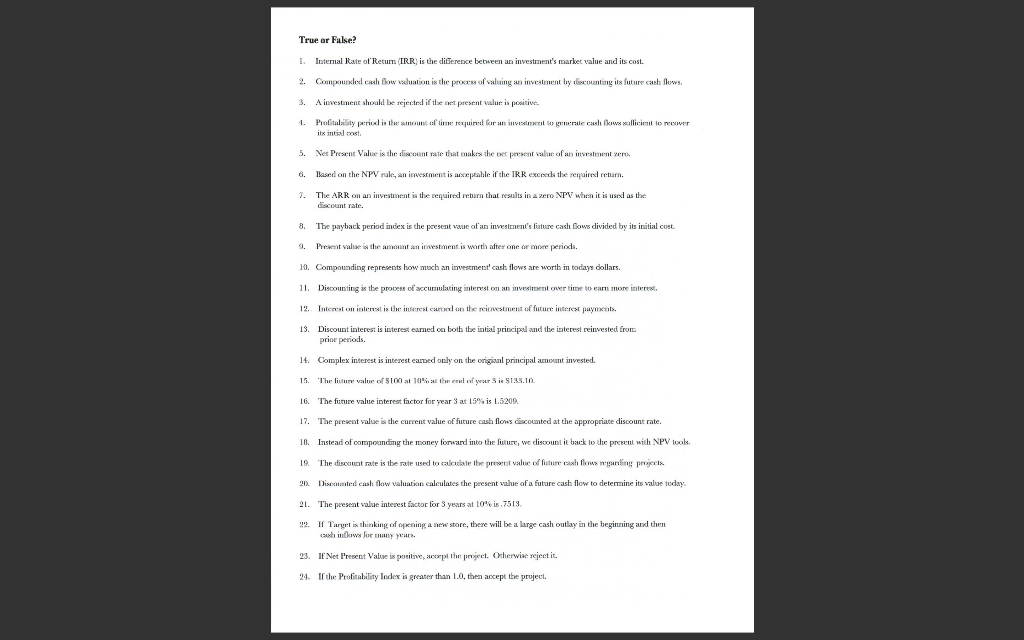

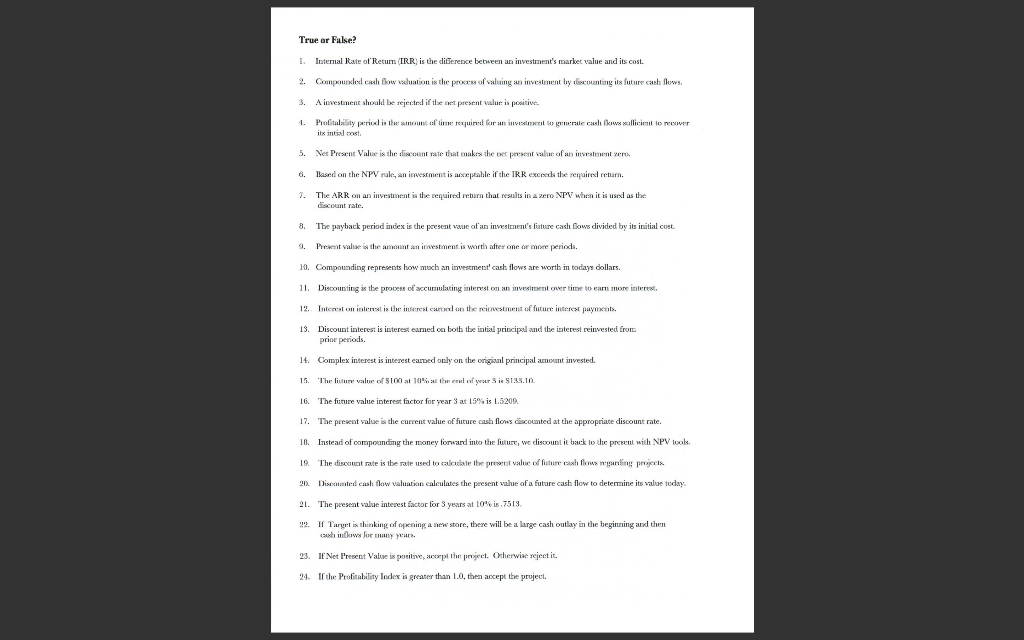

True or False? 2. 1. Internal Rate of Return (IRR) is the difference between an investment's market value and its cost. Composed cash flow valuation is the process of valuing an investment by discounting its future cash flows. A investment should be rejected if the wet present value in positive. Profitability red in the amount of time required for an investil onerale canli www xullicient to recover is italost 1. 5. Net Present Value in the discount rate that makes the represent value of an investment zero Rased on the NPV rale, an investment is acceptable if the IRR exceed the required return. The ARR on an investment is the required return that results in a zero NPV when it is used as the discount rate 2. The payback period index is the present we of an investment's future cash ows divided by its initial cost Prezent value is the amount an investment is worth after one or more periods. 10. Compounding represents how much an investment' cash flows are worth in todays dollars. 11. Discounting is the process of accumulating interest on an investment one time to earn more interest 12. Interest on interest is the interest and on the reinvestment of future interest payments. 13. Discount interest is interest earned ca both the intial principal and the interest reinvested from prior periods. 14. Complex interest is interest eamed only on the origin principal amount invested. 15. The lifur value of $100 at 10" at the end of year SS125.10. 16. The future value interest factor for years at 15% is 1.5209. 17. The present value is the current value of future cash flows discounted at the appropriate discount rate. 18. Instead of compounding the money forward into the future, we discount it back to the present with NPV looks. The discount the rate the prevale f future how megarding proces 20. Discounted cash flow valuation calculates the pecsent value of a future cash flow to determine its value today 21. The present value interest factor for 3 years at 10% is.7513 ...I Target is thinking of opening a new store, there will be a large cash outlay in the beginning and then ab inflows for many years. 23. If Net Present Value is positive, expl the project. Otherwise reject it. 24. If the Profitability Index is greater than 1.0, then accept the pruject