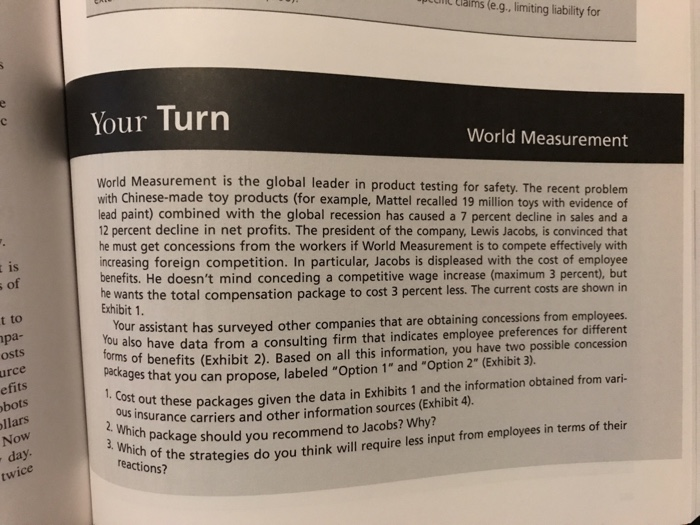

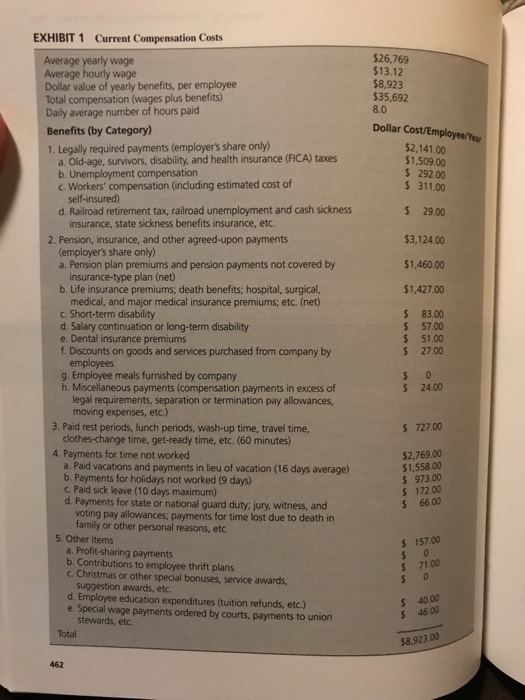

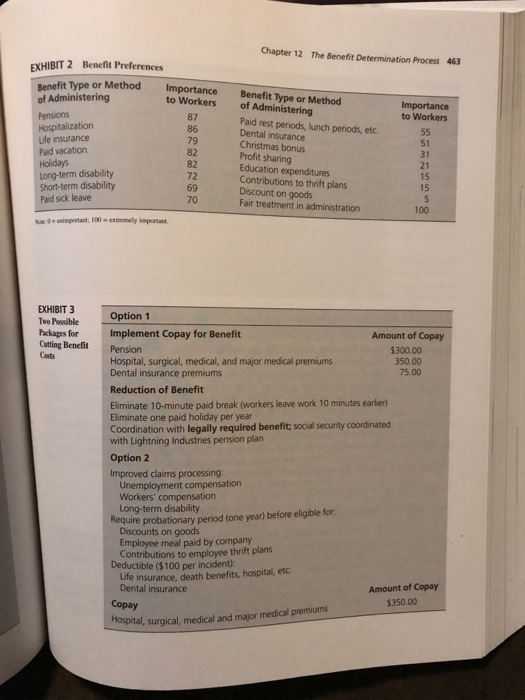

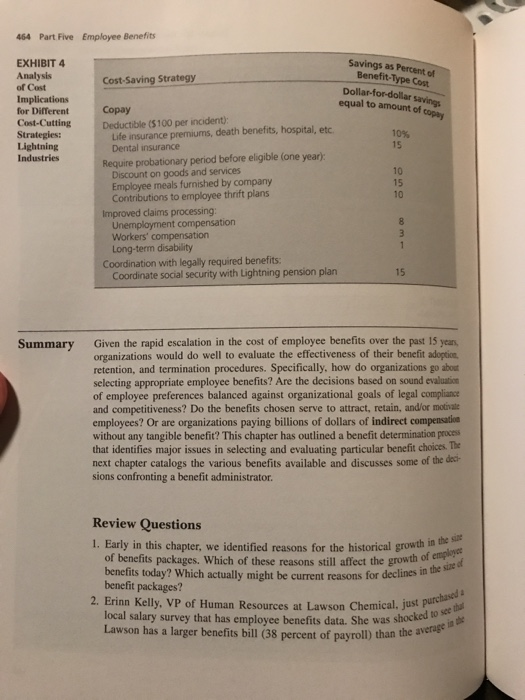

tunlt Llaims le.g, limiting liability for Your Turn World Measurement World Measurement is the global leader in product testing for safety. The recent problem with Chinese-made toy products (for example, Mattel recalled 19 million toys with evidence of lead paint) combined with the global recession has caused a 7 percent decline in sales and a 12 percent decline in net profits. The president of the company, Lewis Jacobs, is convinced that he must get concessions from the workers if World Measurement is to compete effectively with increasing foreign competition. In particular, Jacobs is displeased with the cost of employee benefits. He doesn't mind conceding a competitive wage increase (maximum 3 percent), but he wants the total compensation package to cost 3 percent less. The current costs are shown in 1s Exhibit 1 Your assistant has surveyed other companies that are obtaining concessions from employees. You also have data from a consulting firm that indicates employee preferences for different of benefits (Exhibit 2). Based on all this information, you have two possible concession t to pa- ages that you can propose, labeled "Option 1" and "Option 2" (Exhibit 3). 1. Cost out packages urance carriers and other information sources (Exhibit 4). which package should you recommend to Jacobs? Why? 3. Which of the ese packages given the data in Exhibits 1 and the information obtained from vari- Now day reactions, ne Strategies do you think will require less input from employees in terms of their EXHIBIT 1 Current Compensation Costs Average yearly wage Average hourly wage Dollar value of yearly benefits, per employee Total compensation (wages plus benefits) Daily average number of hours paid $26,769 $13.12 $8,923 535,692 8.0 Dollar Cost/Employee/Year $2,141.00 $1,509.00 s 292.00 S 311.00 Benefits (by Category) 1. Legally required payments (employer's share only) a. Old-age, survivors, disability, and health insurance (FICA) taxes b. Unemployment compensation c. Workers' compensation (including estimated cost of self-insured) d. Railroad retirement tax, railroad unemployment and cash sickness 5 29.00 $3,124.00 $1,460.00 $1,427.00 insurance, state sickness benefits insurance, etc. 2. Pension, insurance, and other agreed-upon payments (employer's share only) a. Pension plan premiums and pension payments not covered by insurance-type plan (net) b. Life insurance premiums; death benefits; hospital, surgical, medical, and major medical insurance premiums; etc. (net) c. Short-term disability d. Salary continuation or long-term disability e. Dental insurance premiums f. Discounts on goods and services purchased from company by S 83.00 S 57.00 $ 51.00 s 27.00 employees g. Employee meals furnished by company h. Miscelaneous payments (compensation payments in excess of S 24.00 legal requirements, separation or termination pay allowances, moving expenses, etc.) 3. Paid rest periods, lunch periods, wash-up time, travel time, S 727.00 clothes-change time, get-ready time, etc. (60 minutes) 4. Payments for time not worked a. Paid vacations and payments in lieu of vacation (16 days average) b. Payments for holidays not worked (9 days) c. Paid sick leave (10 days maximum) d. Payments for state or national guard duty jury, witness, and $2,769.00 $1,558.00 5 973.00 5 172.00 S 66.00 voting pay allowances; payments for time lost due to death in family or other personal reasons, etc. 5. Other items a. Profit-sharing payments b. Contributions to employee thrift plans c. Christmas or other special bonuses, service awards s 157.00 S 71.00 5 4000 suggestion awards, etc. d. Employee education expenditures (tuition refunds, etc.) e. Special wage payments ordered by courts, payments to union 5 46 00 stewards, etc. Total $8,923.00 462 Chapter 12 The Benefit Determination Process 463 EXHIBIT 2 Benefit Preferences or Method Importance to Workers 87 Benefit Type or Method of Administering of Administering Pensions to Workers Paid rest periods, lunch periods, etc. Dental insurance Christmas bonus Profit sharing Education expenditures Contributions to thrift plans Discount on goods Fair treatment in administration Life insurance Paid vacation 79 82 82 72 51 31 21 15 15 Long-term disability Short-term disability Paid sick leave 70 100 se .uniprtant; 100 mestremely important EXHIBIT 3 Two Possible Option 1 Packages for Implement Copay for Benefit Cutting Benefit Pension Casts Amount of Copay 5300.00 350.00 75.00 Hospital, surgical, medical, and major medical premiums Dental insurance premiums Reduction of Benefit Eliminate 10-minute paid break (workers leave work 10 minutes earlier) Eliminate one paid holiday per year Coordination with legally required benefit; social security coordinated with Lightning Industries pension plan Option 2 Improved claims processing Workers' compensation Long-term Discounts on goods Employee meal paid by company Contributions to employee thrift plans Deductible ($100 per incident): Life insurance, death benefits, hospital, etc. Dental insurance Amount of Copay 5350.00 Copay Hospital, surgical, medical and major medical premiums 464 Part Five Employee Benefits Savings as Percent of Benefit-Type Cost EXHIBIT4 Analysis of Cost Implications for Different Cost-Cutting Strategies: Lightning Industries Cost-saving Strategy Dollar-for-dollar equal to amount of Deductible (5100 per incident): Life insurance premiums, death benefits, hospital, etc Dental insurance 10% 15 Require probationary period before eligible (one year)y Discount on goods and services Employee meals furnished by company Contributions to employee thrift plans 15 Improved claims processing: Workers' compensation Long-term disability Coordination with legally required benefits Coordinate social security with Lightning pension plarn 15 Summary Given the rapid escalation in the cost of employee benefits over the past 15 yeas organizations would do well to evaluate the effectiveness of their benefit adoption retention, and termination procedures. Specifically, how do organizations go about selecting appropriate employee benefits? Are the decisions based on sound evaluaticn of employee preferences balanced against organizational goals of legal compliance and competitiveness? Do the benefits chosen serve to attract, retain, and/or motivate employees? Or are organizations paying billions of dollars of indirect compensation without any tangible benefit? This chapter has outlined a benefit determination proces that identifies major issues in selecting and evaluating particular benefit choices Ihe next chapter catalogs the various benefits available and discusses some of the dea sions confronting a benefit administrator. Review Questions 1. Early in this chapter, we identified reasons for the historical grwt in the sise of benefits packages. Which of these reasons still affect the growth of e benefits today? Which actually might be current reasons for declines in benefit packages? just purchasod a see that 2. Erinn Kelly, VP of Human Resources at Lawson Chemical local salary survey that has employee benefits data. She was shocked tore i Lawson has a larger benefits bill (38 percent of payroll) than Chapter 12 The Benefit Determination Process 465 community (31 percent). In a memo to you, she demands an explanation for why our package is significantly bigger. What sound reasons might save you from getting fired? 3. You are the benefits manager in a firm metaphorically described as part of the rust of your 600-person workforce is 43. Eighty- eight percent of your workforce is male, and there is hardly any turnover. Not much is happening on the job front. How do these facts influence your decisions about designing an employee benefit program? 4. As HR director at Crangle Fixtures, your bonus this year is based on your ability to cut employee benefit costs. Your boss has said that it's okay to shift some of the costs over to employees (right now they pay nothing for their benefits) but that he doesn't want you to overdo it. In other words, at least one-half of your suggestions should not hurt the employee's pocket book. What alternatives do you want to ex- plore, and why? 5. Google is famous for paying wages significantly above the market and also provid- ing employee benefits that one might call lavish. Currently the European Union is suing Google for its monopolistic behavior, claiming that the company's internet search function systematically favors its own comparison shopping product in its search results pages (Their products turn up earlier in the search effort). Assume the European Union wins this antitrust case resulting in significant financial loss to Google. Speculate on what Google might change about its benefits package as a consequence of this ruling ndnotes 1. U.S. Department of Labor, Bureau of Labor Statistics, Employer Costs for Employee eet" Febreury Compensation-USDL-15-0386, www.bls.gov/ect. March 11, 201:5 2. Socicty for Hluman Resoure Managemel 2010, http://www.shm.org/Research Survey Findings Articles Documents/10-0280%20 Employee%20Benefits%2Survey%20Report-FNL pdf. Benefits Research Institute, fronstin@ebri.org., 2013 PP. 36-38, http://fortune.com/best-compan Voluntary Workplace Benefits Survey." Employee 4. S. Bates, "B enefit Packages Nearing 40 Percent of Payroll." HRMagazine, March 2003 ault Fronstin, "2013 Health and Voluntary Workplace Benefits Survey," Employee Slephen Miller, "Survey: Employees Undervalue Benefits," HR Magazine S2(8), 2008 U.S. Chamber of Commerce, Benefits Survey 2011 Benefits Research Institute, fronstin @ebri.org p. 8. Rebecca New Approach," The Wall Street Journal, December 9, 1996, p. Al. Administration 27(9). 1977, pp. ca Blumenstein, "Seeking a Cure: Auto Makers Attack High Health-Care Bills with 9. John Hanna. Bureau of Labor Statistics, Employer Costs for Employce Compensation-December ri-bin/surveymost, accessed April 20, 2015 na, "Can the Challenge of Escalating Benefits Costs Be Met?" Personnel 50-57