Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TRUE / FALSE # True False 5 6 Question The company's working capital policy changes helped operations and fostered investment in core long-term assets. Cash

TRUE / FALSE

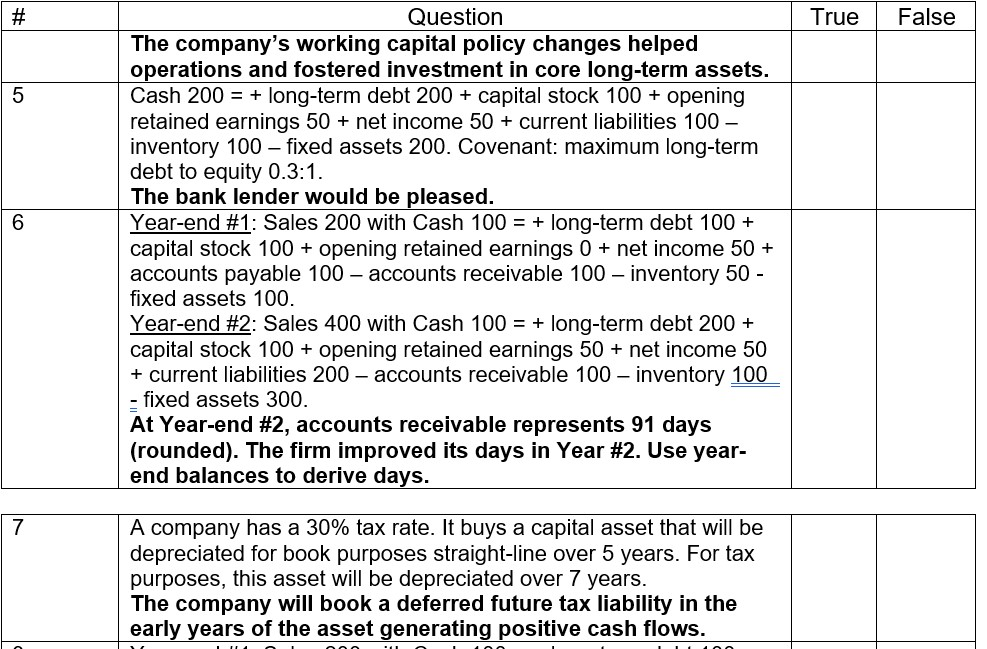

# True False 5 6 Question The company's working capital policy changes helped operations and fostered investment in core long-term assets. Cash 200 = + long-term debt 200 + capital stock 100 + opening retained earnings 50 + net income 50 + current liabilities 100 inventory 100 fixed assets 200. Covenant: maximum long-term debt to equity 0.3:1. The bank lender would be pleased. Year-end #1: Sales 200 with Cash 100 = + long-term debt 100+ capital stock 100+ opening retained earnings 0+ net income 50 + accounts payable 100 - accounts receivable 100 inventory 50 - fixed assets 100. Year-end #2: Sales 400 with Cash 100 = + long-term debt 200 + capital stock 100+ opening retained earnings 50 + net income 50 + current liabilities 200 - accounts receivable 100 inventory 100 - fixed assets 300. At Year-end #2, accounts receivable represents 91 days (rounded). The firm improved its days in Year #2. Use year- end balances to derive days. 7 A company has a 30% tax rate. It buys a capital asset that will be depreciated for book purposes straight-line over 5 years. For tax purposes, this asset will be depreciated over 7 years. The company will book a deferred future tax liability in the early years of the asset generating positive cash flows. nnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started