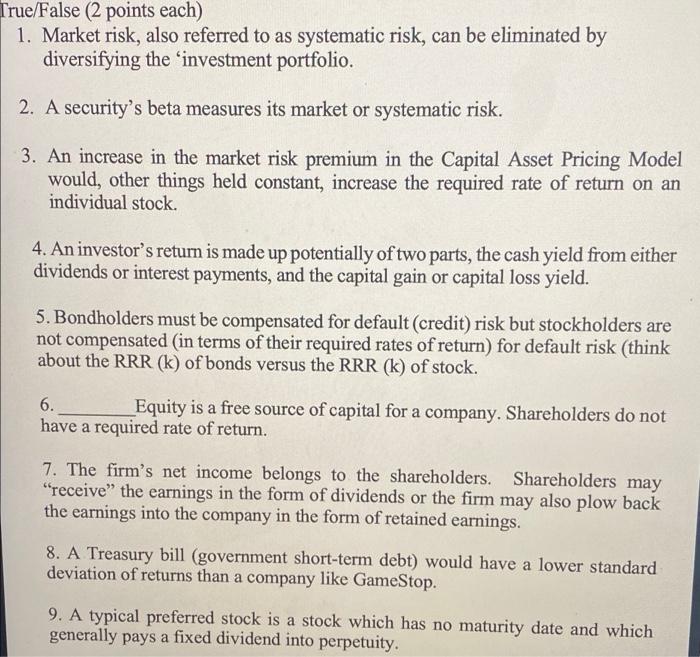

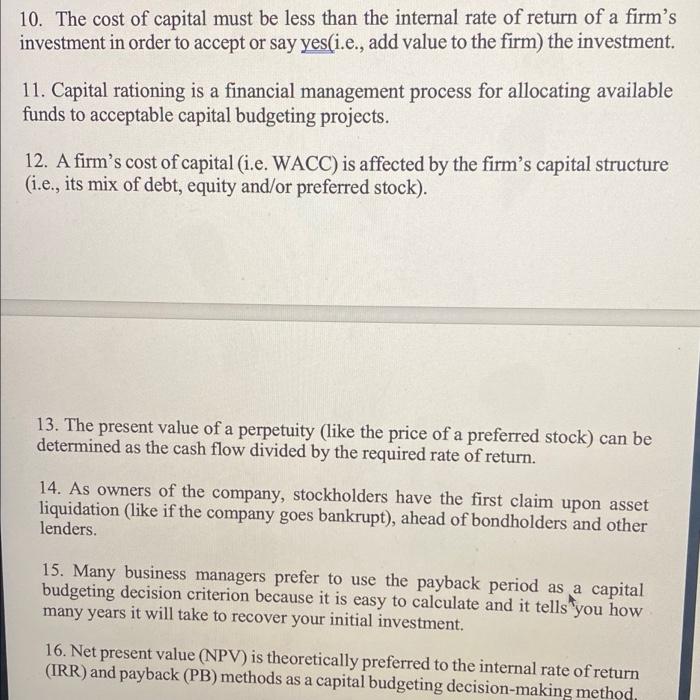

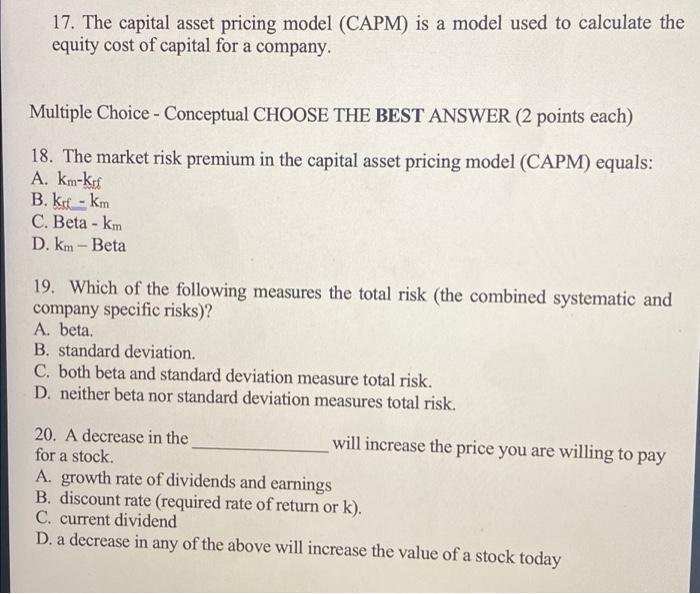

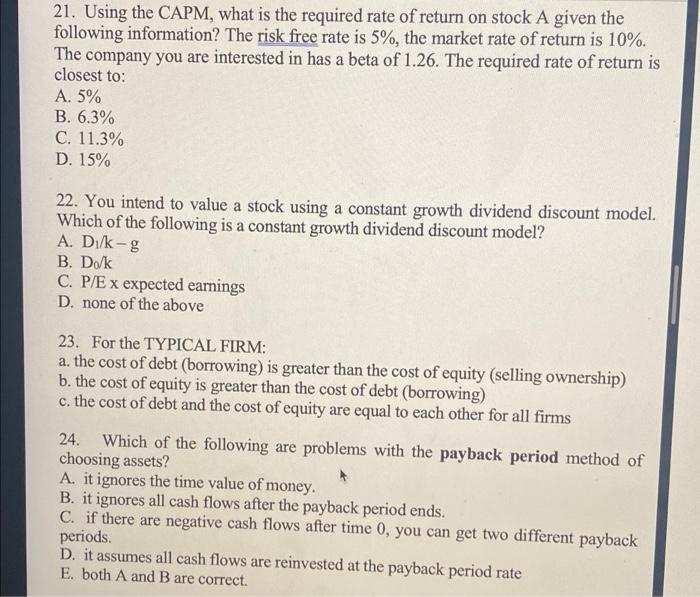

True/False (2 points each) 1. Market risk, also referred to as systematic risk, can be eliminated by diversifying the 'investment portfolio. 2. A security's beta measures its market or systematic risk. 3. An increase in the market risk premium in the Capital Asset Pricing Model would, other things held constant, increase the required rate of return on an individual stock. 4. An investor's return is made up potentially of two parts, the cash yield from either dividends or interest payments, and the capital gain or capital loss yield. 5. Bondholders must be compensated for default (credit) risk but stockholders are not compensated in terms of their required rates of return) for default risk (think about the RRR (k) of bonds versus the RRR (k) of stock. 6. Equity is a free source of capital for a company. Shareholders do not have a required rate of return. 7. The firm's net income belongs to the shareholders. Shareholders may "receive the earnings in the form of dividends or the firm may also plow back the earnings into the company in the form of retained earnings. 8. A Treasury bill (government short-term debt) would have a lower standard deviation of returns than a company like GameStop. 9. A typical preferred stock is a stock which has no maturity date and which generally pays a fixed dividend into perpetuity. 10. The cost of capital must be less than the internal rate of return of a firm's investment in order to accept or say yes(i.e., add value to the firm) the investment. 11. Capital rationing is a financial management process for allocating available funds to acceptable capital budgeting projects. 12. A firm's cost of capital (i.e. WACC) is affected by the firm's capital structure (i.e., its mix of debt, equity and/or preferred stock). 13. The present value of a perpetuity (like the price of a preferred stock) can be determined as the cash flow divided by the required rate of return. 14. As owners of the company, stockholders have the first claim upon asset liquidation (like if the company goes bankrupt), ahead of bondholders and other lenders. 15. Many business managers prefer to use the payback period as a capital budgeting decision criterion because it is easy to calculate and it tells you how many years it will take to recover your initial investment. 16. Net present value (NPV) is theoretically preferred to the internal rate of return (IRR) and payback (PB) methods as a capital budgeting decision-making method. 17. The capital asset pricing model (CAPM) is a model used to calculate the equity cost of capital for a company. Multiple Choice - Conceptual CHOOSE THE BEST ANSWER (2 points each) 18. The market risk premium in the capital asset pricing model (CAPM) equals: A. km-kof B. krt- km C. Beta - km D. km - Beta 19. Which of the following measures the total risk (the combined systematic and company specific risks)? A. beta. B. standard deviation. C. both beta and standard deviation measure total risk. D. neither beta nor standard deviation measures total risk. 20. A decrease in the will increase the price you are willing to pay for a stock. A. growth rate of dividends and earnings B. discount rate (required rate of return or k). C. current dividend D. a decrease in any of the above will increase the value of a stock today a 21. Using the CAPM, what is the required rate of return on stock A given the following information? The risk free rate is 5%, the market rate of return is 10%. The company you are interested in has a beta of 1.26. The required rate of return is closest to: A. 5% B. 6.3% C. 11.3% D. 15% 22. You intend to value a stock using a constant growth dividend discount model. Which of the following is a constant growth dividend discount model? A. Di/k-g B. Dok C. P/E x expected earnings D. none of the above 23. For the TYPICAL FIRM: a. the cost of debt (borrowing) is greater than the cost of equity (selling ownership) b. the cost of equity is greater than the cost of debt (borrowing) c. the cost of debt and the cost of equity are equal to each other for all firms 24. Which of the following are problems with the payback period method of choosing assets? A. it ignores the time value of money. B. it ignores all cash flows after the payback period ends. C. if there are negative cash flows after time 0, you can get two different payback periods D. it assumes all cash flows are reinvested at the payback period rate E. both A and B are correct