the company if the product line is dropped. Change in Income from Operations: $ Trifecta should the basketball line Only 30% of the fixed costs relating to the basketball segment would remain with the company if the product line is dropped, Change in Income from Operations: $ Trifecta should the basketball line