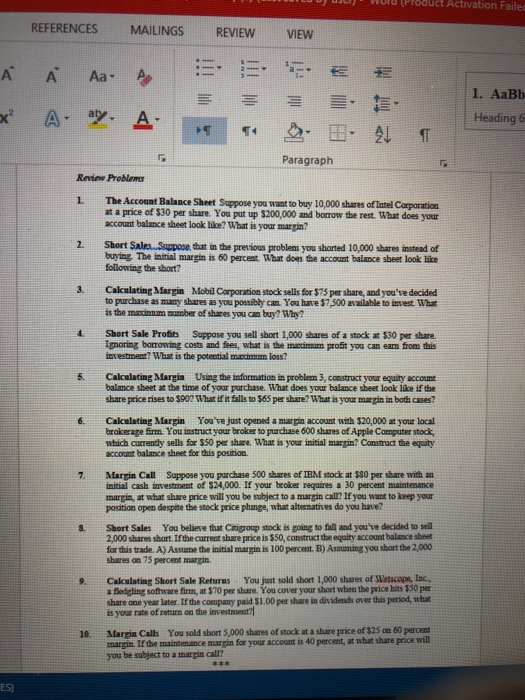

TUDJ u " WUI (Product Activation Failed REFERENCES MAILINGS REVIEW VIEW A A Aa A 5 5 ' = = 1. AaBb x? A ay. A = Heading 6 . E 21 A Paragraph Ravin Problems The Account Balance Sheet Suppose you want to buy 10,000 shares of Intel Corporation at a price of 530 per share. You put up $200,000 and borrow the rest. What does your account balance sheet look like? What is your nursin? Short Sale.Supose that in the previous problem you shorted 10,000 shares instead of buying. The initial margin is 60 percent. What does the account balance sheet look like following the short? Calculating Margin Mobil Corporation stock sells for $75 per share, and you've decided to purchase as many shares as you possibly can. You have $7,500 available to invest. What is the main mumber of shares you can buy? Why? Short Sale Profits Suppose you sell short 1,000 shares of a stock at $30 per share Ignoring borrowing costs and fees, what is the maximum profit you can eam from this investment? What is the potentia l Calculating Margin Using the information in problem 3, construct your equity account balance sheet at the time of your purchase. What does your balance sheet look like if the share price rises to $907 What if it falls to $65 per share? What is your marrin in both cases? Calculating Margin You've just opened a margin account with $20,000 at your local brokerage firm. You instruct your broker to purchase 600 shares of Apple Computer stock, which currently sells for $50 per share. What is your initial marin? Construct the equity account balance sheet for this position Marrin Call Suppose you purchase 500 shares of IBM stock at 580 per share with a initial cash investment of 524,000. If your broker requires a 30 percent maintenance margin, at what share price will you be subject to a margin call? If you want to keep your position open despite the stock price plunge, what alternatives do you have? Short Sales You believe that Citigroup stock is going to fall and you've decided to sell 2,000 shares short. If the current share price is $50, construct the equity account balance sheet for this trade. A) Assume the initial margin is 100 percent. B) Assuming you short the 2,000 shares on 75 percent margin Calculating Short Sale Returns You just sold short 1,000 shares of Setscope, Inc a fledgling software firm, at $70 per share. You cover your short when the price hits $50 per share one year later. If the company paid $1.00 per share in dividends over this period, what is your rate of return on the investment? Marin Call You sold short 5,000 shares of stock at a share price of $25 on 60 percent margin. If the maintenance margin for your account is 40 percent, at what share price will you be subject to a margin call? TUDJ u " WUI (Product Activation Failed REFERENCES MAILINGS REVIEW VIEW A A Aa A 5 5 ' = = 1. AaBb x? A ay. A = Heading 6 . E 21 A Paragraph Ravin Problems The Account Balance Sheet Suppose you want to buy 10,000 shares of Intel Corporation at a price of 530 per share. You put up $200,000 and borrow the rest. What does your account balance sheet look like? What is your nursin? Short Sale.Supose that in the previous problem you shorted 10,000 shares instead of buying. The initial margin is 60 percent. What does the account balance sheet look like following the short? Calculating Margin Mobil Corporation stock sells for $75 per share, and you've decided to purchase as many shares as you possibly can. You have $7,500 available to invest. What is the main mumber of shares you can buy? Why? Short Sale Profits Suppose you sell short 1,000 shares of a stock at $30 per share Ignoring borrowing costs and fees, what is the maximum profit you can eam from this investment? What is the potentia l Calculating Margin Using the information in problem 3, construct your equity account balance sheet at the time of your purchase. What does your balance sheet look like if the share price rises to $907 What if it falls to $65 per share? What is your marrin in both cases? Calculating Margin You've just opened a margin account with $20,000 at your local brokerage firm. You instruct your broker to purchase 600 shares of Apple Computer stock, which currently sells for $50 per share. What is your initial marin? Construct the equity account balance sheet for this position Marrin Call Suppose you purchase 500 shares of IBM stock at 580 per share with a initial cash investment of 524,000. If your broker requires a 30 percent maintenance margin, at what share price will you be subject to a margin call? If you want to keep your position open despite the stock price plunge, what alternatives do you have? Short Sales You believe that Citigroup stock is going to fall and you've decided to sell 2,000 shares short. If the current share price is $50, construct the equity account balance sheet for this trade. A) Assume the initial margin is 100 percent. B) Assuming you short the 2,000 shares on 75 percent margin Calculating Short Sale Returns You just sold short 1,000 shares of Setscope, Inc a fledgling software firm, at $70 per share. You cover your short when the price hits $50 per share one year later. If the company paid $1.00 per share in dividends over this period, what is your rate of return on the investment? Marin Call You sold short 5,000 shares of stock at a share price of $25 on 60 percent margin. If the maintenance margin for your account is 40 percent, at what share price will you be subject to a margin call