Answered step by step

Verified Expert Solution

Question

1 Approved Answer

True/False need 1-10 O 1. Flotation costs serve to decrea iCloud. Purchase additional storage or remo documents from iCloud. 2. For a firm with debt,

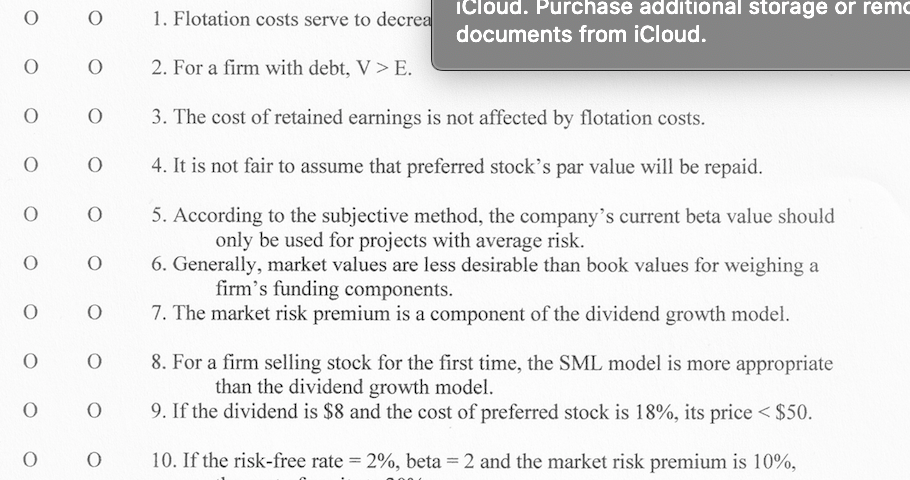

True/False need 1-10

O 1. Flotation costs serve to decrea iCloud. Purchase additional storage or remo documents from iCloud. 2. For a firm with debt, V>E. O O O O 3. The cost of retained earnings is not affected by flotation costs. O O 4. It is not fair to assume that preferred stocks par value will be repaid. 0 O O O 5. According to the subjective method, the company's current beta value should only be used for projects with average risk. 6. Generally, market values are less desirable than book values for weighing a firm's funding components. 7. The market risk premium is a component of the dividend growth model. O O O 0 8. For a firm selling stock for the first time, the SML model is more appropriate than the dividend growth model. 9. If the dividend is $8 and the cost of preferred stock is 18%, its price E. O O O O 3. The cost of retained earnings is not affected by flotation costs. O O 4. It is not fair to assume that preferred stocks par value will be repaid. 0 O O O 5. According to the subjective method, the company's current beta value should only be used for projects with average risk. 6. Generally, market values are less desirable than book values for weighing a firm's funding components. 7. The market risk premium is a component of the dividend growth model. O O O 0 8. For a firm selling stock for the first time, the SML model is more appropriate than the dividend growth model. 9. If the dividend is $8 and the cost of preferred stock is 18%, its priceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started