Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tulia Industries Inc. issued $10,000,000 face value of convertible ten year, 8% bonds on January 1, 2018 for $9,850,000. If the bonds had not

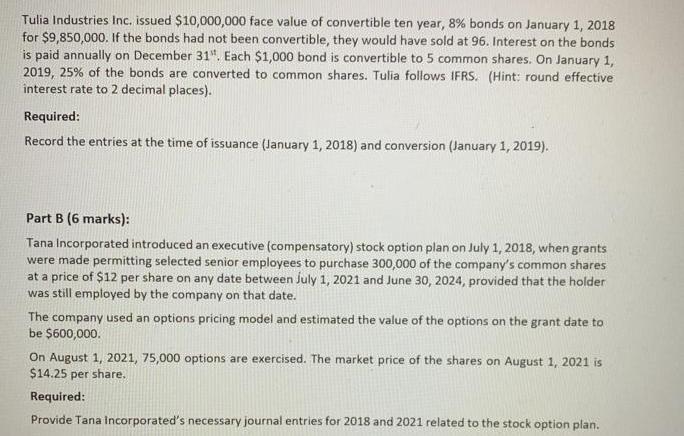

Tulia Industries Inc. issued $10,000,000 face value of convertible ten year, 8% bonds on January 1, 2018 for $9,850,000. If the bonds had not been convertible, they would have sold at 96. Interest on the bonds is paid annually on December 31". Each $1,000 bond is convertible to 5 common shares. On January 1, 2019, 25% of the bonds are converted to common shares. Tulia follows IFRS. (Hint: round effective interest rate to 2 decimal places). Required: Record the entries at the time of issuance (January 1, 2018) and conversion (January 1, 2019). Part B (6 marks): Tana Incorporated introduced an executive (compensatory) stock option plan on July 1, 2018, when grants were made permitting selected senior employees to purchase 300,000 of the company's common shares at a price of $12 per share on any date between July 1, 2021 and June 30, 2024, provided that the holder was still employed by the company on that date. The company used an options pricing model and estimated the value of the options on the grant date to be $600,000. On August 1, 2021, 75,000 options are exercised. The market price of the shares on August 1, 2021 is $14.25 per share. Required: Provide Tana Incorporated's necessary journal entries for 2018 and 2021 related to the stock option plan.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Question 4 a Discuss what accounting treatment is required for convertible debt and for debt issued ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started