Answered step by step

Verified Expert Solution

Question

1 Approved Answer

trish rish Craig and Ted Smith have a bio-energy and consulting business and share profit and losses in a 3:1 ratio. They decide to quidate

trish

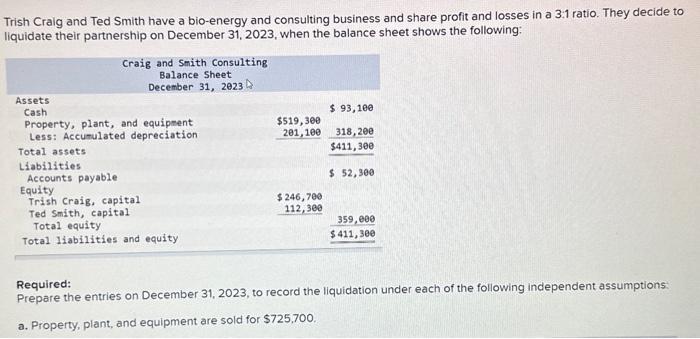

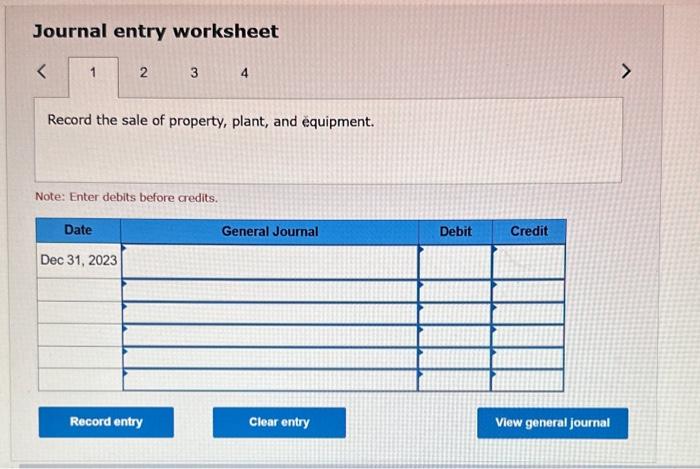

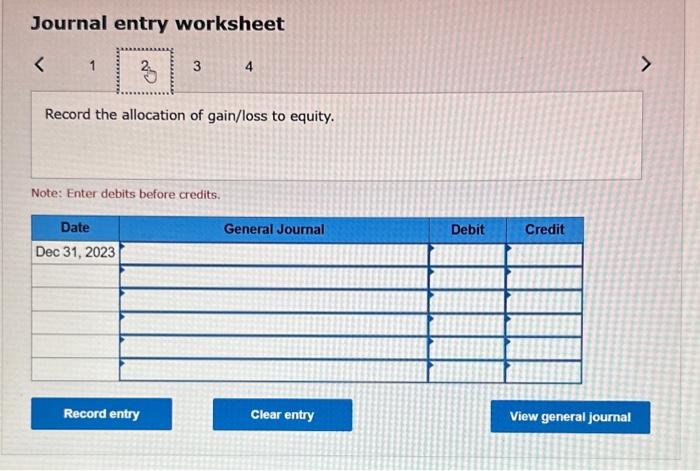

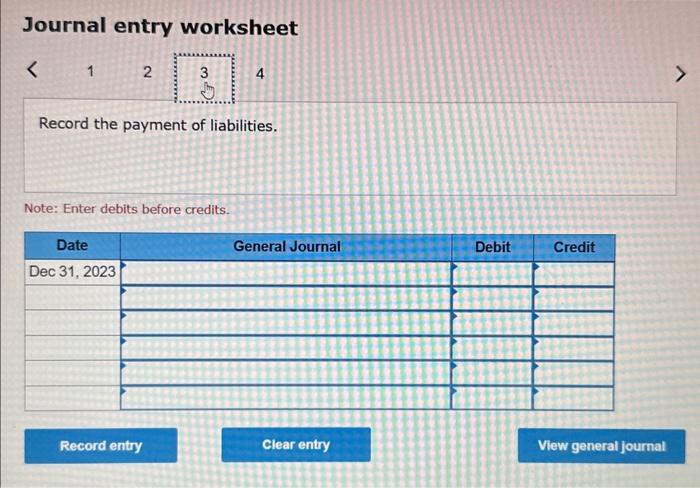

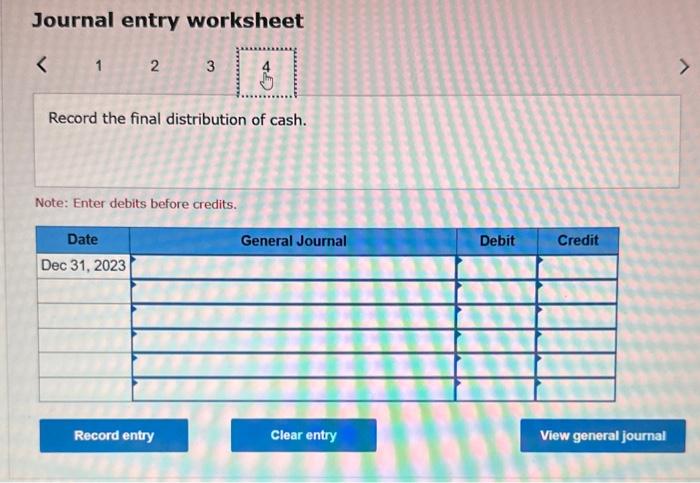

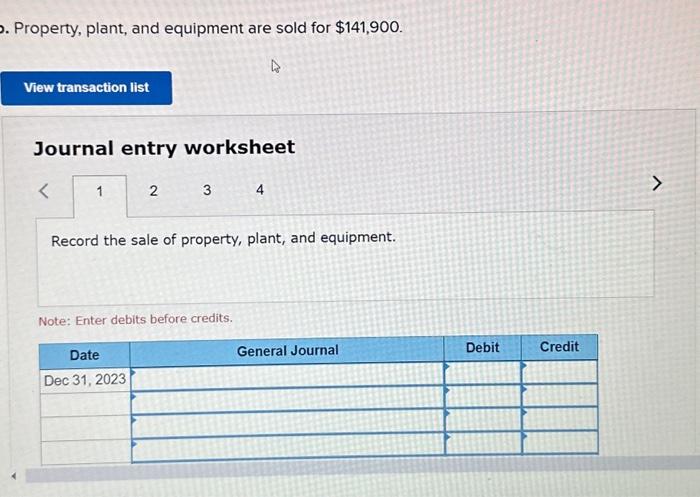

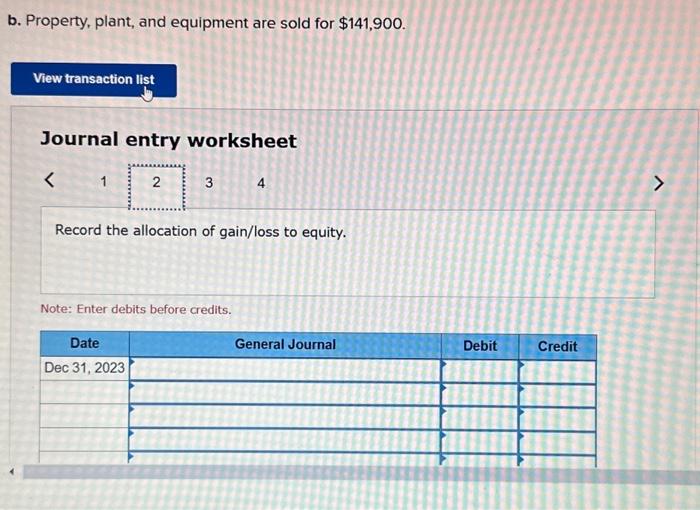

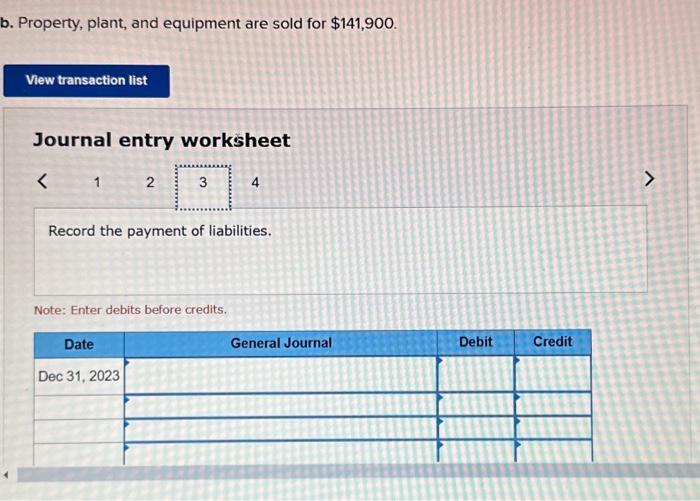

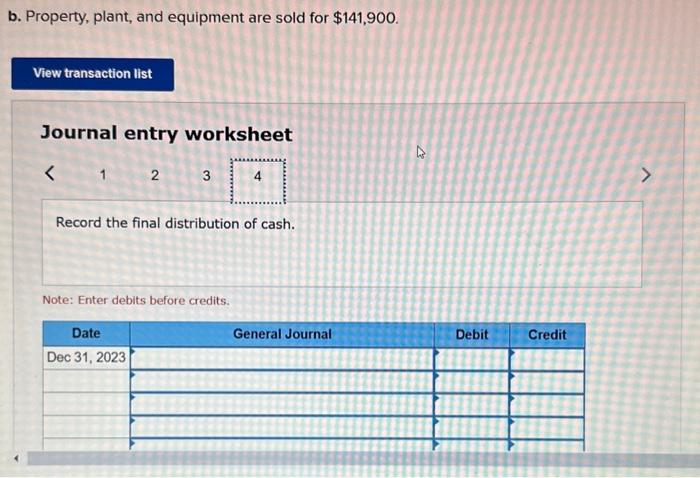

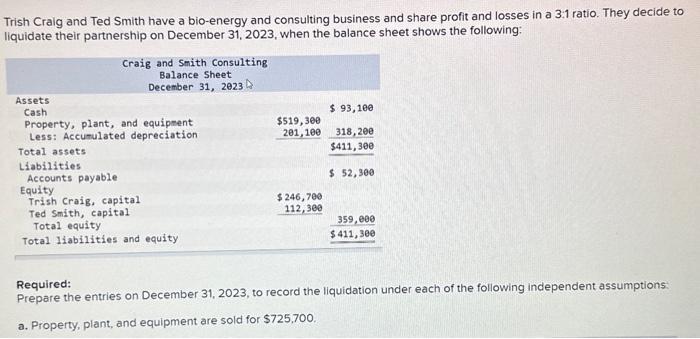

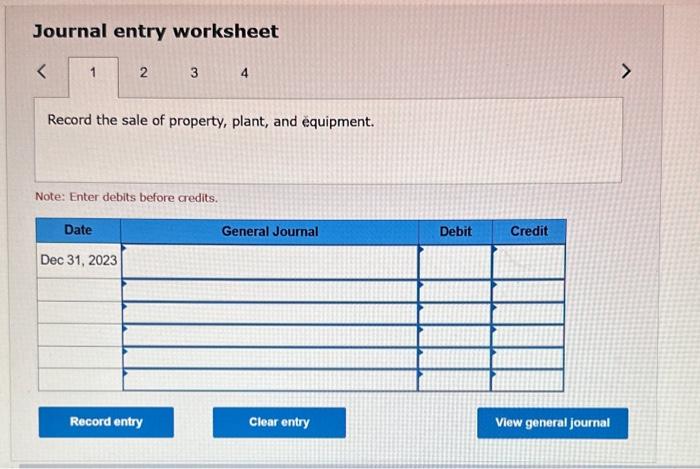

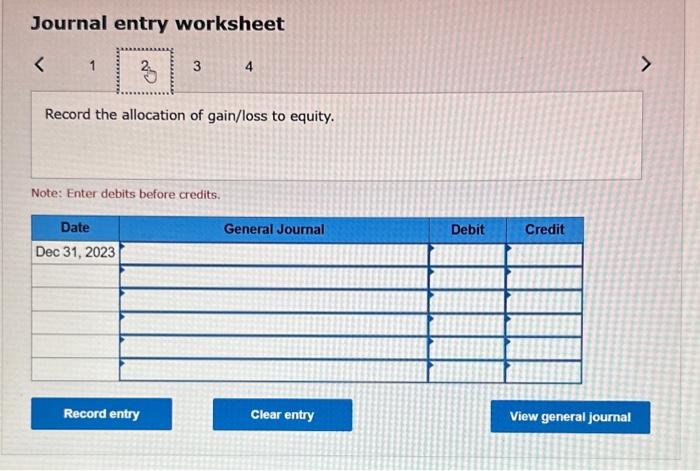

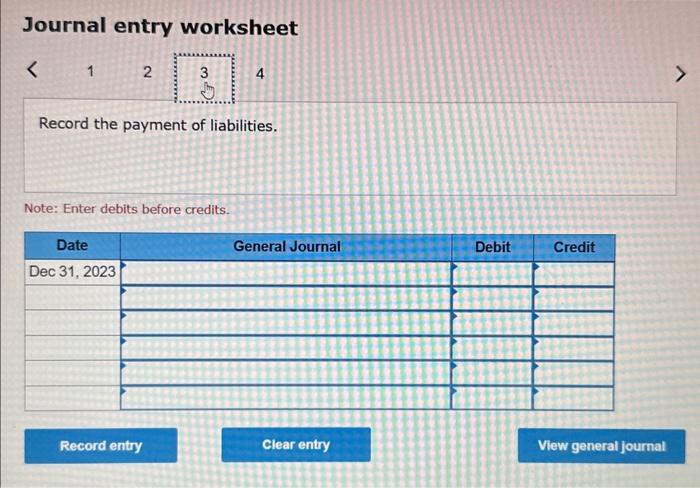

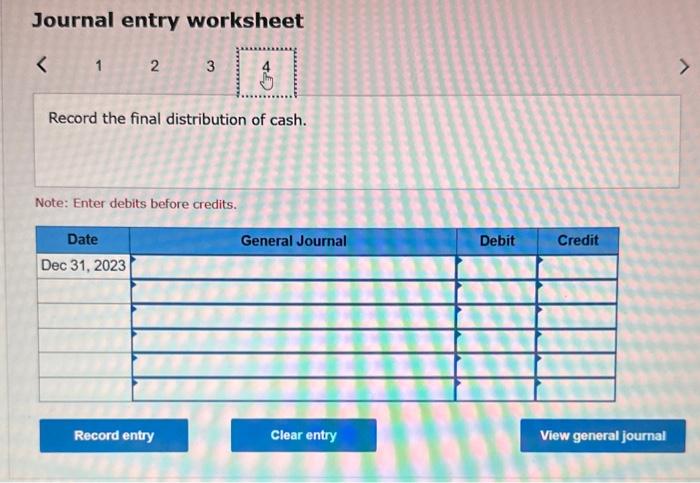

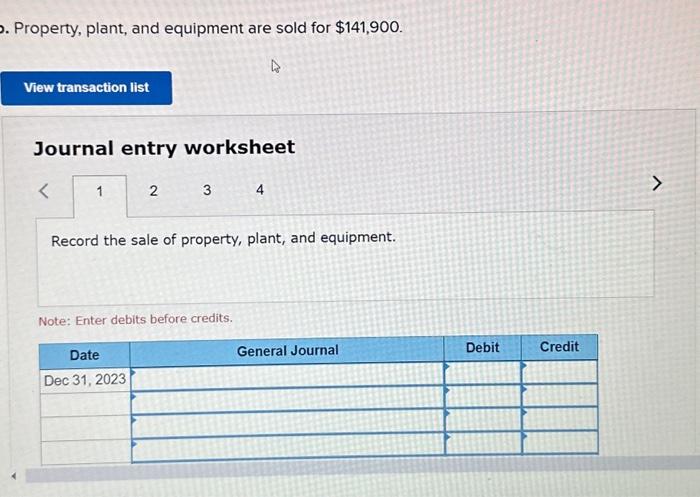

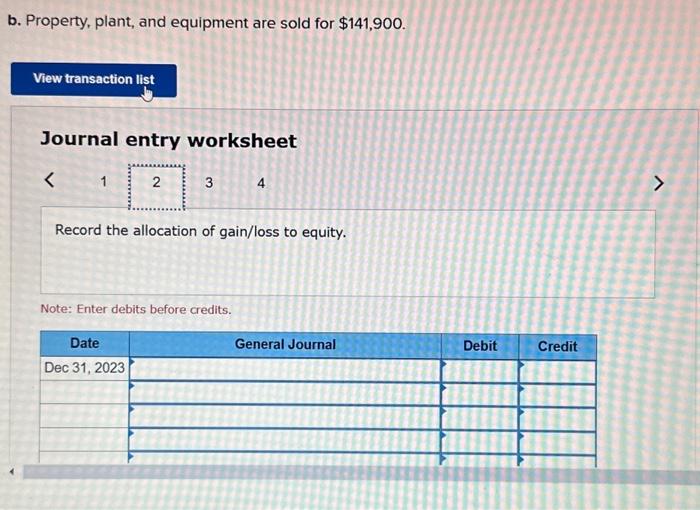

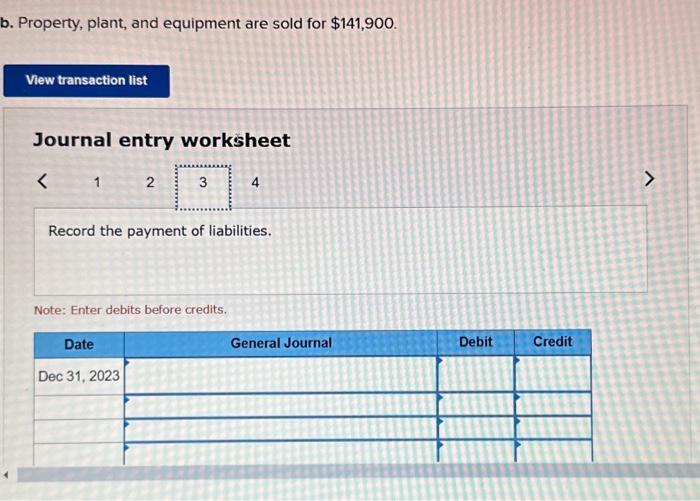

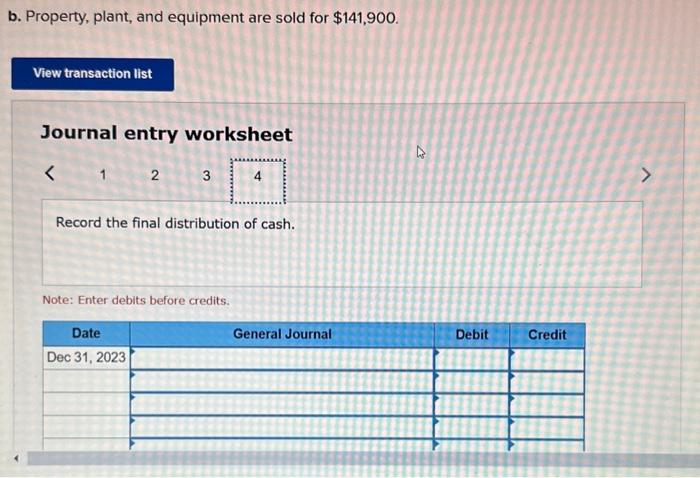

rish Craig and Ted Smith have a bio-energy and consulting business and share profit and losses in a 3:1 ratio. They decide to quidate their partnership on December 31, 2023, when the balance sheet shows the following: Required: Prepare the entries on December 31, 2023, to record the liquidation under each of the following independent assumptions: a. Property, plant, and equipment are sold for $725,700. Journal entry worksheet Record the sale of property, plant, and quipment. Note: Enter debits before credits. Journal entry worksheet Record the allocation of gain/loss to equity. Note: Enter debits before credits. Journal entry worksheet Record the payment of liabilities. Note: Enter debits before credits. Journal entry worksheet 1 Record the final distribution of cash. Note: Enter debits before credits. Property, plant, and equipment are sold for $141,900. Journal entry worksheet Record the sale of property, plant, and equipment. Note: Enter debits before credits. b. Property, plant, and equipment are sold for $141,900. Journal entry worksheet 1 Record the allocation of gain/loss to equity. Note: Enter debits before credits. b. Property, plant, and equipment are sold for $141,900. Journal entry worksheet Record the payment of liabilities. Note: Enter debits before credits. b. Property, plant, and equipment are sold for $141,900. Journal entry worksheet Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started