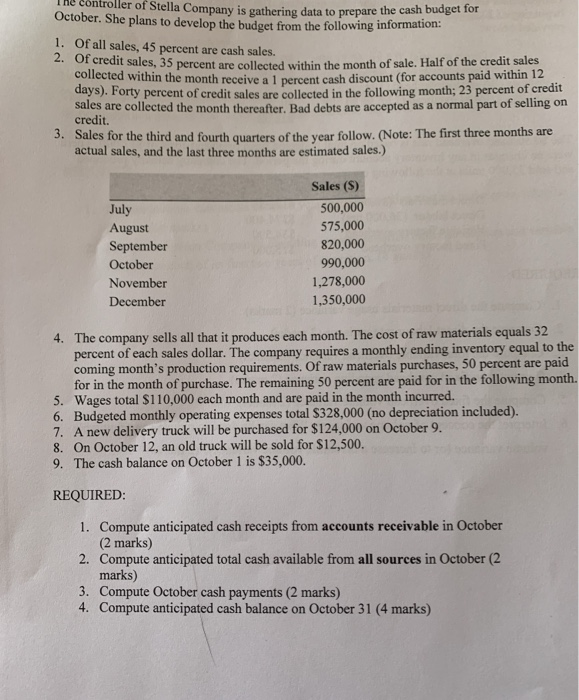

TU LUller of Stella Company is on Stella Company is gathering data to prepare the cash budget for October. She plans to develop the budget from the following information: 1. Of all sales, 45 percent are cash sales. it sales, 35 percent are collected within the month of sale. Half of the credit sales collected within the month receive a 1 percent cash discount (for accounts paid within 12 days). Forty percent of credit sales are collected in the following month; 23 percent of credit sales are collected the month thereafter. Bad debts are accepted as a normal part of selling on credit. 3. Sales for the third and fourth quarters of the year follow. (Note: The first three months are actual sales, and the last three months are estimated sales.) July August September October November December Sales (S) 500,000 575,000 820,000 990,000 1,278,000 1,350,000 4. The company sells all that it produces each month. The cost of raw materials equals 32 percent of each sales dollar. The company requires a monthly ending inventory equal to the coming month's production requirements. Of raw materials purchases, 50 percent are paid for in the month of purchase. The remaining 50 percent are paid for in the following month. 5. Wages total $110,000 each month and are paid in the month incurred. 6. Budgeted monthly operating expenses total $328,000 (no depreciation included). 7. A new delivery truck will be purchased for $124,000 on October 9. 8. On October 12, an old truck will be sold for $12,500. 9. The cash balance on October 1 is $35,000. REQUIRED: 1. Compute anticipated cash receipts from accounts receivable in October (2 marks) 2. Compute anticipated total cash available from all sources in October (2 marks) 3. Compute October cash payments (2 marks) 4. Compute anticipated cash balance on October 31 (4 marks) TU LUller of Stella Company is on Stella Company is gathering data to prepare the cash budget for October. She plans to develop the budget from the following information: 1. Of all sales, 45 percent are cash sales. it sales, 35 percent are collected within the month of sale. Half of the credit sales collected within the month receive a 1 percent cash discount (for accounts paid within 12 days). Forty percent of credit sales are collected in the following month; 23 percent of credit sales are collected the month thereafter. Bad debts are accepted as a normal part of selling on credit. 3. Sales for the third and fourth quarters of the year follow. (Note: The first three months are actual sales, and the last three months are estimated sales.) July August September October November December Sales (S) 500,000 575,000 820,000 990,000 1,278,000 1,350,000 4. The company sells all that it produces each month. The cost of raw materials equals 32 percent of each sales dollar. The company requires a monthly ending inventory equal to the coming month's production requirements. Of raw materials purchases, 50 percent are paid for in the month of purchase. The remaining 50 percent are paid for in the following month. 5. Wages total $110,000 each month and are paid in the month incurred. 6. Budgeted monthly operating expenses total $328,000 (no depreciation included). 7. A new delivery truck will be purchased for $124,000 on October 9. 8. On October 12, an old truck will be sold for $12,500. 9. The cash balance on October 1 is $35,000. REQUIRED: 1. Compute anticipated cash receipts from accounts receivable in October (2 marks) 2. Compute anticipated total cash available from all sources in October (2 marks) 3. Compute October cash payments (2 marks) 4. Compute anticipated cash balance on October 31 (4 marks)