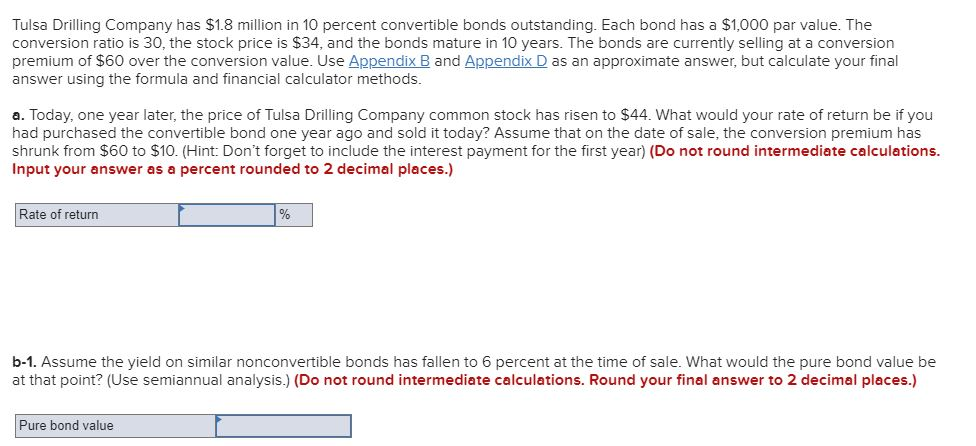

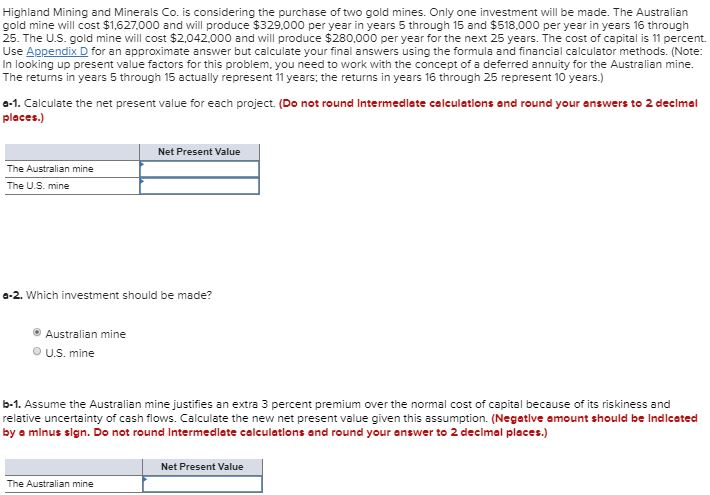

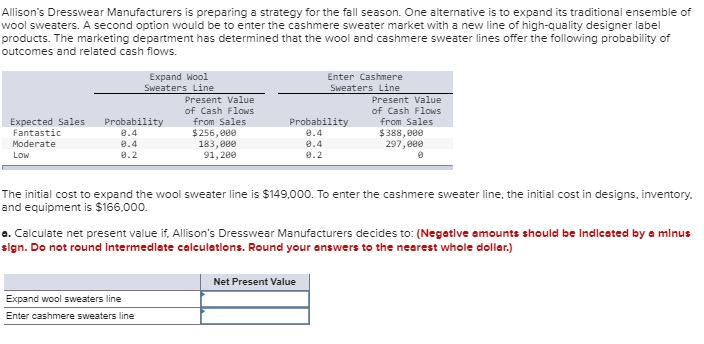

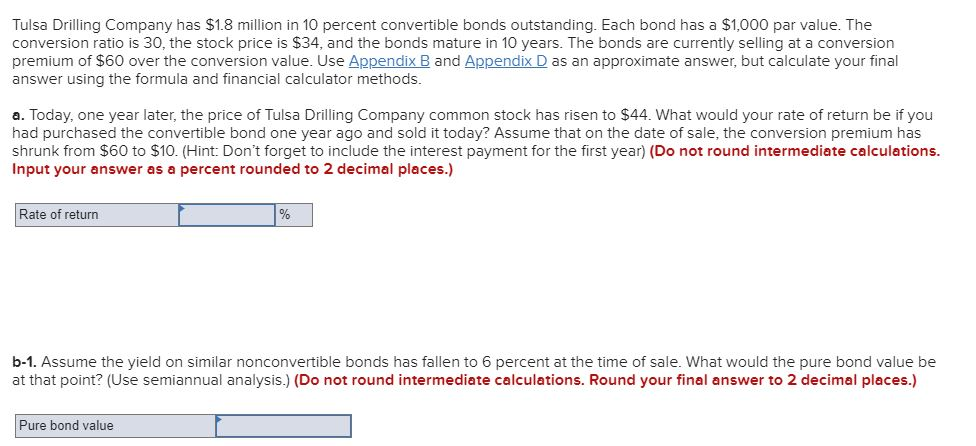

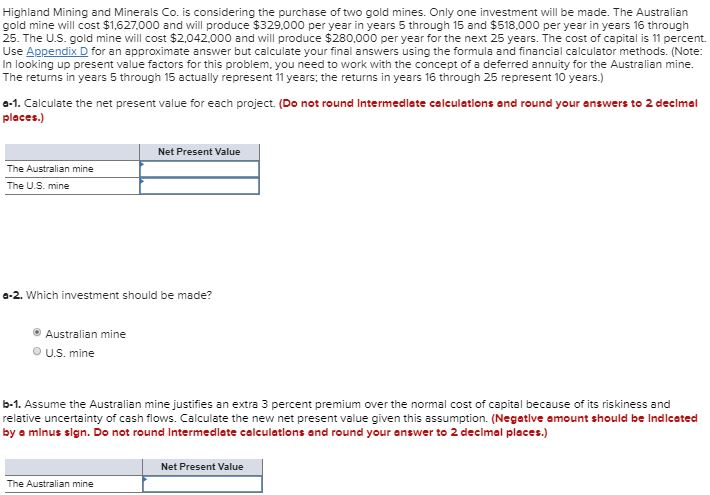

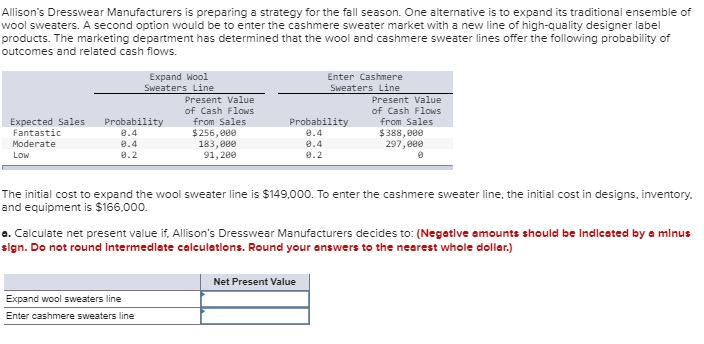

Tulsa Drilling Company has $1.8 million in 10 percent convertible bonds outstanding. Each bond has a $1,000 par value. The conversion ratio is 30, the stock price is $34, and the bonds mature in 10 years. The bonds are currently selling at a conversion premium of $60 over the conversion value. Use Appendix B and Appendix D as an approximate answer, but calculate your final answer using the formula and financial calculator methods. a. Today, one year later, the price of Tulsa Drilling Company common stock has risen to $44. What would your rate of return be if you had purchased the convertible bond one year ago and sold it today? Assume that on the date of sale, the conversion premium has shrunk from $60 to $10. (Hint: Don't forget to include the interest payment for the first year) (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Rate of return % b-1. Assume the yield on similar nonconvertible bonds has fallen to 6 percent at the time of sale. What would the pure bond value be at that point? (Use semiannual analysis.) (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Pure bond value Highland Mining and Minerals Co. is considering the purchase of two gold mines. Only one investment will be made. The Australian gold mine willl cost $1,627000 and will produce $329,000 per year in years 5 through 15 and $518.000 per year in years 16 through 25. The U.S. gold mine will cost $2,042,000 and will produce $280,000 per year for the next 25 years. The cost of capital is 11 percent. Use Appendix D for an approximate answer but calculate your final answers using the formula and financial calculator methods. (Note: In looking up present value factors for this problem. you need to work with the concept of a deferred annuity for the Australian mine. The returns in years 5 through 15 actually represent 11 years; the returns in years 16 through 25 represent 10 years.) a-1. Calculate the net present value for each project. (Do not round Intermediate calculations and round your answers to 2 decimal places.) Net Present Value The Australian mine The U.S. mine a-2. Which investment should be made? Australian mine U.S. mine b-1. Assume the Australian mine justifies an extra 3 percent premium over the normal cost of capital because of its riskiness and relative uncertainty of cash flows. Calculate the new net present value given this assumption. (Negetive amount should be Indicated by a minus sign. Do not round Intermedlate calculations and round your answer to 2 decimal places.) Net Present Value The Australian mine Allison's Dresswear Manufacturers is preparing a strategy for the fall season. One alternative is to expand its traditional ensemble of wool sweaters. A second option would be to enter the cashmere sweater market with a new line of high-quality designer label products. The marketing department has determined that the wool and cashmere sweater lines offer the following probability of outcomes and related cash flows. Expand Wool Sweaters Line Enter Cashmere Sweaters Line Present Value Present Value of Cash Flows from Sales $256,80e 183,00e 91,20e of Cash Flows Probability 8.4 Probability e.4 Expected Sales Fantastic from Sales $388,0ee 297,0ee Moderate .4 0.4 8.2 0.2 Low The initial cost to expand the wool sweater line is $149,000. To enter the cashmere sweater line, the initial cost and equipment is $166,000. in designs, inventory. a. Calculate net present value if, Allison's Dresswear Manufacturers decides to: (Negatlve amounts should be Indicated by a minus sign. Do not round Intermedlate calculatlons. Round your answers to the nearest whole dollar.) Net Present Value Expand wool sweaters line Enter cashmere sweaters line