try to do all please and thank you

try to do all please and thank you

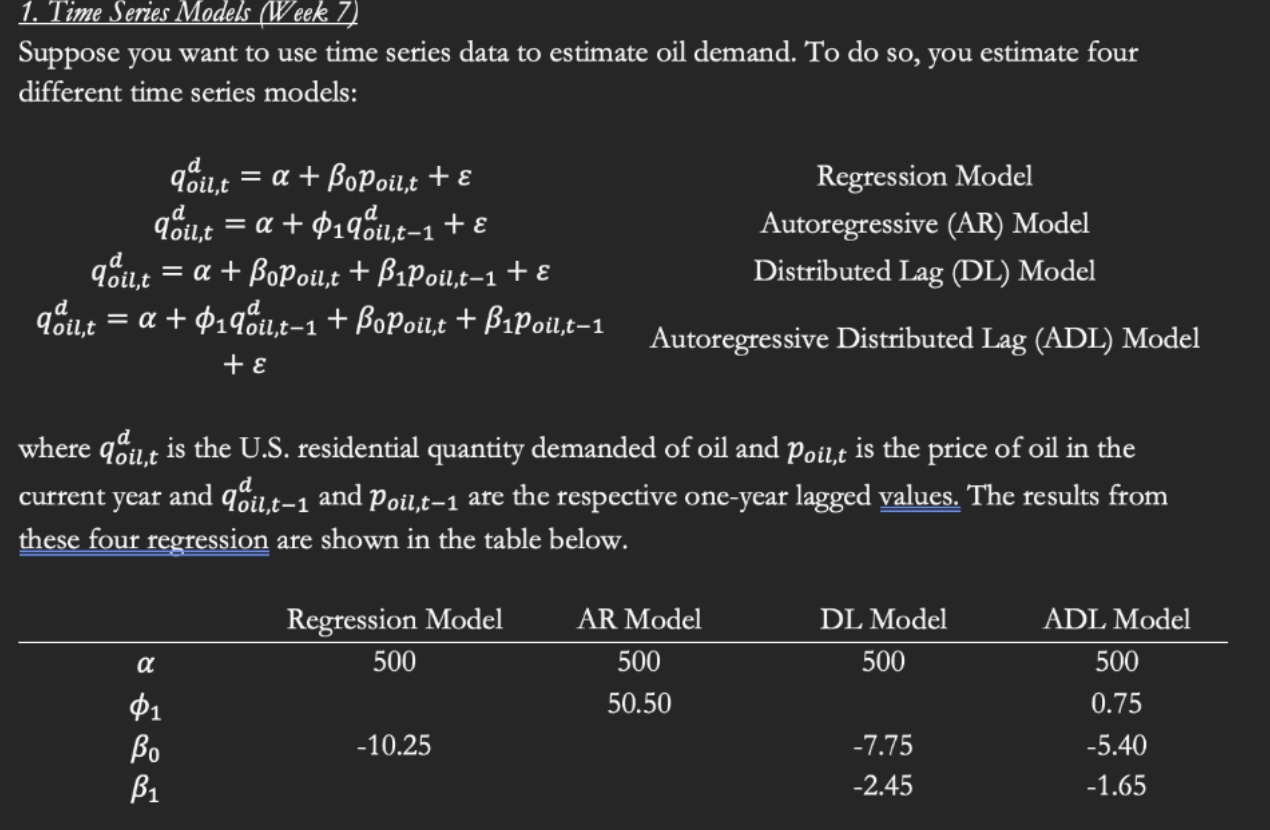

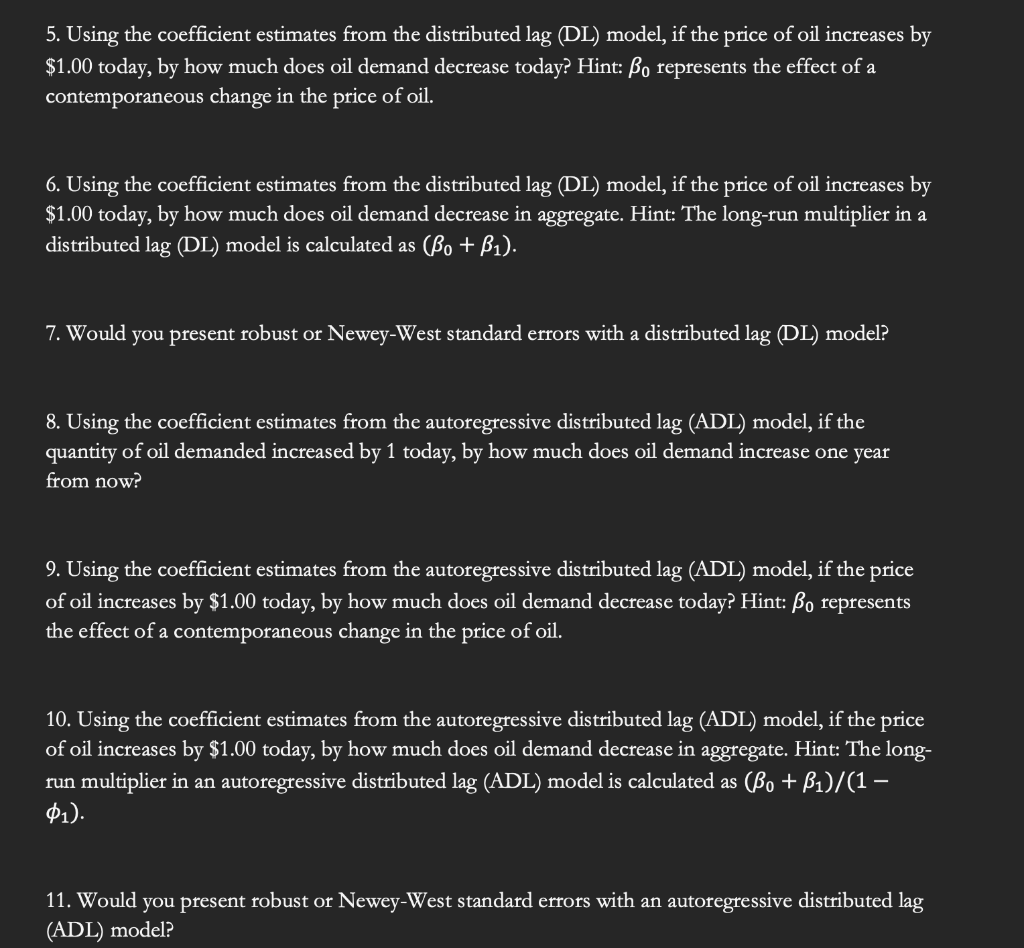

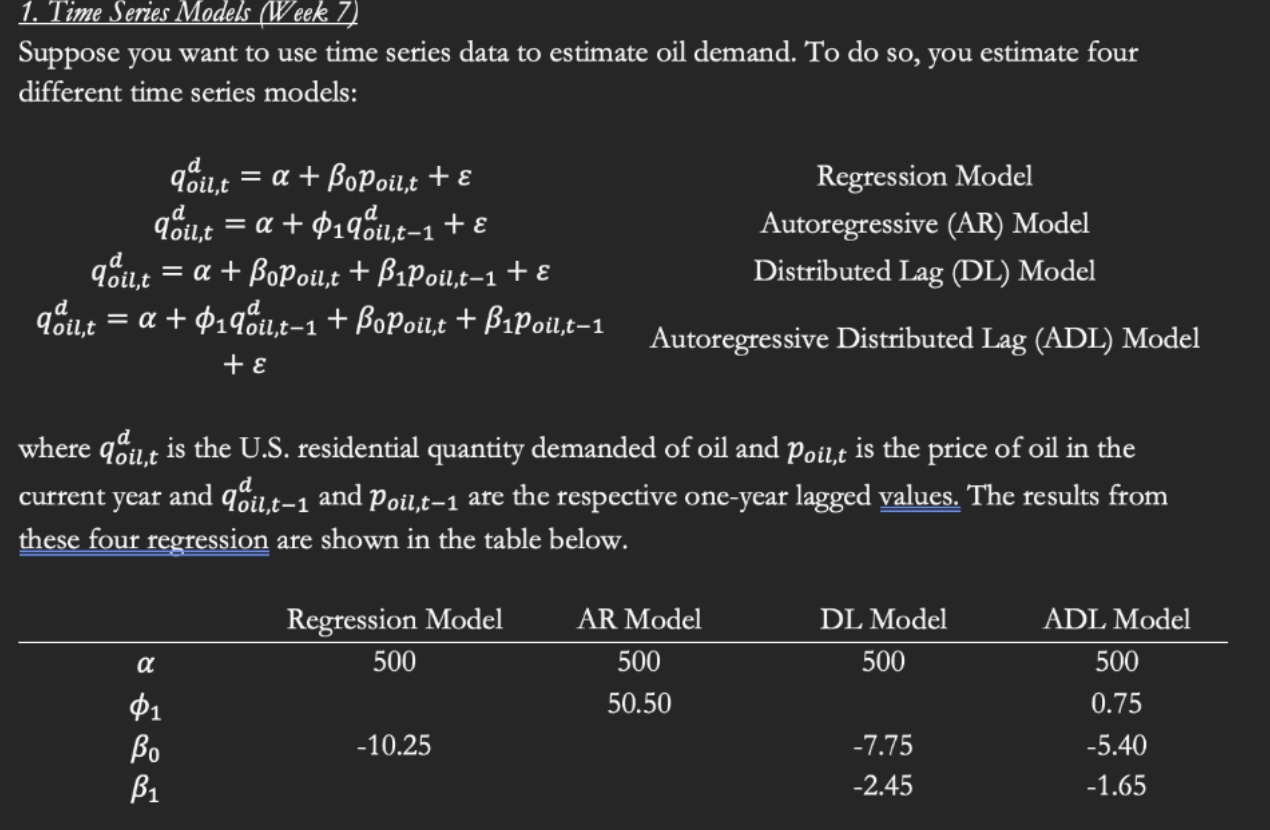

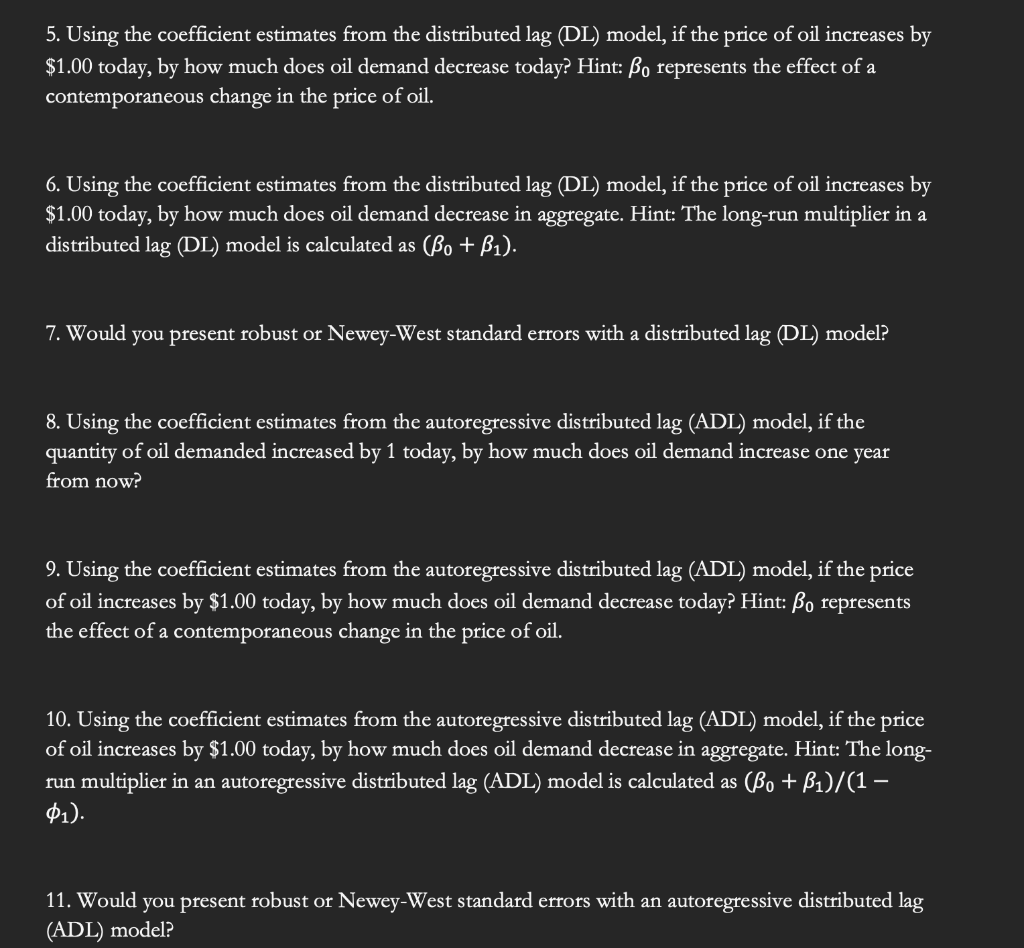

1. Time Series Models (Week 7) Suppose you want to use time series data to estimate oil demand. To do so, you estimate four different time series models: d qoil,t = a + Bopoil,t + Regression Model qoil,t = a + 019@il.t-1 + Autoregressive (AR) Model qoil,t = a + Bopoil,t + B1poil.t-1 + Distributed Lag (DL) Model qin,t = a + $19&u,t-1 + Bopoil,t + Bipoil.t-1 Autoregressive Distributed Lag (ADL) Model + d where qi,t is the U.S. residential quantity demanded of oil and Poil,t is the price of oil in the current year and qil,t-1 and Poil,t-1 are the respective one-year lagged values. The results from these four regression are shown in the table below. t- Regression Model 500 AR Model 500 50.50 DL Model 500 a 01 B1 ADL Model 500 0.75 -5.40 -1.65 -10.25 -7.75 -2.45 5. Using the coefficient estimates from the distributed lag (DL) model, if the price of oil increases by $1.00 today, by how much does oil demand decrease today? Hint: Bo represents the effect of a contemporaneous change in the price of oil. 6. Using the coefficient estimates from the distributed lag (DL) model, if the price of oil increases by $1.00 today, by how much does oil demand decrease in aggregate. Hint: The long-run multiplier in a distributed lag (DL) model is calculated as (Bo + B1). 7. Would you present robust or Newey-West standard errors with a distributed lag (DL) model? 8. Using the coefficient estimates from the autoregressive distributed lag (ADL) model, if the quantity of oil demanded increased by 1 today, by how much does oil demand increase one year from now? 9. Using the coefficient estimates from the autoregressive distributed lag (ADL) model, if the price of oil increases by $1.00 today, by how much does oil demand decrease today? Hint: Bo represents the effect of a contemporaneous change in the price of oil. 10. Using the coefficient estimates from the autoregressive distributed lag (ADL) model, if the price of oil increases by $1.00 today, by how much does oil demand decrease in aggregate. Hint: The long- run multiplier in an autoregressive distributed lag (ADL) model is calculated as (Bo + B1)/(1 01). 11. Would you present robust or Newey-West standard errors with an autoregressive distributed lag (ADL) model? 1. Time Series Models (Week 7) Suppose you want to use time series data to estimate oil demand. To do so, you estimate four different time series models: d qoil,t = a + Bopoil,t + Regression Model qoil,t = a + 019@il.t-1 + Autoregressive (AR) Model qoil,t = a + Bopoil,t + B1poil.t-1 + Distributed Lag (DL) Model qin,t = a + $19&u,t-1 + Bopoil,t + Bipoil.t-1 Autoregressive Distributed Lag (ADL) Model + d where qi,t is the U.S. residential quantity demanded of oil and Poil,t is the price of oil in the current year and qil,t-1 and Poil,t-1 are the respective one-year lagged values. The results from these four regression are shown in the table below. t- Regression Model 500 AR Model 500 50.50 DL Model 500 a 01 B1 ADL Model 500 0.75 -5.40 -1.65 -10.25 -7.75 -2.45 5. Using the coefficient estimates from the distributed lag (DL) model, if the price of oil increases by $1.00 today, by how much does oil demand decrease today? Hint: Bo represents the effect of a contemporaneous change in the price of oil. 6. Using the coefficient estimates from the distributed lag (DL) model, if the price of oil increases by $1.00 today, by how much does oil demand decrease in aggregate. Hint: The long-run multiplier in a distributed lag (DL) model is calculated as (Bo + B1). 7. Would you present robust or Newey-West standard errors with a distributed lag (DL) model? 8. Using the coefficient estimates from the autoregressive distributed lag (ADL) model, if the quantity of oil demanded increased by 1 today, by how much does oil demand increase one year from now? 9. Using the coefficient estimates from the autoregressive distributed lag (ADL) model, if the price of oil increases by $1.00 today, by how much does oil demand decrease today? Hint: Bo represents the effect of a contemporaneous change in the price of oil. 10. Using the coefficient estimates from the autoregressive distributed lag (ADL) model, if the price of oil increases by $1.00 today, by how much does oil demand decrease in aggregate. Hint: The long- run multiplier in an autoregressive distributed lag (ADL) model is calculated as (Bo + B1)/(1 01). 11. Would you present robust or Newey-West standard errors with an autoregressive distributed lag (ADL) model

try to do all please and thank you

try to do all please and thank you