Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Triumph leased equipment for an eight - year period, at which time possession of the equipment will revert back to the lessor. The equipment is

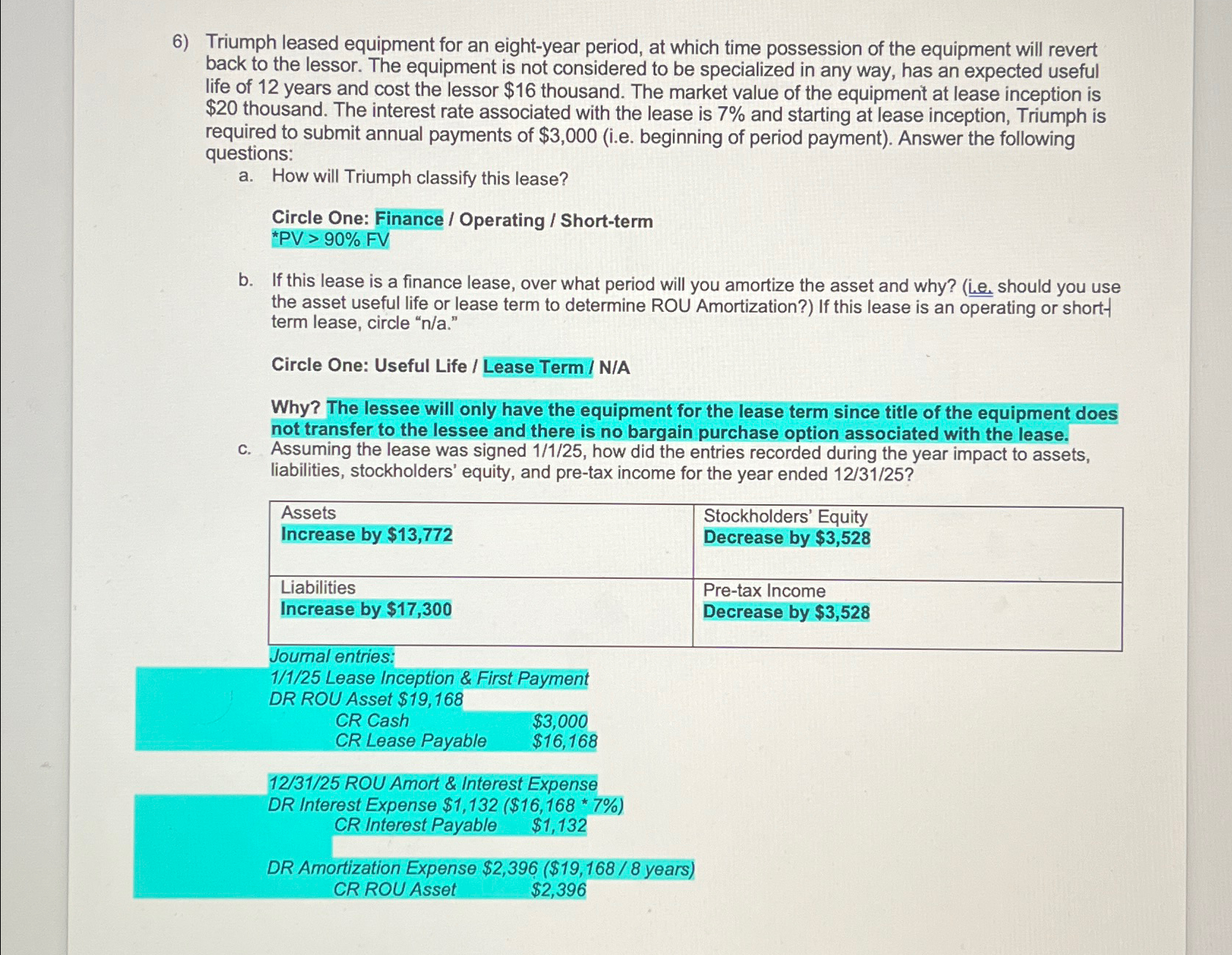

Triumph leased equipment for an eightyear period, at which time possession of the equipment will revert back to the lessor. The equipment is not considered to be specialized in any way, has an expected useful life of years and cost the lessor $ thousand. The market value of the equipment at lease inception is $ thousand. The interest rate associated with the lease is and starting at lease inception, Triumph is required to submit annual payments of $ie beginning of period payment Answer the following questions:

a How will Triumph classify this lease?

Circle One: Finance Operating Shortterm

b If this lease is a finance lease, over what period will you amortize the asset and why? Le should you use the asset useful life or lease term to determine ROU Amortization? If this lease is an operating or shortterm lease, circle

Circle One: Useful Life Lease Term NA

Why? The lessee will only have the equipment for the lease term since title of the equipment does not transfer to the lessee and there is no bargain purchase option associated with the lease.

c Assuming the lease was signed how did the entries recorded during the year impact to assets, liabilities, stockholders' equity, and pretax income for the year ended

tabletableAssetsIncrease by $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started