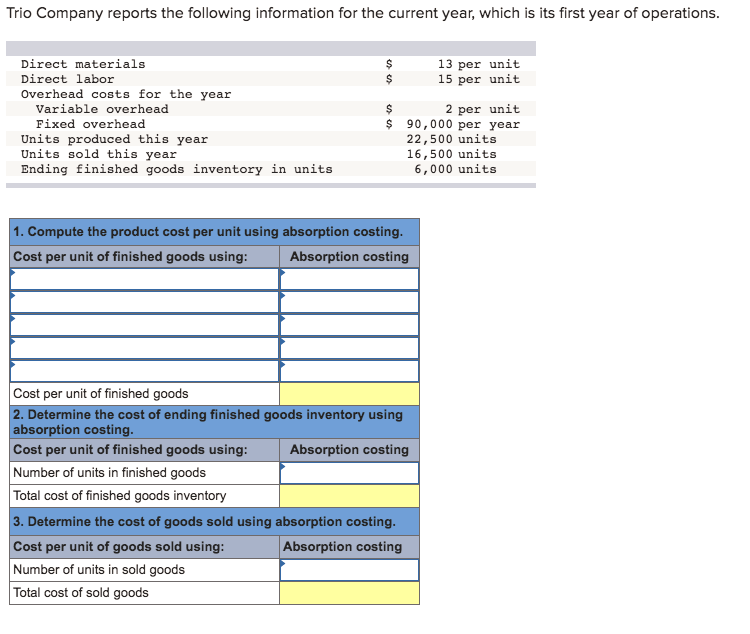

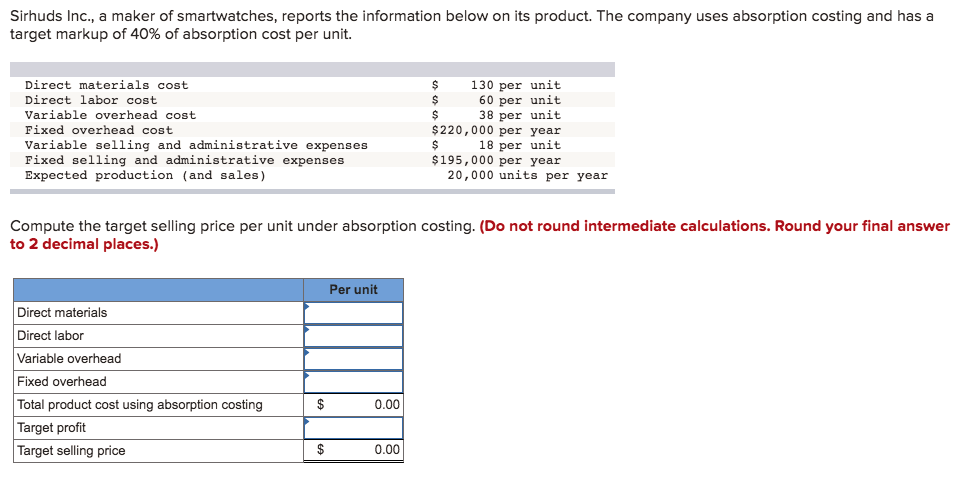

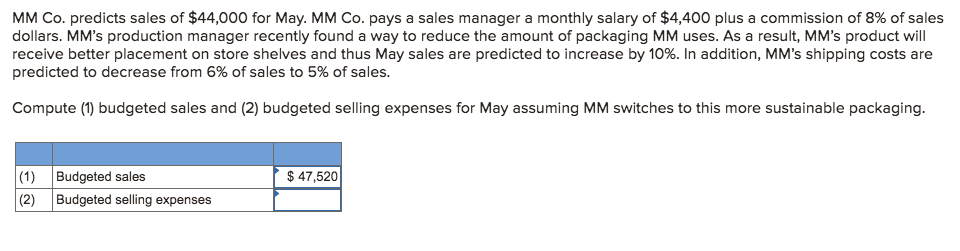

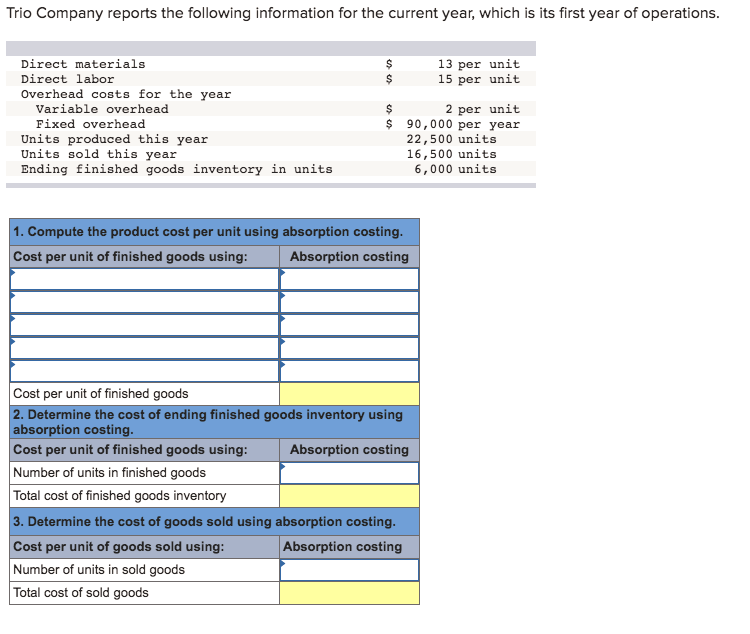

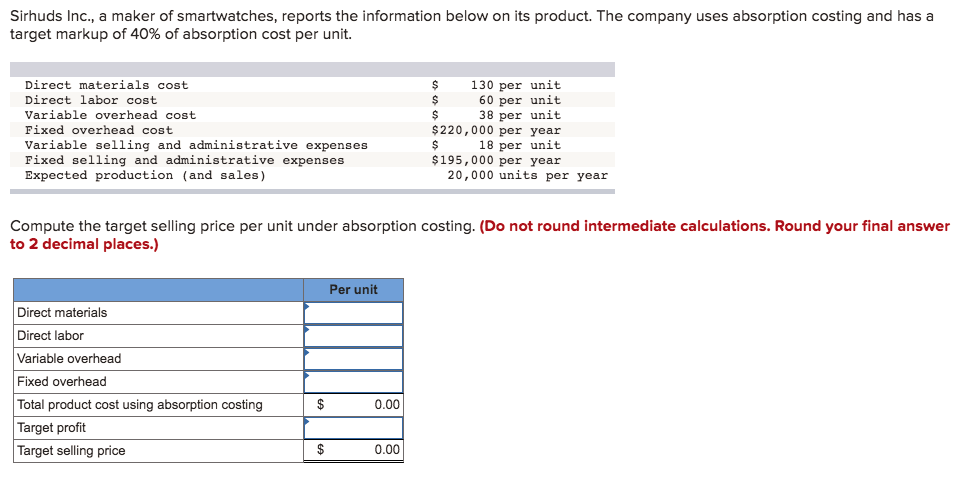

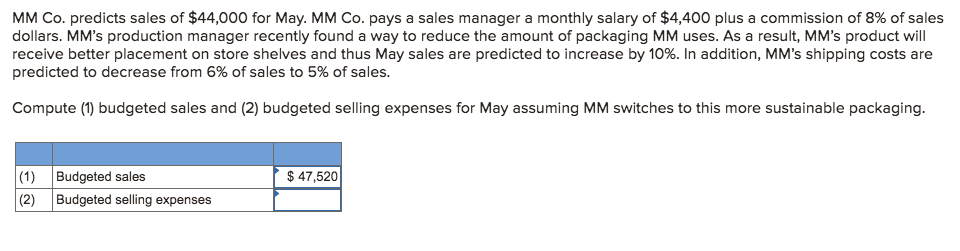

Trio Company reports the following information for the current year, which is its first year of operations. 13 per unit 15 per unit u Direct materials Direct labor Overhead costs for the year Variable overhead Fixed overhead Units produced this year Units sold this year Ending finished goods inventory in units sus 2 per unit $ 90,000 per year 22,500 units 16,500 units 6,000 units 1. Compute the product cost per unit using absorption costing. Cost per unit of finished goods using: Absorption costing Cost per unit of finished goods 2. Determine the cost of ending finished goods inventory using absorption costing. Cost per unit of finished goods using: Absorption costing Number of units in finished goods Total cost of finished goods inventory 3. Determine the cost of goods sold using absorption costing. Cost per unit of goods sold using: Absorption costing Number of units in sold goods Total cost of sold goods Sirhuds Inc., a maker of smartwatches, reports the information below on its product. The company uses absorption costing and has a target markup of 40% of absorption cost per unit. Direct materials cost Direct labor cost Variable overhead cost Fixed overhead cost Variable selling and administrative expenses Fixed selling and administrative expenses Expected production (and sales ) $ 130 per unit $ 60 per unit $ 38 per unit $ 220,000 per year 18 per unit $195,000 per year 20,000 units per year Compute the target selling price per unit under absorption costing. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Per unit Direct materials Direct labor Variable overhead Fixed overhead Total product cost using absorption costing Target profit Target selling price $ 0.00 MM Co. predicts sales of $44,000 for May. MM Co. pays a sales manager a monthly salary of $4,400 plus a commission of 8% of sales dollars. MM's production manager recently found a way to reduce the amount of packaging MM uses. As a result, MM's product will receive better placement on store shelves and thus May sales are predicted to increase by 10%. In addition, MM's shipping costs are predicted to decrease from 6% of sales to 5% of sales. Compute (1) budgeted sales and (2) budgeted selling expenses for May assuming MM switches to this more sustainable packaging. $ 47,520 (1) (2) Budgeted sales Budgeted selling expenses