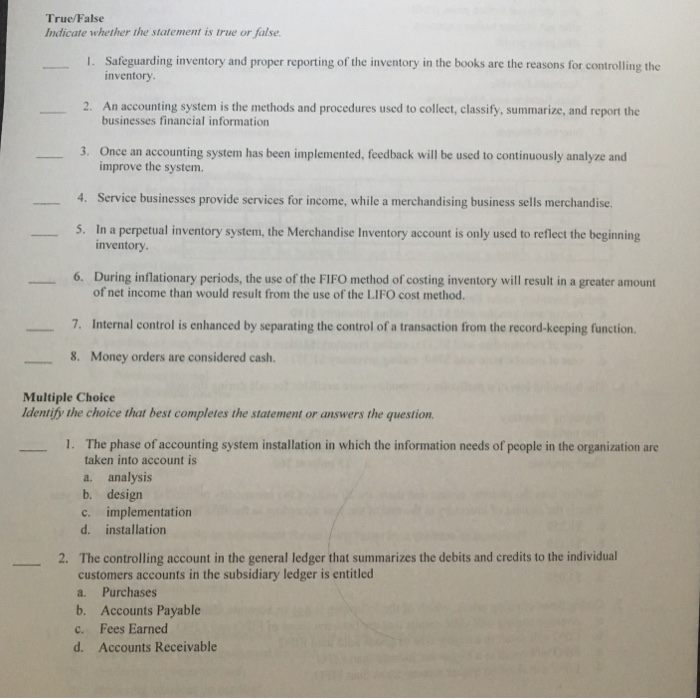

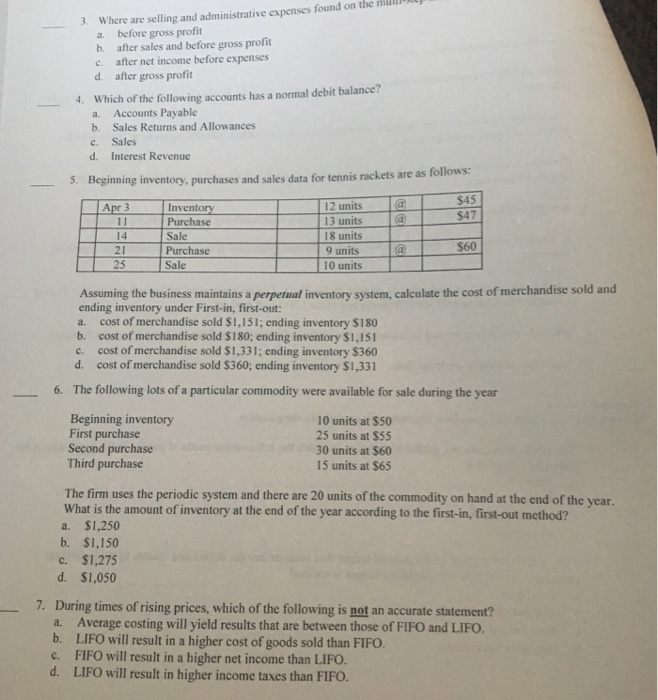

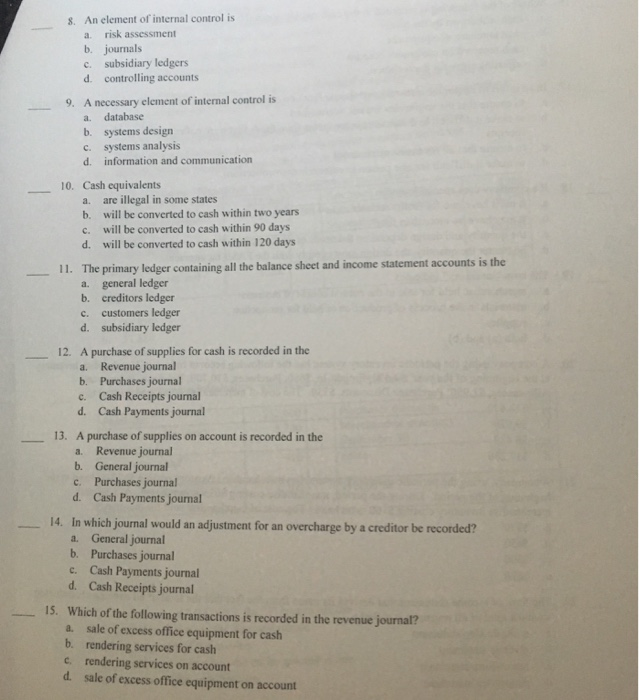

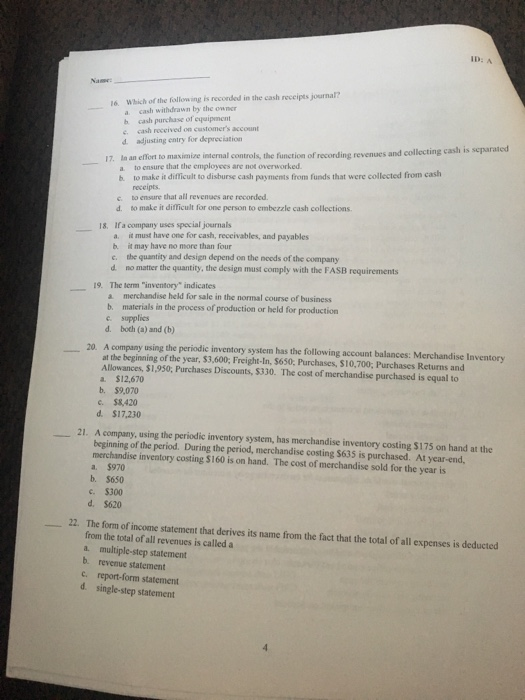

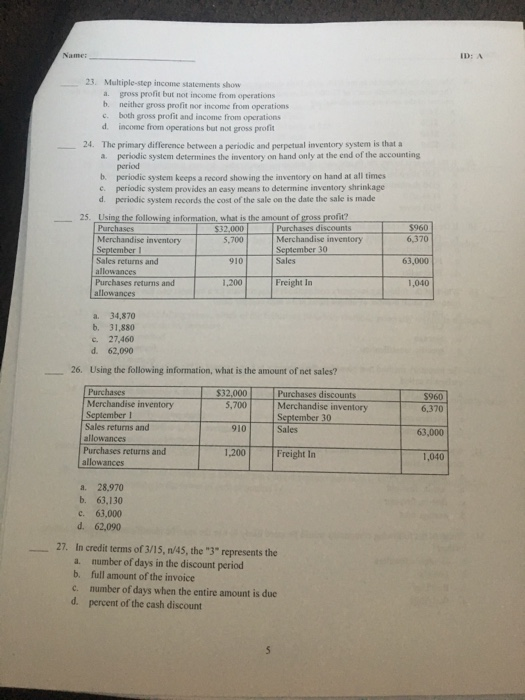

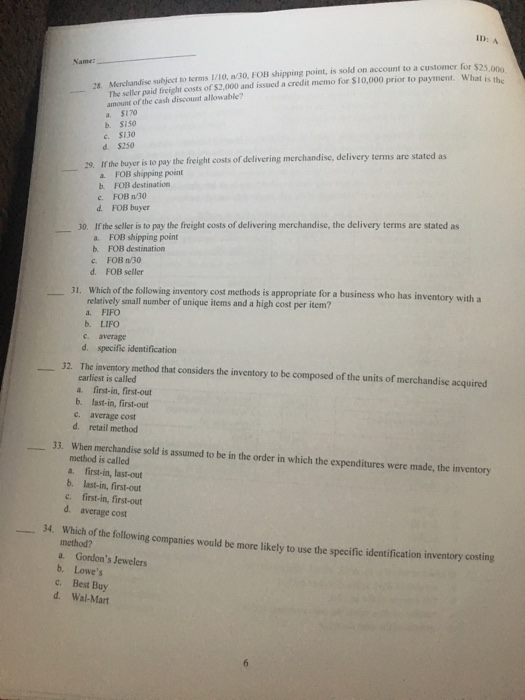

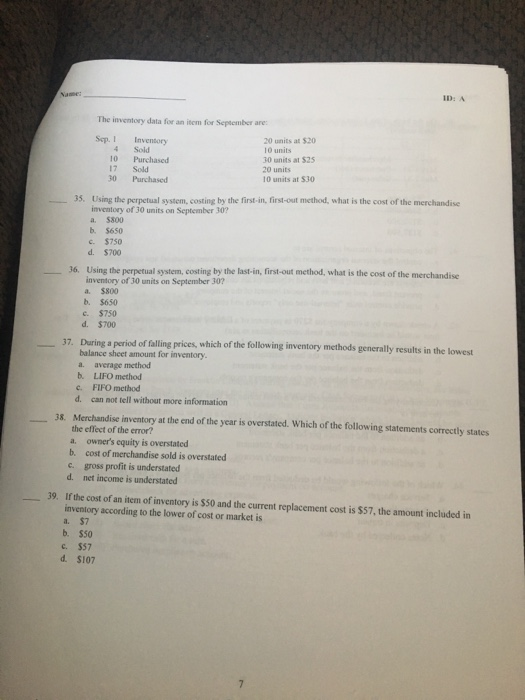

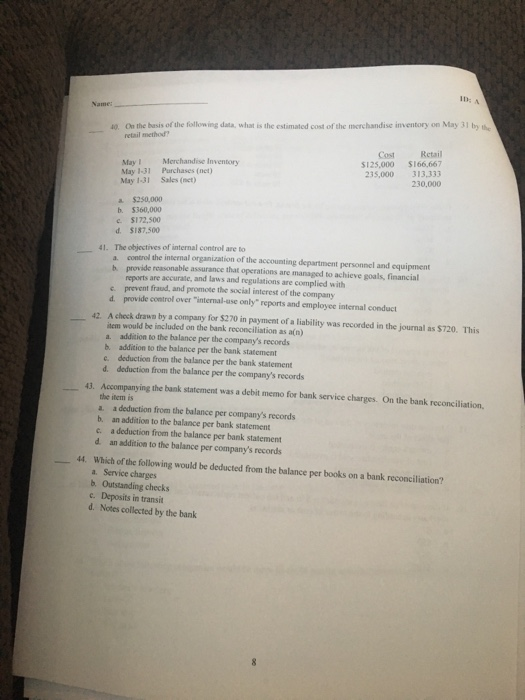

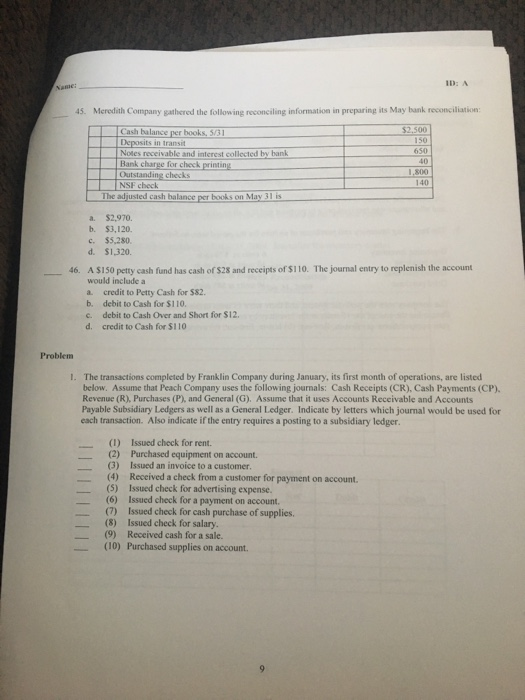

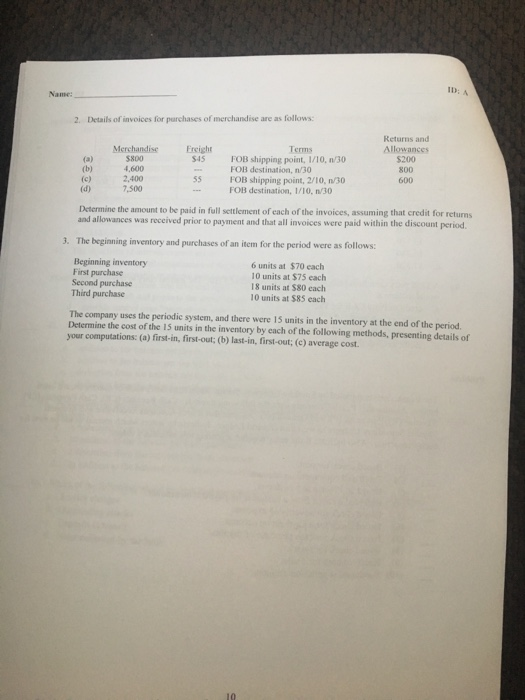

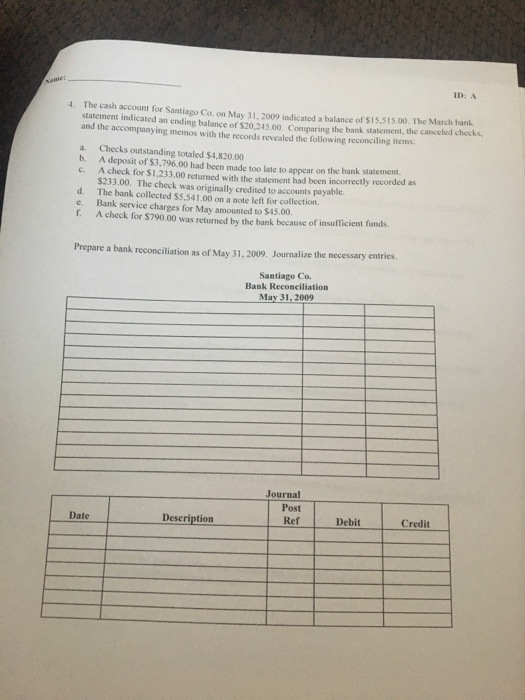

True/False Indicate whether the statement is true or false Safeguarding inventory and proper reporting of the inventory in the books are the reasons for controlling the inventory I. 2. An accounting system is the methods and procedures used to collect, classify, summarize, and report the businesses financial information 3. Once an accounting system has been implemented, feedback will be used to continuously analyze and improve the system. 4. Service businesses provide services for income, while a merchandising business sells merchandise s. In a perpetual inventory system, the Merchandise Inventory account is only used to reflect the beginning inventory. During inflationary periods, the use of the FIFO method of costing inventory will result in a greater amount of net income than would result from the use of the LIFO cost method. 6. 7. Internal control is enhanced by separating the control of a transaction from the record-keeping function 8. Money orders are considered cash. Multiple Choice ldentify the choice that best completes the statement or answers the question 1 The phase of accounting system installation in which the information needs of people in the organization are taken into account is a. analysis b. desig c. implementation d. installation The controlling account in the general ledger that summarizes the debits and credits to the individual customers accounts in the subsidiary ledger is entitled a. Purchases 2. b. Accounts Payable c. Fees Earned d. Accounts Receivable on the 3. Where are selling and administrative expenses found a. before gross profit b. after sales and before gross profit c. after net income before expenses d. after gross profit 4. Which of the following accounts has a normal debit balance? a. b. c. d. Accounts Payable Sales Returns and Allowances Sales Interest Revenue Beginning inventory, purchases and sales data for tennis rackets are as follows: Apr 3 Inventory 12 units$45 $47 13 units 18 units 14 2I 25 Purchase Sale Purchase Sale 9 units$60 10 units Assuming the business maintains a perpetual inventory system, calculate the cost of merchandise sold and ending inventory under First-in, first-out: a. cost of merchandise sold $1,151; ending inventory $180 b. c. d. cost of merchandise sold $180; ending inventory $1,151 cost of merchandise sold $1,331; ending inventory $360 cost of merchandise sold $360; ending inventory $1,331 6. The following lots of a particular commodity were available for sale during the year Beginning inventory 10 units at $50 25 units at $55 30 units at $60 15 units at $65 First purchase Second purchase Third purchase The firm uses the periodic system and there are 20 units of the commodity on hand at the end of the year What is the amount of inventory at the end of the year according to the first-in, first-out method? a. $1,250 b. $1,150 . $1,275 d. $1,050 During times of rising prices, which of the following is not an accurate statement? a. Average costing will yield results that are between those of FIFO and LIFO. 7. b. LIFO will result in a higher cost of goods sold than FIFO. FIFO will result in a higher net income than LIFO. LIFO will result in higher income taxes than FIFO. c. d. An element of internal control is a. risk assessment b. journals c. subsidiary ledgers d. controlling accounts s. A necessary element of intermal control is a. database b. systems design c. systems analysis d. information and communication 9. 10. Cash equivalents are illegal in some states b. a. will be converted to cash within two years will be converted to cash within 90 days c. d. will be converted to cash within 120 days The primary ledger containing all the balance sheet and income statement accounts is the a. general ledger b. creditors ledger c. customers ledger d. subsidiary ledger A purchase of supplies for cash is recorded in the a. Revenue journal b. Purchases journal c. d. 12. Cash Receipts journal Cash Payments journal 13. A purchase of supplies on account is recorded in the a. Revenue journal b. General journal c. Purchases journal d. Cash Payments journal 14. In which journal would an adjustment for an overcharge by a creditor be recorded? a. General journal b. Purchases journal c. Cash Payments journal d. Cash Receipts journal 15. Which of the following transactions is recorded in the revenue journal? a. sale of excess office equipment for cash b. rendering services for cash c. rendering services on account d. sale of excess office equipment on account ID: A 6. Which of the follow ing is reconded in the cash receipts journal? a cash withdrawn by the owner b cash purchase of eaipment c cash roceived on customer's account d. adjusting entry for dkpreciation cash is separated 17. ln an efort to mavimize internmal controls, the function of recording revenues and collecting a to ensure that the employees are not overworked b to make it difficult to disburse cash payments from funds that were collected from cash receipts. c to ensure that all revenues are recorded. d. to make it difficult for one person to embezzle cash collections 18. If a company uses special journals a, b. c. d it must have one for cash, receivables, and payables it may have no more than four the quantity and design depend on the noods of the mo matter the quantity, the design must comply with the FASB requirements company 19. The sem "inventory indicates handise held for sale in the normal course of business b. materials in the process of production or held for production c. supplics d. both (a) and (b) 20. A company using the periodic inventory system has the following account balances: Merchandise Inventory at the beginaing of the year, $3,600, Freight-In, $650. Purchases, $10,700 Purchases Returns and Allowances, S1,950, Purchases Discounts, $330. The cost of merchandise purchased is equal to a. $12,670 b. $9,070 e $8420 d. $17,230 21. A company, using the periodic inventory system, has merchandise inventory costing $175 on hand at the beginning of the period. During the period, merchandise costing S635 is purchased. At year-end, merchandise inventory costing $160 is on hand. The cost of merchandise sold for the year is a. $970 b. $650 c. $300 d. $620 22. The form of income statement that derives its name from the fact that the total of all expenses is deducted from the total of all revenues is called a multiple-step statement b. revenue statement c. report-form statement d. single-step statement Name ID: A 23. Multiple-step income statements show a. gross profit but not income from operations b. neither gross profit nor income from operations c. both gross profit and income from operations d. income from operations but not gross profit 24. The primary difference between a periodic and perpetual inventory system is that a a periodic system determines the inventory on hand only at the end of the accounting period b. periodic system keeps a record showing the inventory on hand at all times e periodic system provides an easy means to determine inventory shrinkage d. periodic system records the cost of the sale on the date the sale is made 25 Using the following information, what is the amount of gross profit? $32,000 Purchases discounts Purchases $960 6,370 63,000 1,040 Merchandise inventory 5,700 910 1.200 Merchandise inventory September 30 Sales Sales returns and allowances Purchases returns and Freight In allowances a. 34,870 b. 31,880 c 27,460 d. 62,090 Using the following information, what is the amount of net sales? 26. Purchases Merchandise inventory $32,000 5,700 Purchases discounts Merchandise inventory September 30 Sales S960 6,370 63,000 1,040 Sales returns and 910 allowances Purchases returns and allowances 1,200Freight In a. 28,970 b. 63,130 c. 63,000 d. 62,090 27. In credit terms of 3/15, n/45, the "3" represents the number of days in the discount period full amount of the invoice number of days when the entire amount is due percent of the cash discount a. b. c. d. ID: A The seller paid frcight costs of $2.,000 and issued a credit memo for S10,000 prior to payment. What is th amount of the cash discouat allowable? 28. Merchandise subject to terms 1/10, n/30, FOB shipping point, is sold on account to a customer for $25 n a. $170 b. $1S0 . $130 d $250 If the buyer is to pay the freight costs of delivering merchandise, delivery terms are stated as a. FOB shipping point b. FOB destination 29. e FOB n/30 d FOB buyer If the seller is to pay the freight costs of delivering merchandise, the delivery terms are stated as a. FOB shipping point b. FOB destination 30. c. FOB n/30 d. FOB seller Which of the following inventory cost methods is appropriate for a business who has in relatively small number of unique items and a high cost per item? a. FIFO b. LIFO c. average d. specific identification 31. ventory with a The inventory method that considers the inventory to be composed of the units of merchandise acquired earliest is called 32. a. first-in, first-out b. last-in, first-out c. average cost d. retail method When merchandise sold is assumed to be in the order in which the expenditures were made, the inventory method is called a. first-in, last-out b. last-in, first-out c. first-in, first-out d. average cost 33. 34. Which of the following companies would be more likely to use the specific identification method? inventory costing a. Gordon's Jewelers b. Lowe's c. Best Buy d. Wal-Mart ID: A The inventory data for an item for September are 20 units at $20 10 units 30 units at $25 20 units 10 units at $30 Sep. I Inventory 4 Sold 10 Purchased 17 Sold 30 Purchased 35. Using the perpetual system, costing by the first-in, first-out method, what is the cost of the merchandise inventory of 30 units on September 30? a. $800 b $650 $750 d. $700 36. Using the perpetual system, costing by the last-in, first-out method, what is the cost of the merchandise inventory of 30 units on September 30? $800 b. $650 $750 d. $700 37. During a period of falling prices, which of the following inventory methods generally results in the lowest balance sheet amount for inventory a. average method b. LIFO method c. FIFO method d. can not tell without more information Merchandise inventory at the end of the year is overstated. Which of the following statements correctly states the effect of the error? a. owner's equity is overstated b. cost of merchandise sold is overstated c. gross profit is understated d. net income is understated 38. If the cost of an item of inventory is $50 and the current replacement cost is $57, the amount included in inventory according to the lower of cost or market is a, $7 39. b. $50 c. $57 d. $107 11 A Name a0. On the basis of the following data, what is the estimated cost of the merchandise inventory on May 31 by the retail methou? CostRctail $125,000 $166,667 235,000 313,333 230,000 May Merchandise Inventory May 1-31 Purchases (net) May 1-31 Sales (net) a $250,000 b. $360,000 $172,500 d $187,500 The objectives of internal control are to 41. control the internal organization of the accounting department personnel and equipment b provide reasonable assurance that operations are managed to achieve goals, financial reports are accurate, and laws and regulations are complied with e prevent fraud, and promote the social interest of the company d. provide control over "internal-ase only" reports and employee internal conduct 42. A check drawn by a company for $270 in payment of a liability was recorded in the journal as $720. This tem would be included on the bank reconciliation as a(n) a. addition to the balance per the company's records b. addition to the balance per the bank statement e. deduction from the balance per the bank statement d deduction from the balance per the company's records 43. Accompanying the bank statement was a debit memo for bank service charges. On the bank reconciliation, the item is a a deduction from the balance per company's records b. an addition to the balance per bank statement c. a deduction from the balance per bank statement d an addition to the balance per company's records Which of the following would be deducted from the balance per books on a bank reconciliation? a. Service charges b. Outstanding checks c. Deposits in transit 44. d. Notes collected by the bank ID:A 45. Meredith Company gathered the following reconciling information in preparing its May bank reconciliation Cash balance per books, 531 Notes receivable and interest collected by bank Bank charge for check printing Outstanding checks 150 650 40 1,800 140 The adjusted cash balance per books on May 31 is a. $2,970. b. $3,120. C. $5,280. d. $1,320. A S150 petty cash fund has cash of $28 and receipts of $1 10. The jounal entry to replenish the account would include a a credit to Petty Cash for $82. b. debit to Cash for $110. c. debit to Cash Over and Short for $12 d. credit to Cash for $110 46. Problem The transactions completed by Franklin Company during January, its first month of operations, are listed below. Assume that Peach Company uses the following journals: Cash Receipts (CR), Cash Payments (CP). Revenue (R), Purchases (P), and General (G). Assume that it uses Accounts Reccivable and Accounts Payable Subsidiary Ledgers as well as a General Ledger. Indicate by letters which journal would be used for each transaction. Also indicate if the entry requires a posting to a subsidiary ledger l. (1) Issued check for rent. (2) Purchased equipment on account (3) Issued an invoice to a customer. (4) Received a check from a customer for payment on account. (S) Issued check for advertising expense (6) Issued check for a payment on account. (7) Issued check for cash purchase of supplies. (8) Issued check for salary (9) Received cash for a sale. (10) Purchased supplies on account. : A Name: 2. Details of invoices for parchases of merchandise are as follows: Returns and Allowances $200 800 600 Merchandise Eright Terms 800 ,600 2,400 7.500 SS FOB shipping point, 1/10, n/30 FOB destination, n/30 55 FOB shipping point, 2/10, n/30 FOB destination, 1/10, n/30 Determine the amount to be paid in full settliement of each of the invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period. The beginning inventory and purchases of an item for the period were as follows Beginning inventory 3. First purchase Second purchase Third purchase 6 units at $70 each 10 units at $75 each 18 units at $80 cach 10 units at $85 each The company uses the periodic system, and there were 15 units in the inventory at the end of the period. Determine the cost of the 15 units in the inventory by each of the following methods, presenting details of your computations: (a) first-in, first-out; (b) last-in, first-out; (c) average cost. ID: A 4. The cash account for Santiago Co on May 31.2009 indicated a balance of $15,515.00. The March bank statement indicated an ending balance of $20,245.00. Comparing the bank statement, the canceled cheeks and the accompanying memos with the records revealed the following reconciling items a. Checks outstanding totaled $4,820.00 b. A deposit of $3,796.00 had been made too late to appear on the bank statement c. A check for $1,233.00 returned with the statement had been incorrectly recorded as S233.00. The check was originally credited to accounts payable d. The bank collected $5,541.00 on a note left for collection. e. Bank service charges for May amounted to $45.00. T. A check for $790.00 was returned by the bank because of insufficient funds. Prepare a bank econciliation as of May 31, 200 9 Journalize the necessary entries. Santiago Co. Bank Reconciliation May 31, 2009 Journal Post Credit Date Deseription ReDebit