Answered step by step

Verified Expert Solution

Question

1 Approved Answer

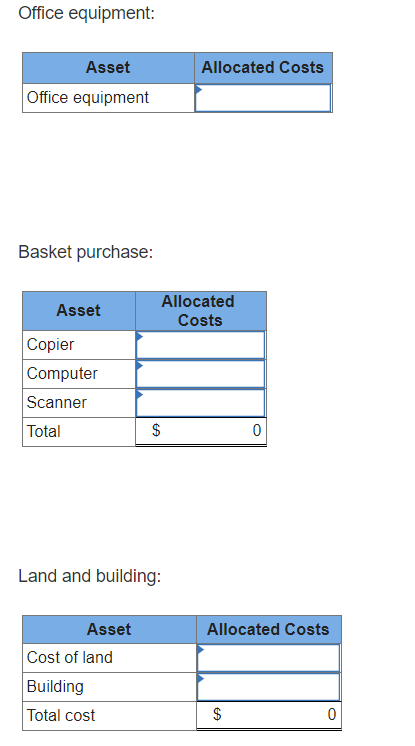

Trinkle Co., Inc. made several purchases of long-term assets in Year 1. The details of each purchase are presented here. New Office Equipment List price:

Trinkle Co., Inc. made several purchases of long-term assets in Year 1. The details of each purchase are presented here. New Office Equipment

- List price: $44,500; terms: 2/10 n/30; paid within discount period.

- Transportation-in: $870.

- Installation: $590.

- Cost to repair damage during unloading: $583.

- Routine maintenance cost after six months: $120.

Basket Purchase of Copier, Computer, and Scanner for $53,300 with Fair Market Values

- Copier, $25,038.

- Computer, $7,062.

- Scanner, $32,100.

Land for New Warehouse with an Old Building Torn Down

- Purchase price, $77,100.

- Demolition of building, $4,920.

- Lumber sold from old building, $1,900.

- Grading in preparation for new building, $6,200.

- Construction of new building, $254,000.

Required In each of these cases, determine the amount of cost to be capitalized in the asset accounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started