Question

TSLA4007901 TSLA4103350 TSLA4103351 Total Coupon Rate 1.50% 0.25% 1.25% Last Trade Price $168.30 $85 $81.44 Cost of Debt (Coupon amount / current market price) 0.89%

|

| TSLA4007901 | TSLA4103350 | TSLA4103351 | Total |

| Coupon Rate | 1.50% | 0.25% | 1.25% |

|

| Last Trade Price | $168.30 | $85 | $81.44 |

|

| Cost of Debt (Coupon amount / current market price) | 0.89% | 0.29% | 1.54% |

|

| Outstanding Book Value | $660,000 | $920,000 | $1,380,000 | $2,960,000 |

| Face value of bounds | $100 | $100 | $100 | $100 |

| Number of outstanding bounds | 6600 | 9200 | 13800 | 29600 |

| Last Trade Yield (Yield to Maturity) | -21.081% | 5.840% | 5.585% |

|

| Market Value | $1,110,780 | $782,000 | $1,123,872 | $3,016,652 |

| Weighted Market Value | 0.368 | 0.259 | 0.373 | 1 |

| Weighted Book Value | 0.223 | 0.311 | 0.466 | 1 |

|

|

|

|

|

|

| Weighted average cost of capital using weighted market values = 0.37 * 0.89% + 0.26 * 0.29% + 0.37 * 1.54% = 0.9745% | ||||

|

|

|

|

|

|

| Weighted average cost of capital using weighted book values = 0.22 * 0.89% + 0.31 * 0.29% + 0.47 * 1.54% = 1.0095% | ||||

The yield on the 10-year Treasury Bond is 1.88%.

The yield on the 10-year Treasury Bonds as proxies for the risk-free rate.

Cost of Equity = Risk-Free Rate + Beta * (Market Rate of Return - Risk-Free Rate)

10 Year = 0.0188 + 0.985214 * (7%) = 8.776%

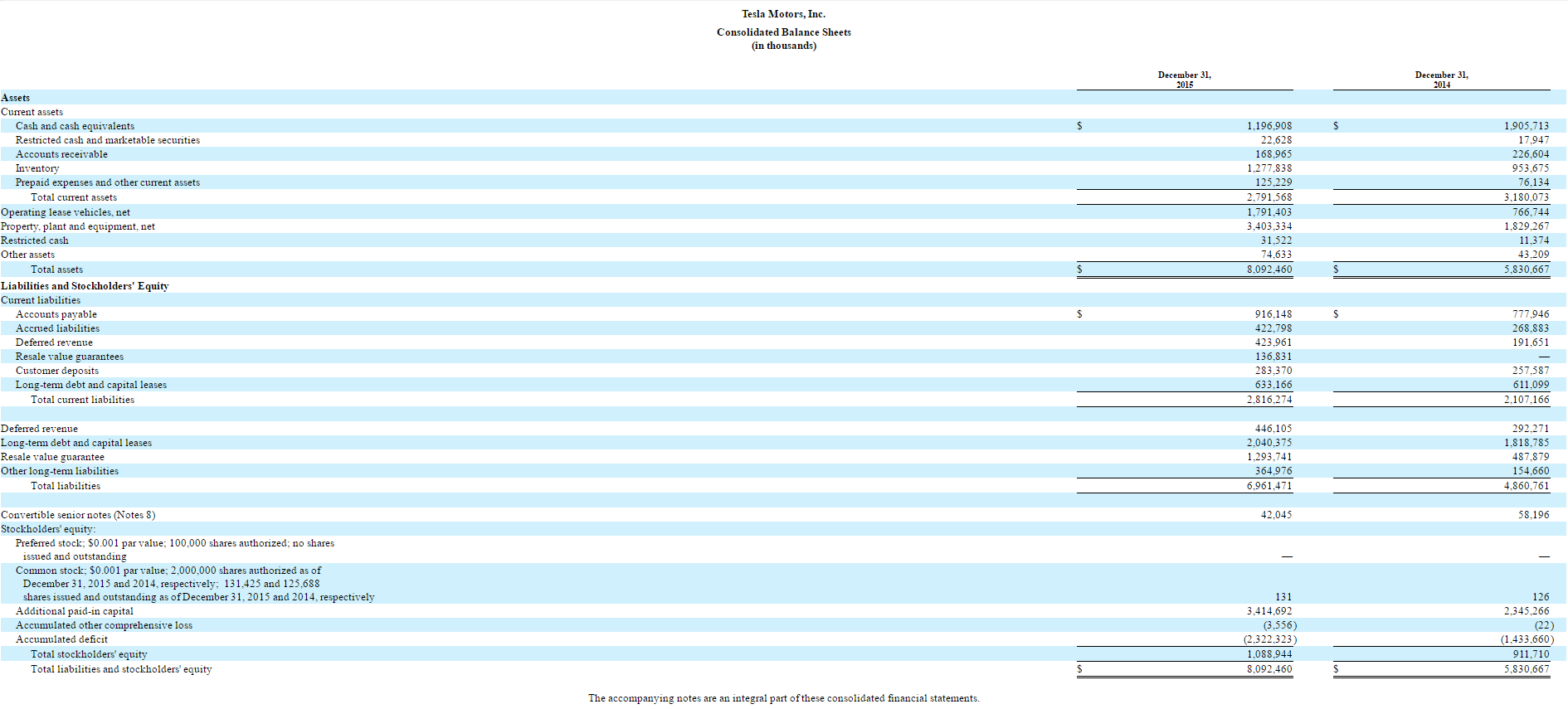

Assuming SMI has a 35 percent marginal tax rate, calculate the weighted average cost of capital for SMI using book values of equity and debt from the SEC 10K or 10Q balance sheet and your calculations of the market values of equity and debt and using the cost of equity based on the 10-year Treasury Bond yield. Which cost of capital is most relevant? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started