Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Try to match the five following types of companies with their corresponding balance sheets and financial ratios, which are shown in Exhibit 3. 1.

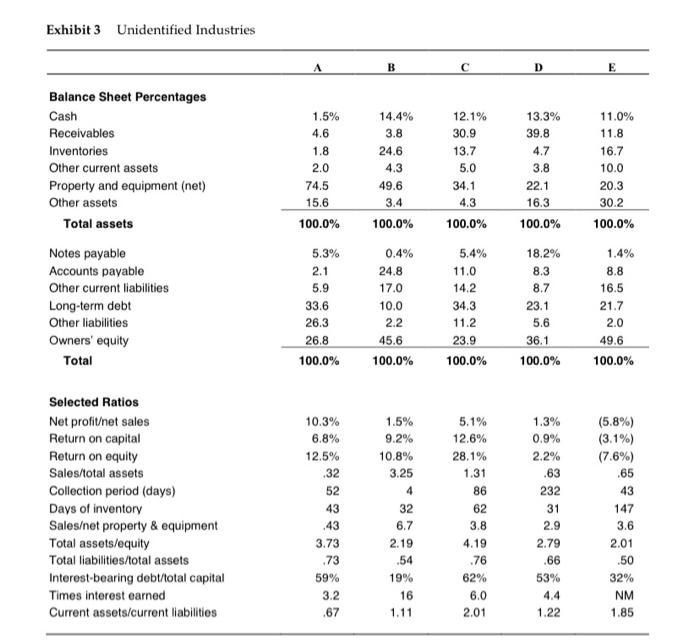

Try to match the five following types of companies with their corresponding balance sheets and financial ratios, which are shown in Exhibit 3. 1. Electric utility 2. Japanese automobile manufacturer 3. Discount general merchandise retailer 4. Automated test equipment/systems company 5. Upscale apparel retailer In doing the exercise, consider the operating and competitive characteristics of the industry and their implications for (1) the collection period; (2) the inventory turnover; (3) the amount of plant & equipment; (4) the profit margins and profitability; and (5) the appropriate financing structure. Then identify which one of the five sets of balance sheets and financial ratios best match your expectations, given the difficult economic conditions of 2009. Exhibit 3 Unidentified Industries Balance Sheet Percentages Cash Receivables Inventories Other current assets Property and equipment (net) Other assets Total assets Notes payable Accounts payable Other current liabilities Long-term debt Other liabilities Owners' equity Total Selected Ratios Net profit/net sales Return on capital Return on equity Sales/total assets Collection period (days) Days of inventory Sales/net property & equipment Total assets/equity Total liabilities/total assets Interest-bearing debt/total capital Times interest earned Current assets/current liabilities A 1.5% 4.6 1.8 2.0 74.5 15.6 100.0% 5.3% 2.1 5.9 33.6 26.3 26.8 100.0% 10.3% 6.8% 12.5% .32 52 43 .43 3.73 .73 59% 3.2 .67 B 14.4% 3.8 24.6 4.3 49.6 3.4 100.0% 0.4% 24.8 17.0 10.0 2.2 45.6 100.0% 1.5% 9.2% 10.8% 3.25 4 32 6.7 2.19 .54 19% 16 1.11 C 12.1% 30.9 13.7 5.0 34.1 4.3 100.0% 5.4% 11.0 14.2 34.3 11.2 23.9 100.0% 5.1% 12.6% 28.1% 1.31 86 62 3.8 4.19 .76 62% 6.0 2.01 D 13.3% 39.8 4.7 3.8 22.1 16.3 100.0% 18.2% 8.3 8.7 23.1 5.6 36.1 100.0% 1.3% 0.9% 2.2% .63 232 31 2.9 2.79 .66 53% 1.22 E 11.0% 11.8 16.7 10.0 20.3 30.2 100.0% 1.4% 8.8 16.5 21.7 2.0 49.6 100.0% (5.8%) (3.1%) (7.6%) .65 43 147 3.6 2.01 .50 32% NM 1.85 A Warning The calculated ratios are no more valid than the financial statements from which they are derived. The quality of the financial statements should be assessed and appropriate adjustments should be made, before any ratios are calculated. Particular attention should be placed on assessing the reasonableness of the accounting choices and assumptions that are embedded in the financial statements. The Case of the Unidentified Industries The preceding exercise suggests a series of questions that may be helpful in assessing a company's future financial health. It also describes several ratios that are useful in answering some of the questions, especially if the historical trend in these ratios can be reasonably extrapolated. However, it is also important to compare the actual absolute value with some standard to determine whether the company is performing well. Unfortunately, there is no single current ratio, inventory turnover, or debt ratio that is appropriate to all industries. The operating and competitive characteristics of a company's industry greatly influence its investment in the various types of assets, the riskiness of these investments, and the financial structure of its balance sheet. Try to match the five following types of companies with their corresponding balance sheets and financial ratios, which are shown in Exhibit 3. 1. Electric utility 2. Japanese automobile manufacturer 3. Discount general merchandise retailer 4. Automated test equipment/systems company 5. Upscale apparel retailer In doing the exercise, consider the operating and competitive characteristics of the industry and their implications for (1) the collection period; (2) the inventory turnover; (3) the amount of plant & equipment; (4) the profit margins and profitability; and (5) the appropriate financing structure. Then identify which one of the five sets of balance sheets and financial ratios best match your expectations, given the difficult economic conditions of 2009.

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Please see the explanation below A is electric utility company because have a big number of pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started