Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TRUE OR FALSE, DON'T COPY OTHER ANSWERS FROM CHEGG BECAUSE HALF OF IT IS WRONG 7 - examining the relative proportions of various Balance Sheet

TRUE OR FALSE, DON'T COPY OTHER ANSWERS FROM CHEGG BECAUSE HALF OF IT IS WRONG

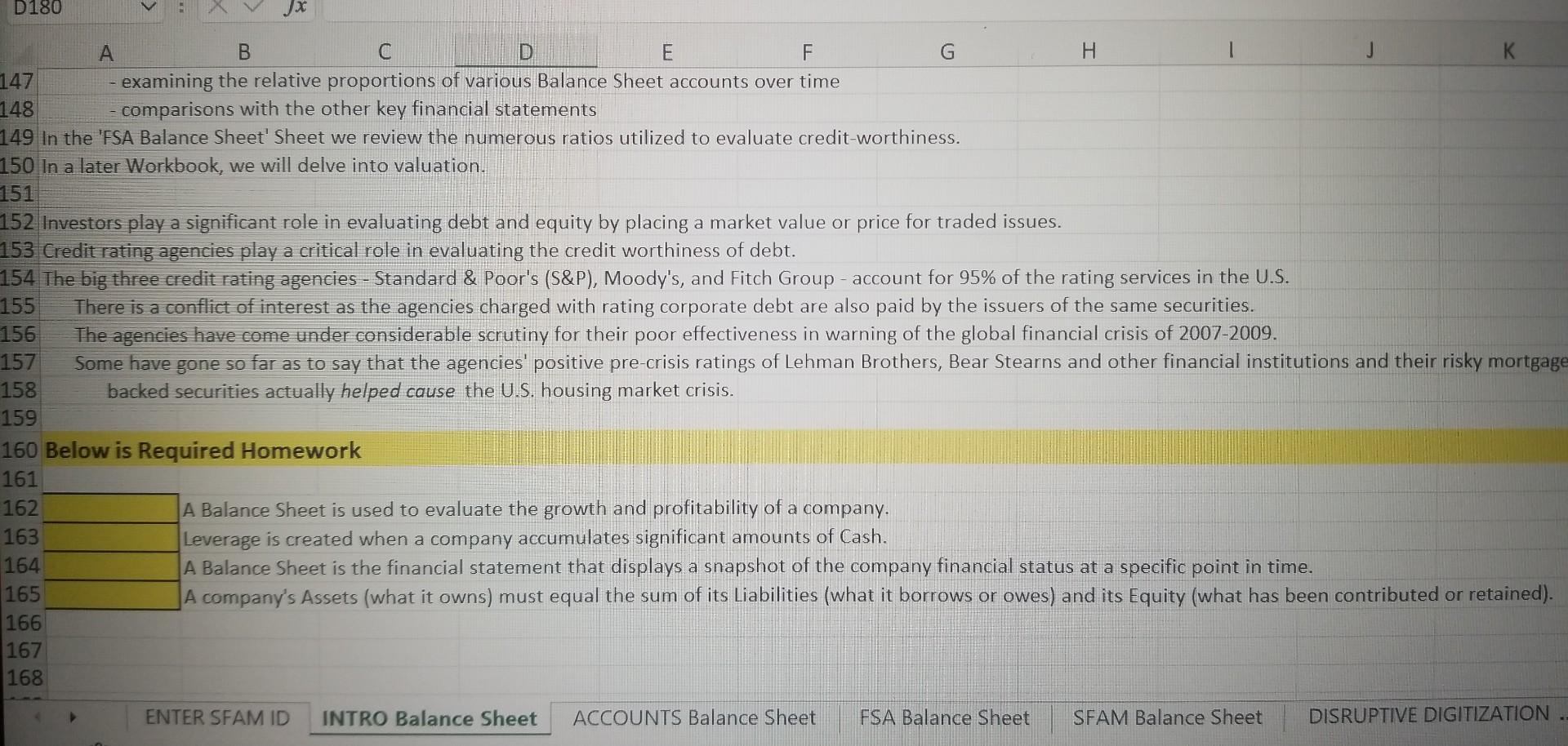

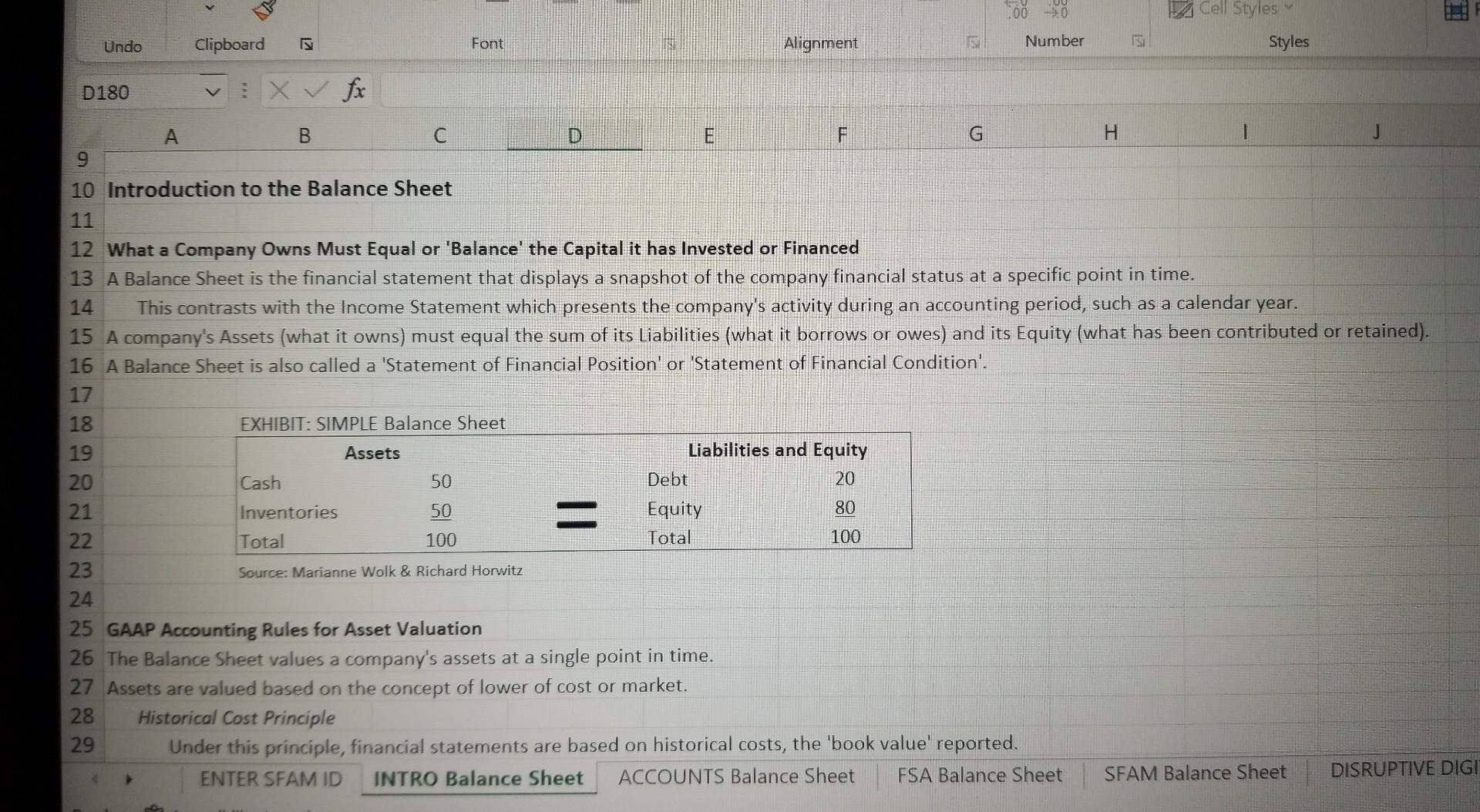

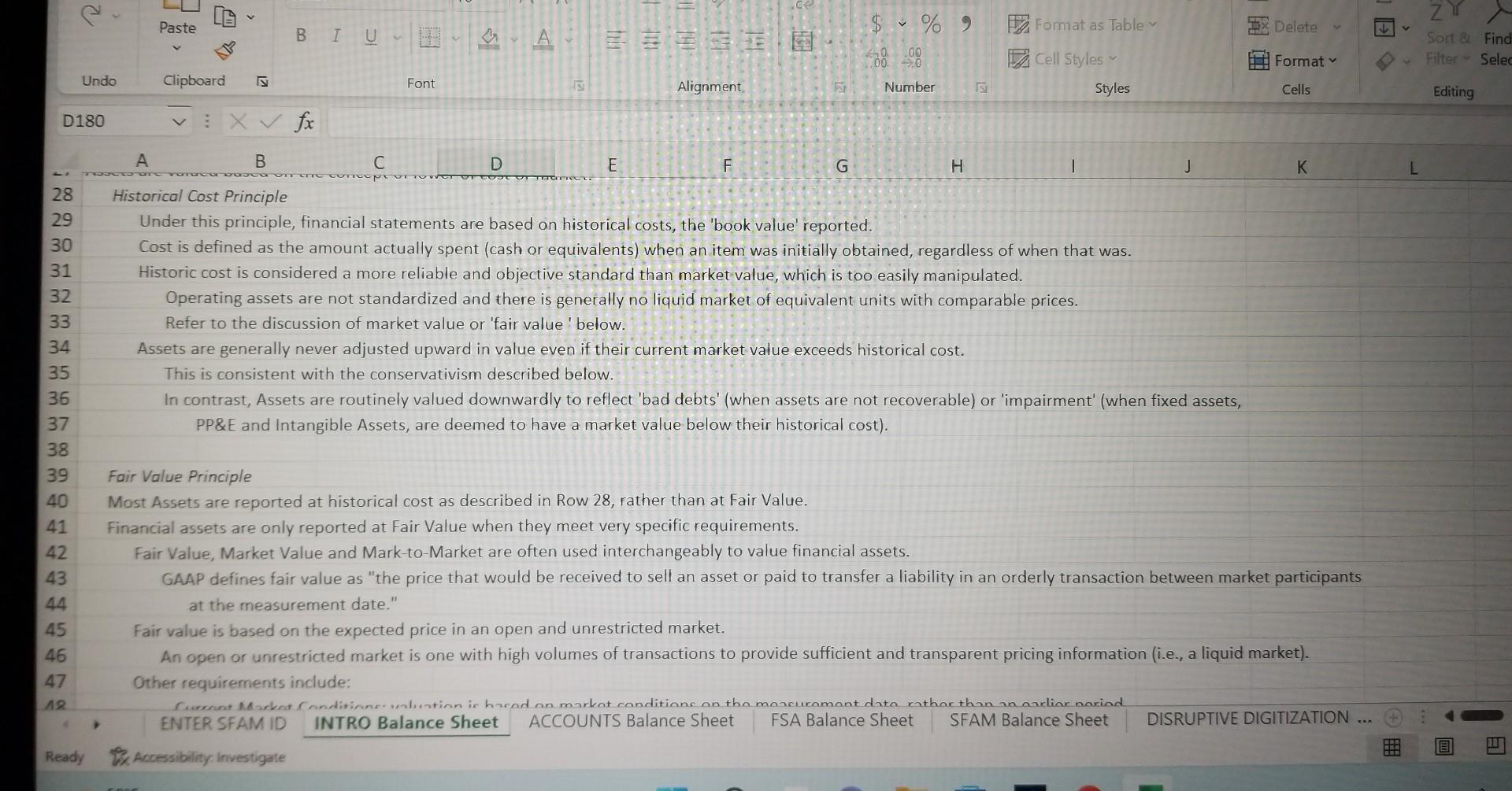

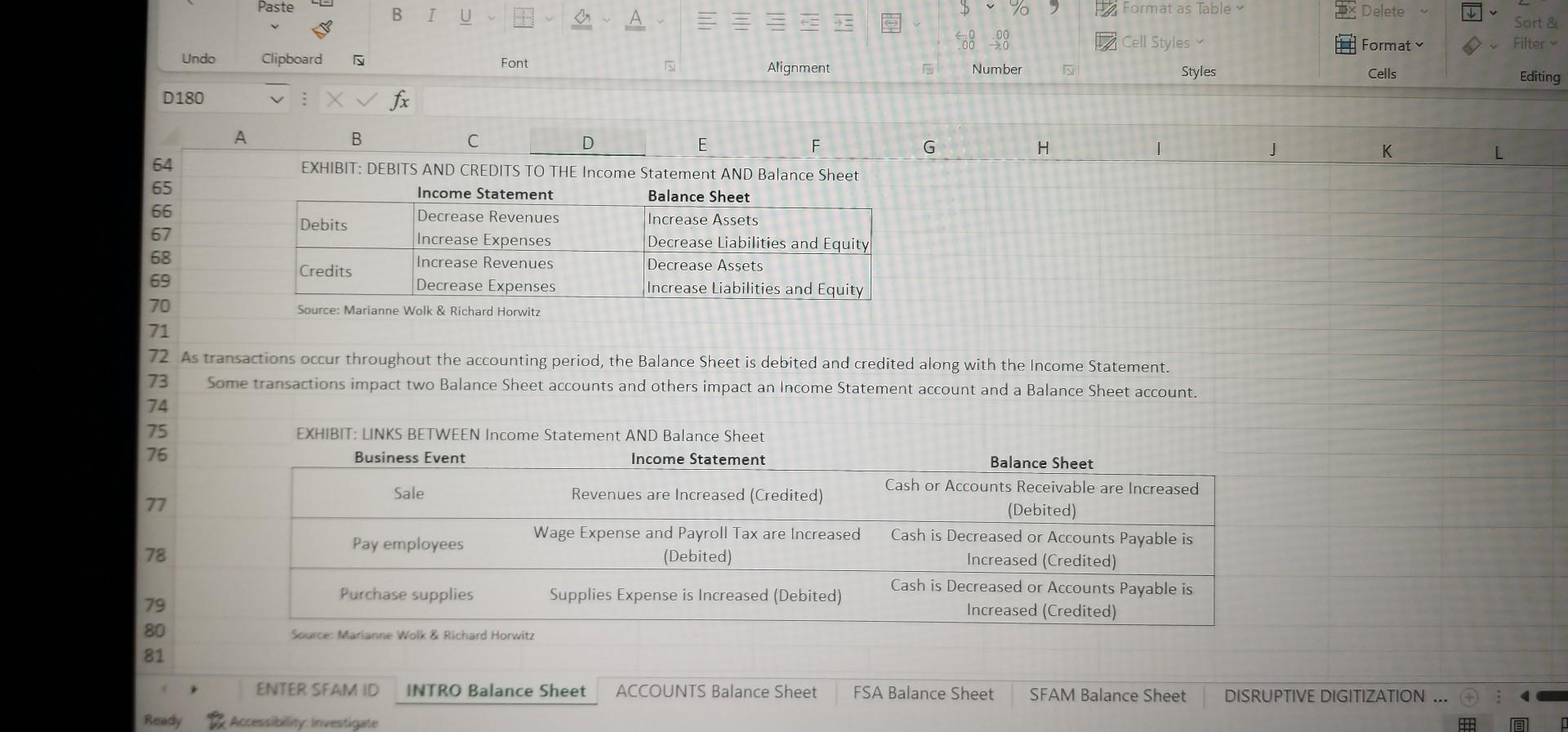

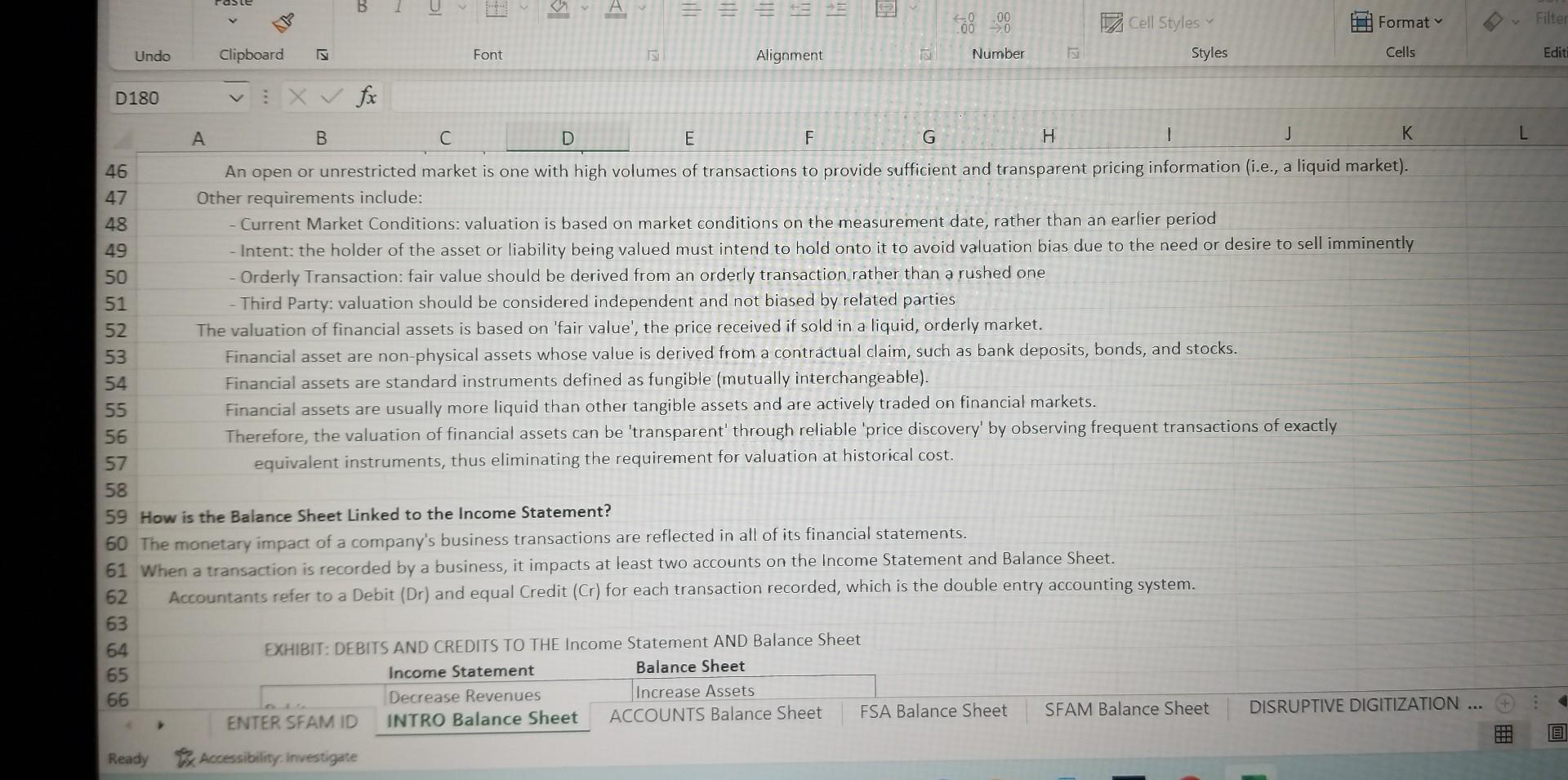

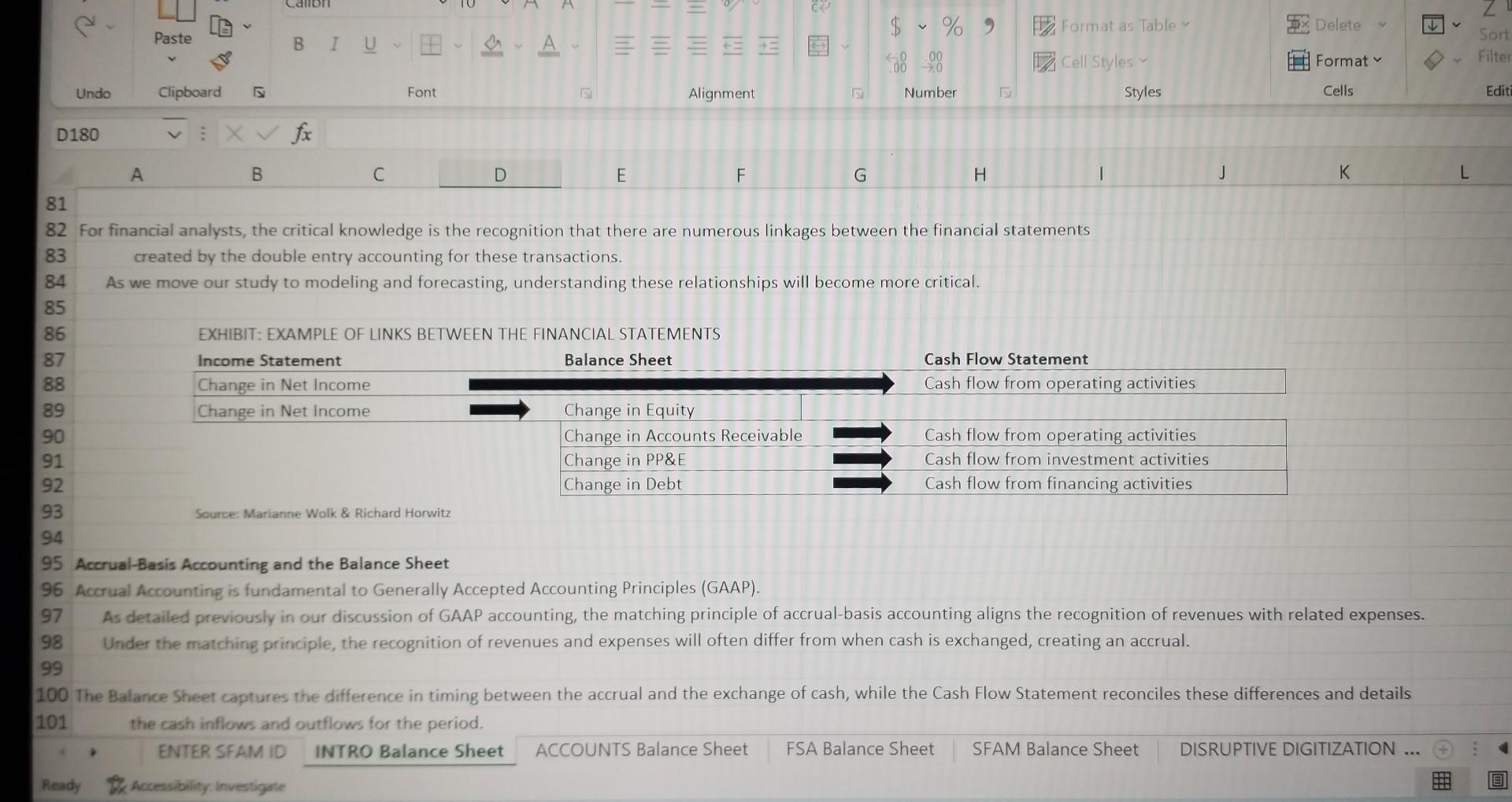

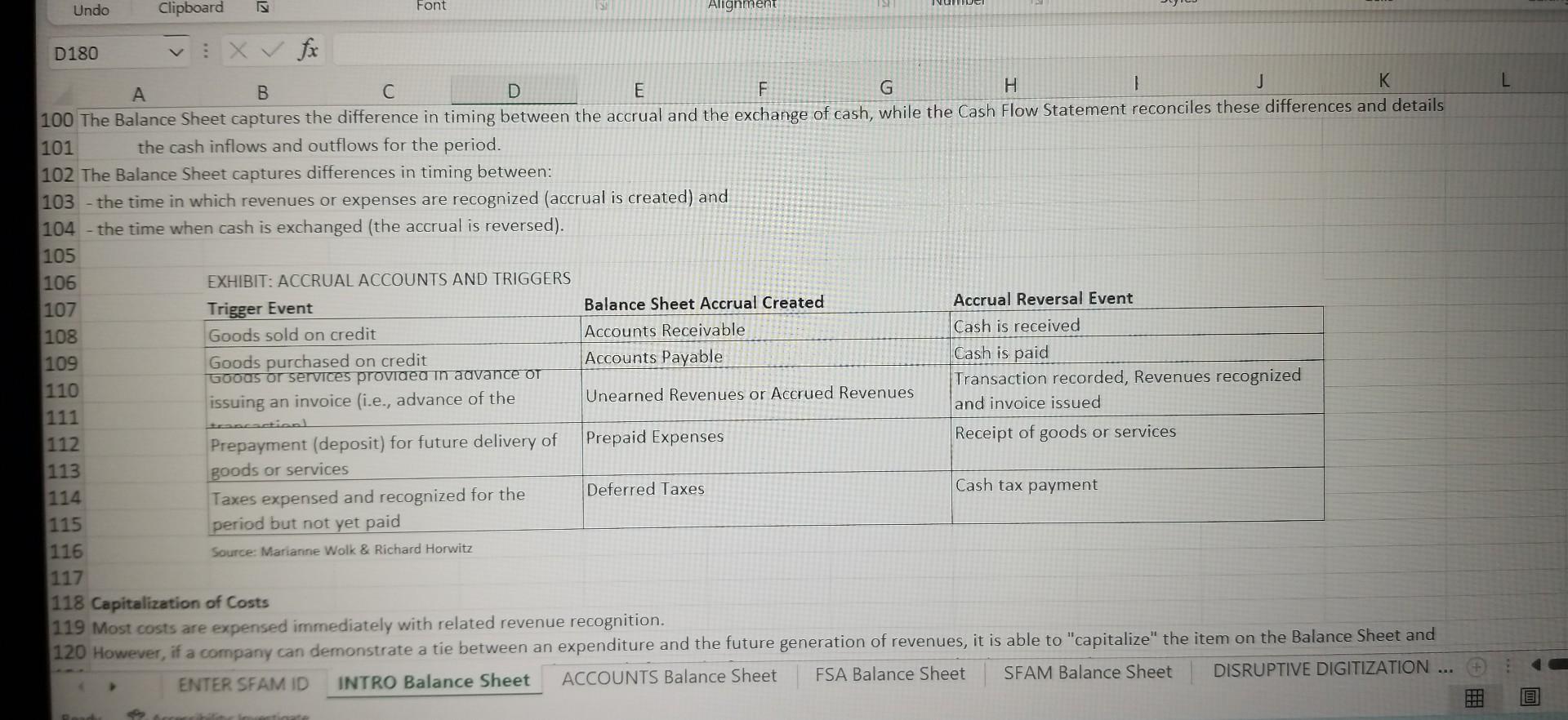

7 - examining the relative proportions of various Balance Sheet accounts over time - comparisons with the other key financial statements In the 'FSA Balance Sheet' Sheet we review the numerous ratios utilized to evaluate credit-worthiness. In a later Workbook, we will delve into valuation. 2 Investors play a significant role in evaluating debt and equity by placing a market value or price for traded issues. 3 Credit rating agencies play a critical role in evaluating the credit worthiness of debt. 4 The big three credit rating agencies - Standard \& Poor's (S\&P), Moody's, and Fitch Group - account for 95% of the rating services in the U.S. There is a conflict of interest as the agencies charged with rating corporate debt are also paid by the issuers of the same securities. The agencies have come under considerable scrutiny for their poor effectiveness in warning of the global financial crisis of 20072009. Some have gone so far as to say that the agencies' positive pre-crisis ratings of Lehman Brothers, Bear Stearns and other financial institutions and their risky mortgag backed securities actually helped cause the U.S. housing market crisis. Below is Required Homework A Balance Sheet is used to evaluate the growth and profitability of a company. Leverage is created when a company accumulates significant amounts of Cash. A Balance Sheet is the financial statement that displays a snapshot of the company financial status at a specific point in time. A company's Assets (what it owns) must equal the sum of its Liabilities (what it borrows or owes) and its Equity (what has been contributed or retained). 10 Introduction to the Balance Sheet What a Company Owns Must Equal or 'Balance' the Capital it has Invested or Financed A Balance Sheet is the financial statement that displays a snapshot of the company financial status at a specific point in time. This contrasts with the Income Statement which presents the company's activity during an accounting period, such as a calendar year. A company's Assets (what it owns) must equal the sum of its Liabilities (what it borrows or owes) and its Equity (what has been contributed or retained). A Balance Sheet is also called a 'Statement of Financial Position' or 'Statement of Financial Condition'. Source: Marianne Wolk \& Kichara Horwitz GAAP Accounting Rules for Asset Valuation The Balance Sheet values a company's assets at a single point in time. Assets are valued based on the concept of lower of cost or market. Historical Cost Principle Under this principle, financial statements are based on historical costs, the 'book value' reported. ENTER SFAM ID ACCOUNTS Balance Sheet Under this principle, financial statements are based on historical costs, the 'book value' reported. Cost is defined as the amount actually spent (cash or equivalents) when an item was initially obtained, regardless of what Historic cost is considered a more reliable and objective standard than market value, which is too easily manipulated Operating assets are not standardized and there is generally no liquid market of equivalent units with comparable prices. Refer to the discussion of market value or 'fair value ' below. Assets are generally never adjusted upward in value even if their current market value exceeds historical cost. This is consistent with the conservativism described below. In contrast, Assets are routinely valued downwardly to reflect 'bad debts' (when assets are not recoverable) or 'impairment' (when fixed assets, PP\&E and Intangible Assets, are deemed to have a market value below their historical cost). Fair Value Principle Most Assets are reported at historical cost as described in Row 28, rather than at Fair Value. Financial assets are only reported at Fair Value when they meet very specific requirements. Fair Value, Market Value and Mark-to-Market are often used interchangeably to value financial assets. GAAP defines fair value as "the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date." Fair value is based on the expected price in an open and unrestricted market. An open or unrestricted market is one with high volumes of transactions to provide sufficient and transparent pricing information (i.e., a liquid market). Other requirements include: 2 As transactions occur throughout the accounting period, the Balance Sheet is debited and credited along with the Income Statement. Some transactions impact two Balance Sheet accounts and others impact an Income Statement account and a Balance Sheet account. An open or unrestricted market is one with high volumes of transactions to provide sufficient and transparent pricing information (i.e., a liquid market). Other requirements include: - Current Market Conditions: valuation is based on market conditions on the measurement date, rather than an earlier period - Intent: the holder of the asset or liability being valued must intend to hold onto it to avoid valuation bias due to the need or desire to selly - Orderly Transaction: fair value should be derived from an orderly transaction, rather than a rushed one - Third Party: valuation should be considered independent and not biased by related parties The valuation of financial assets is based on 'fair value', the price received if sold in a liquid, orderly market. Financial asset are non-physical assets whose value is derived from a contractual claim, such as bank deposits, bonds, and stocks. Financial assets are standard instruments defined as fungible (mutually interchangeable). Financial assets are usually more liquid than other tangible assets and are actively traded on financial markets. Therefore, the valuation of financial assets can be 'transparent' through reliable 'price discovery' by observing frequent transactions of exactly equivalent instruments, thus eliminating the requirement for valuation at historical cost. How is the Balance Sheet Linked to the Income Statement? The monetary impact of a company's business transactions are reflected in all of its financial statements. 82 For financial analysts, the critical knowledge is the recognition that there are numerous linkages between the financial statements created by the double entry accounting for these transactions. Accrual-Basis Accounting and the Balance Sheet Accrual Accounting is fundamental to Generally Accepted Accounting Principles (GAAP). As detailed previously in our discussion of GAAP accounting, the matching principle of accrual-basis accounting aligns the recognition of revenues with related expenses 00 The Balance Sheet captures the difference in timing between the accrual and the exchange of cash, while the Cash Flow Statement reconciles these differences and details 01 the cash inflows and outflows for the period. 100 The Balance Sheet captures the difference in timing between the accrual and the exchange of cash, while the Cash Flow Statement reconciles these differences and details the cash inflows and outflows for the period. The Balance Sheet captures differences in timing between: - the time in which revenues or expenses are recognized (accrual is created) and - the time when cash is exchanged (the accrual is reversed). Capitalization of Costs 119 Most costs are expensed immediately with related revenue recognition. 120 However, if a company can demonstrate a tie between an expenditure and the future generation of revenues, it is able to "capitalize" the item on the Balance Sheet and SFAM Balance Sheet DISRUPTIVE DIGITIZATION

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started