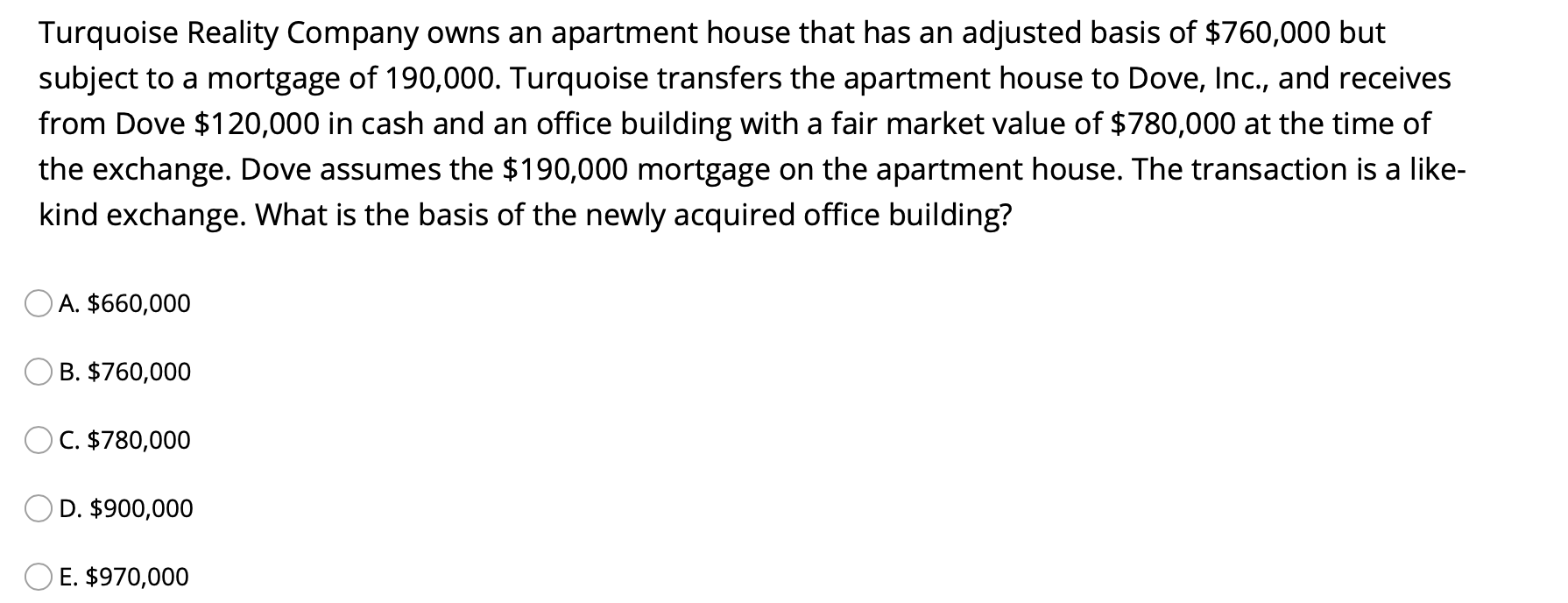

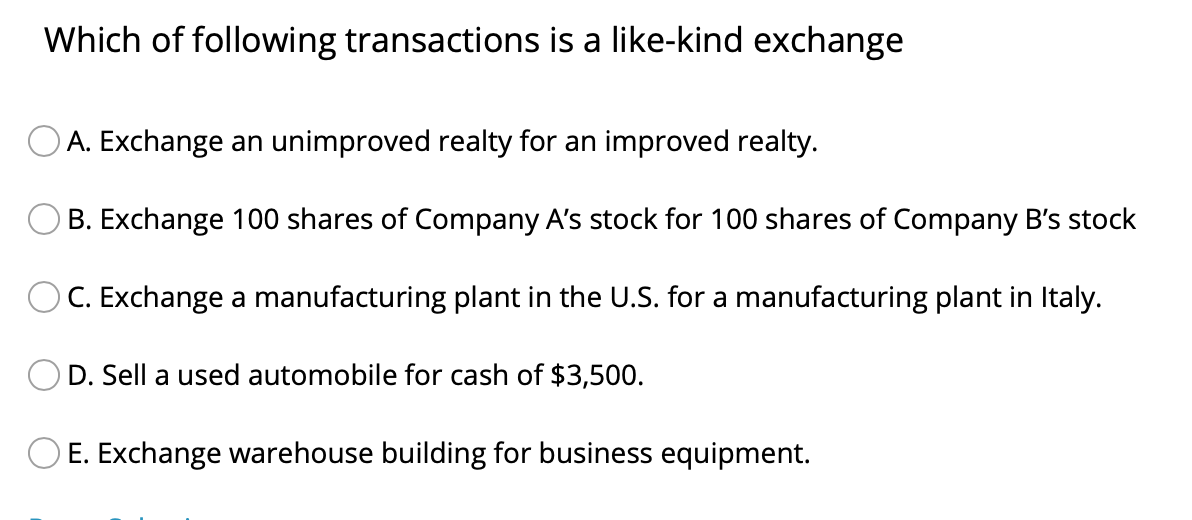

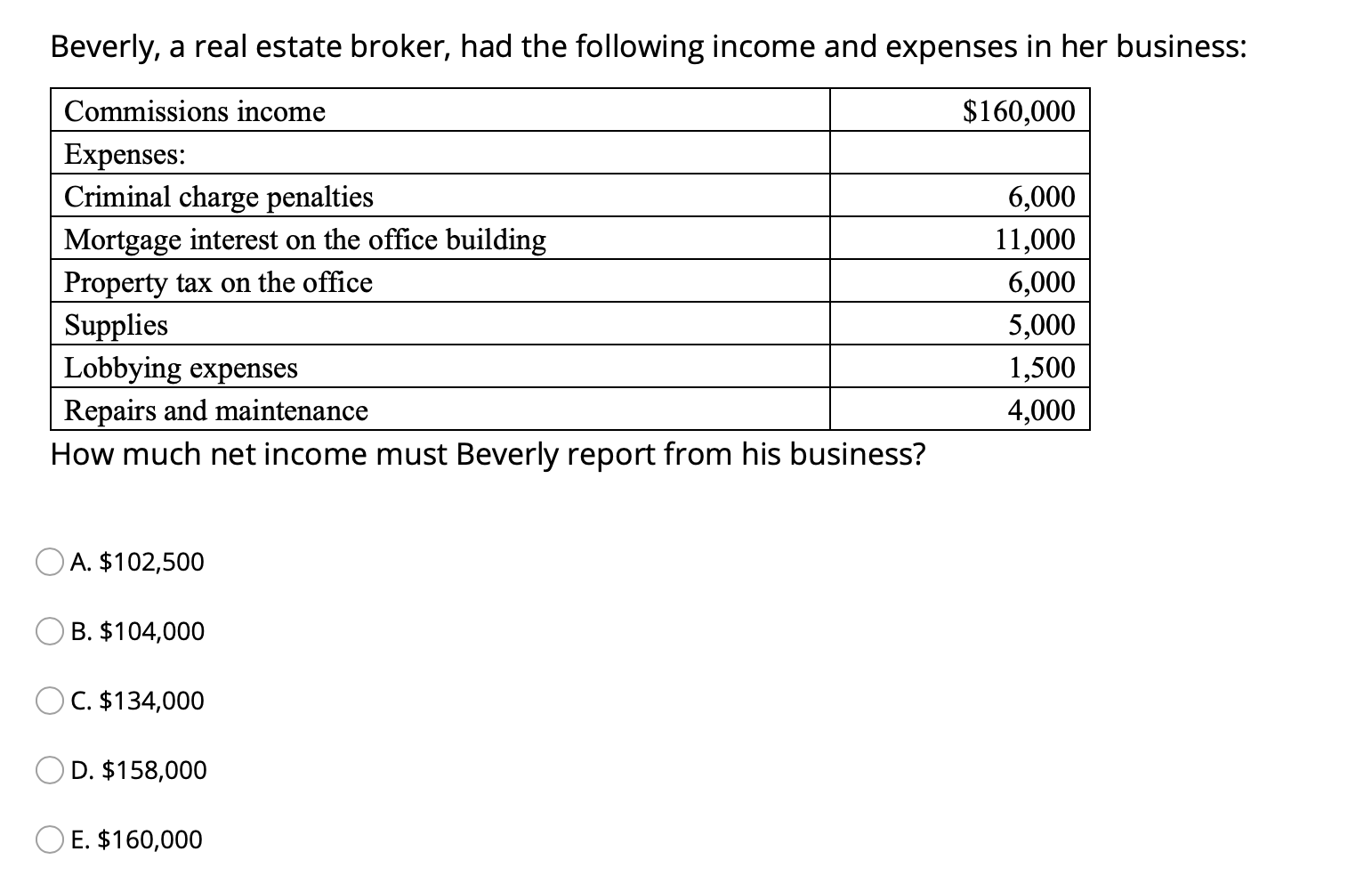

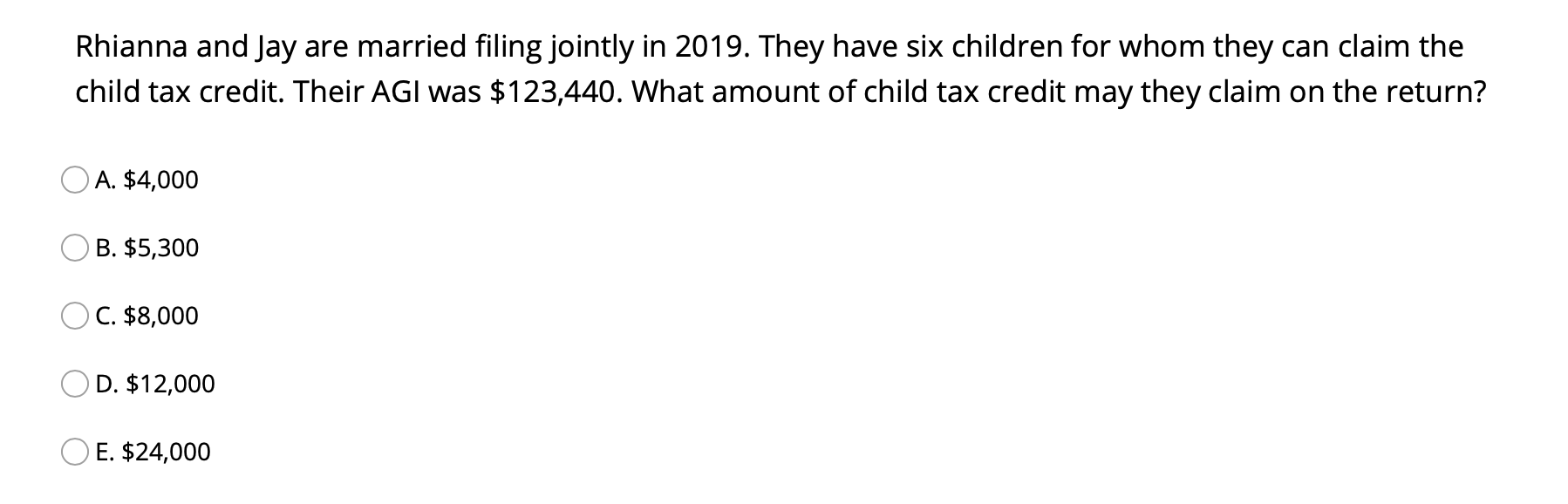

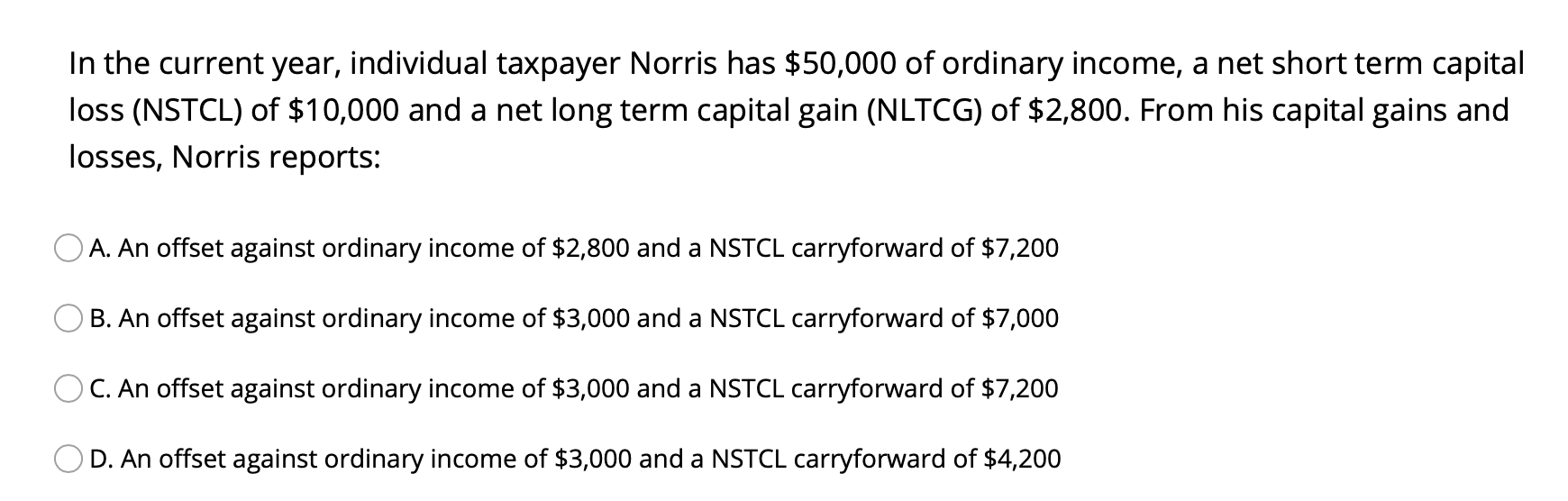

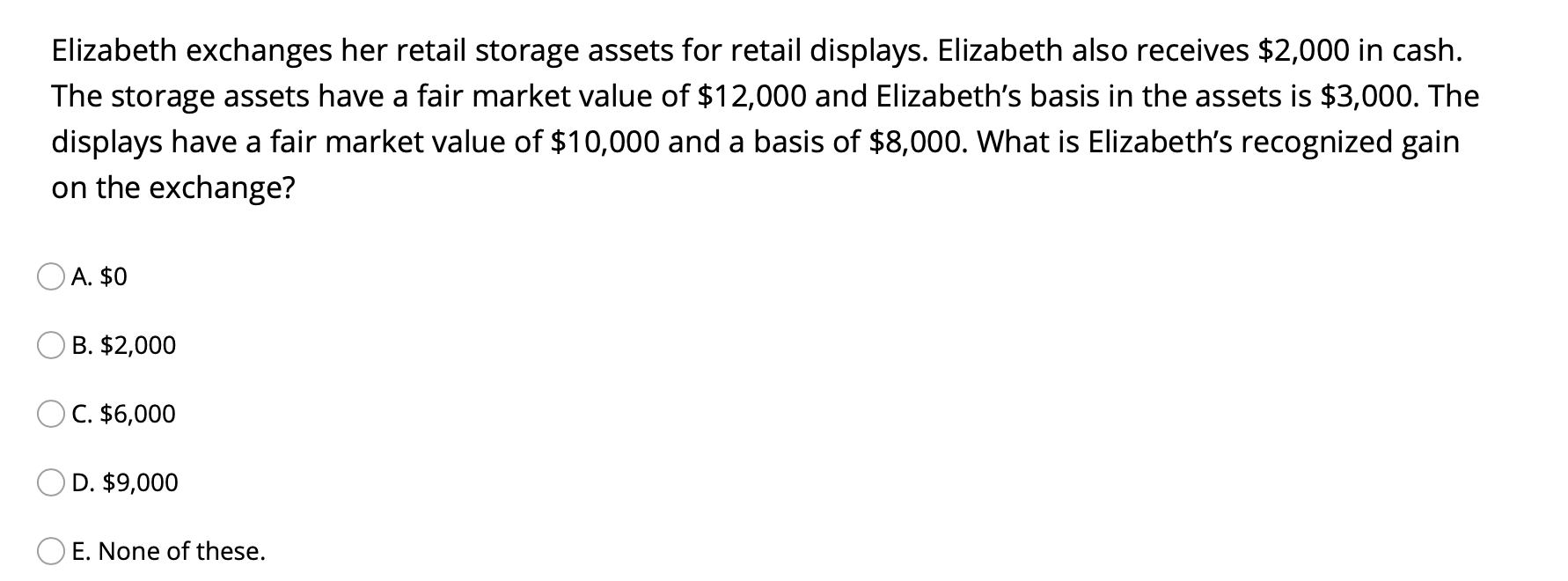

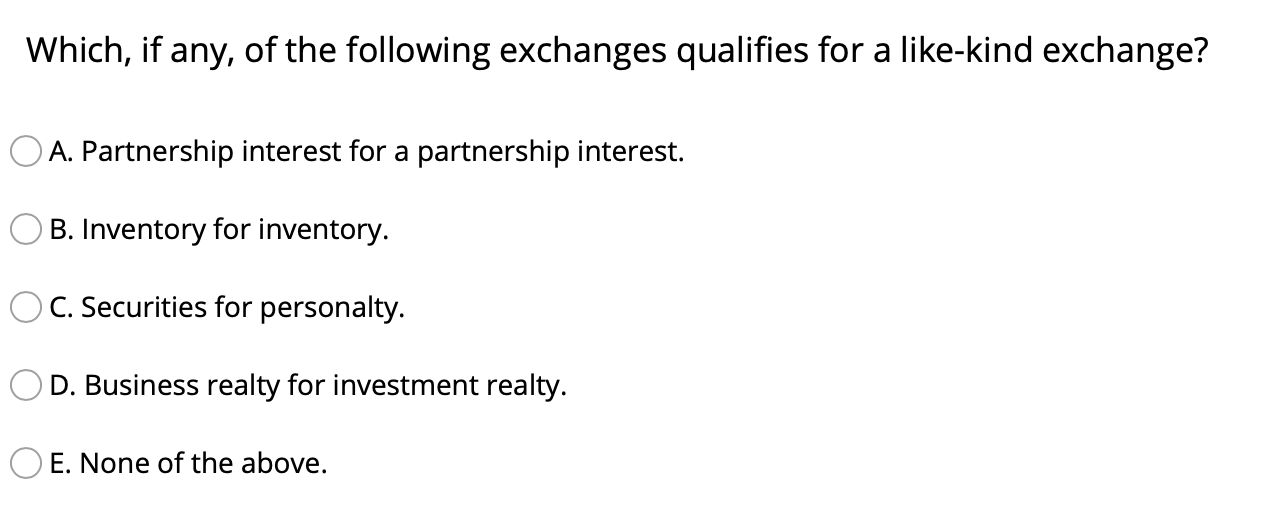

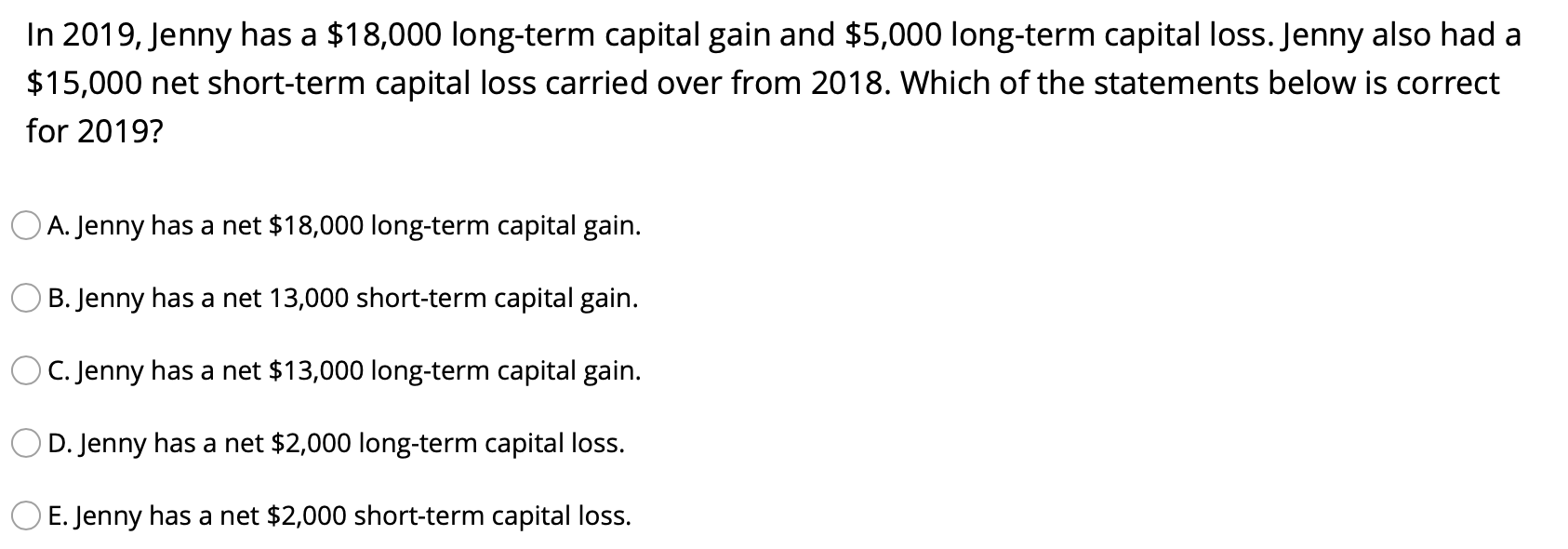

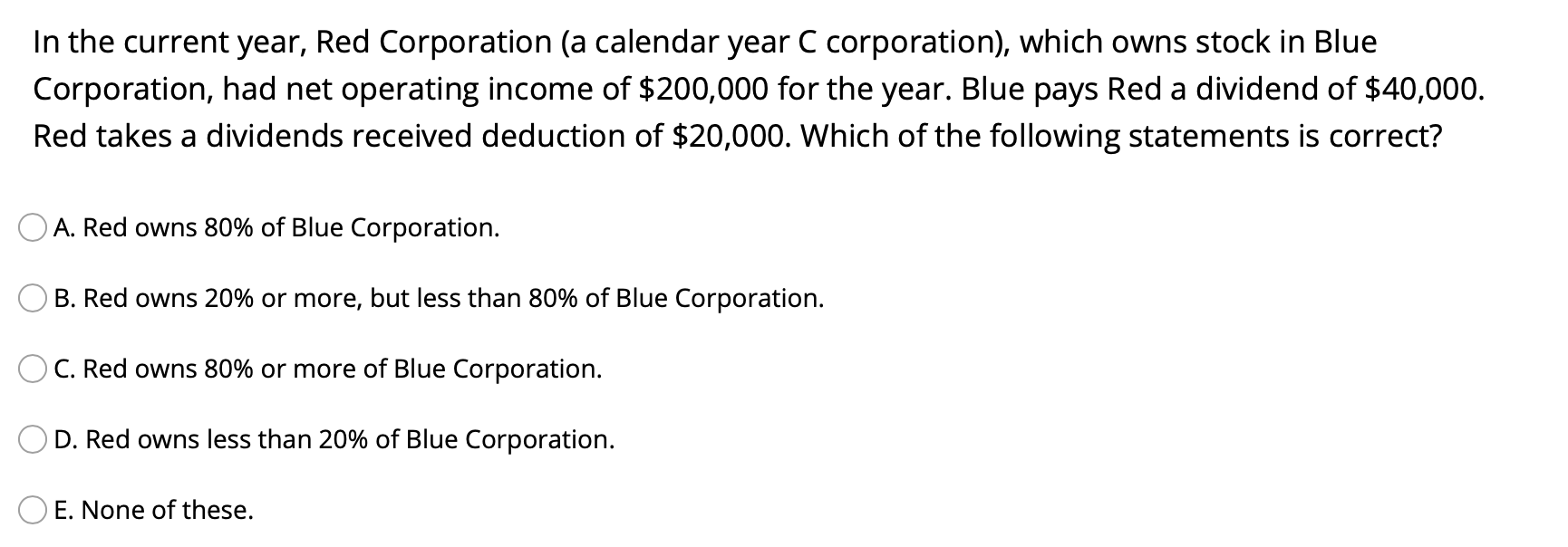

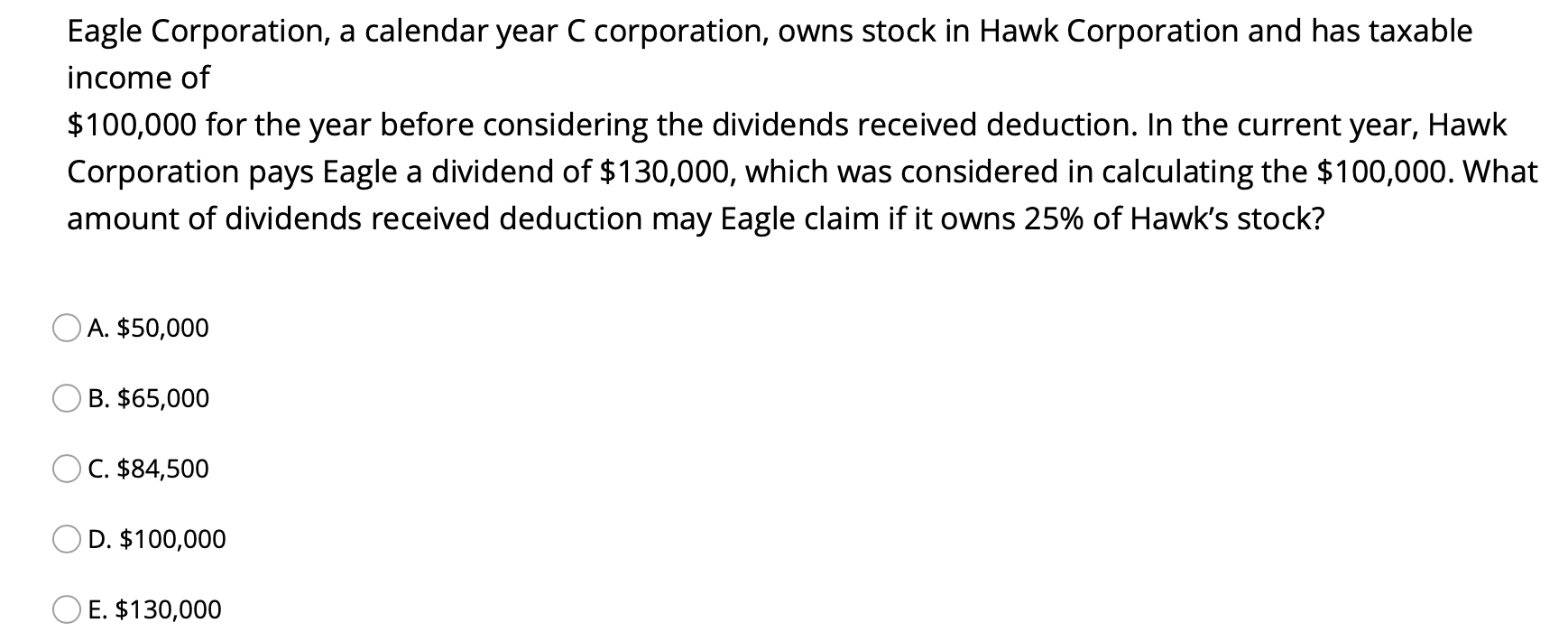

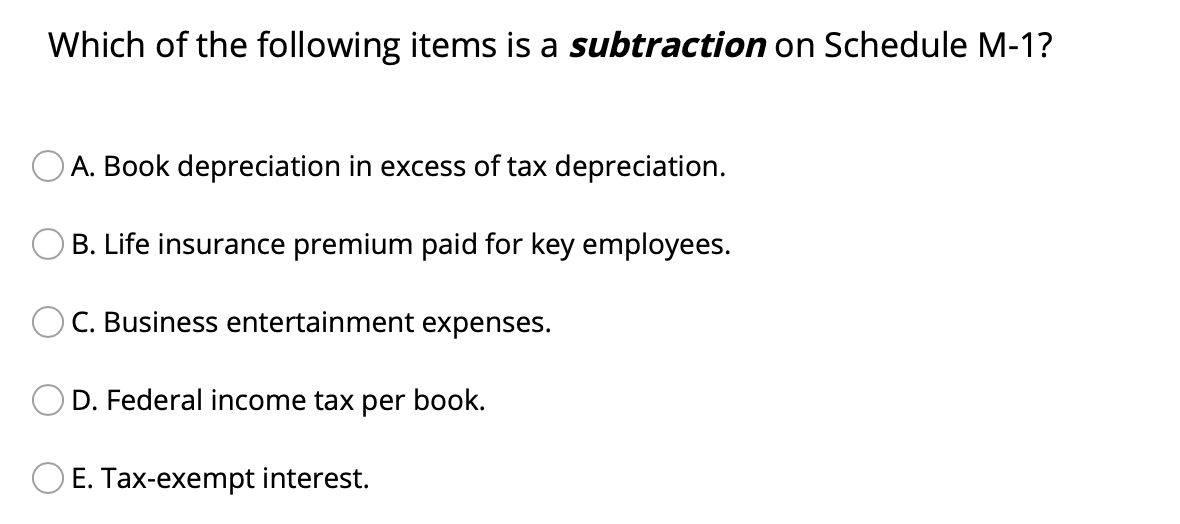

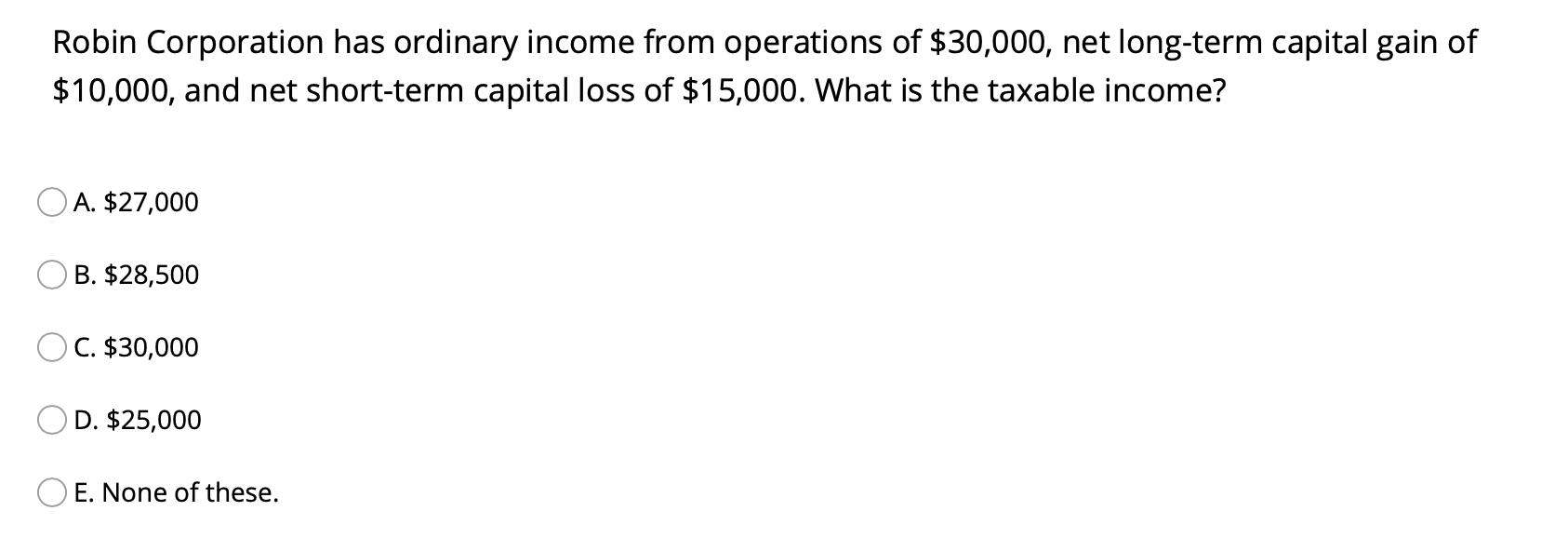

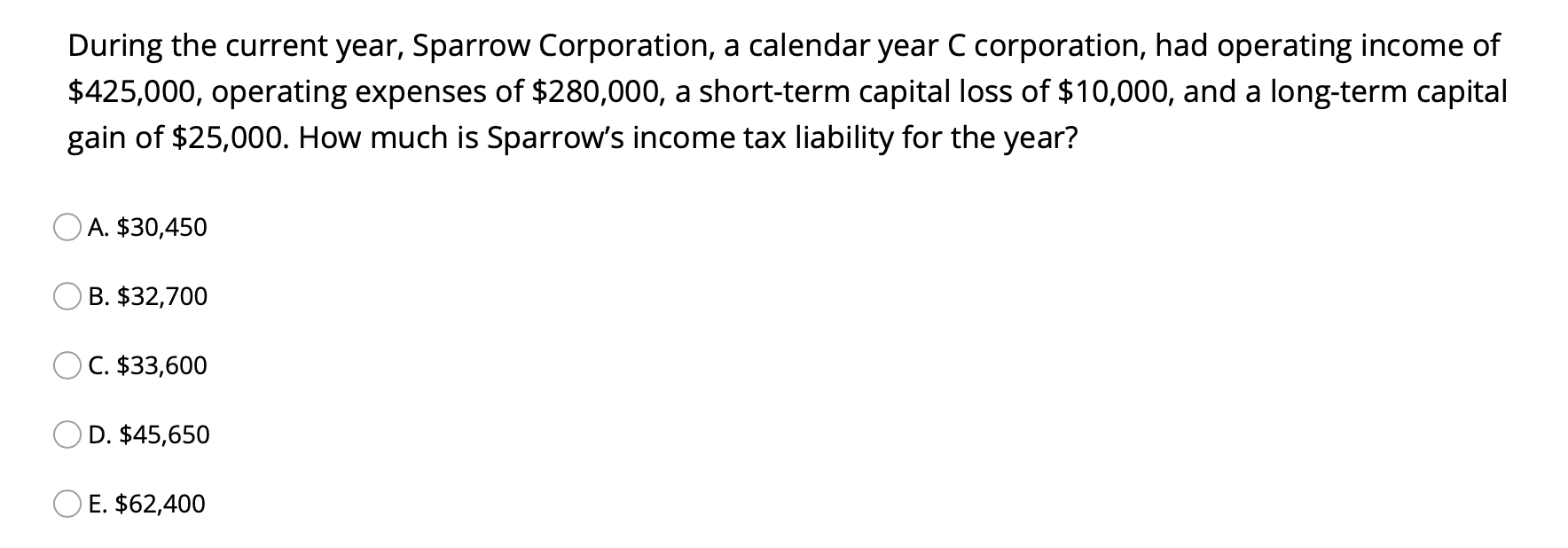

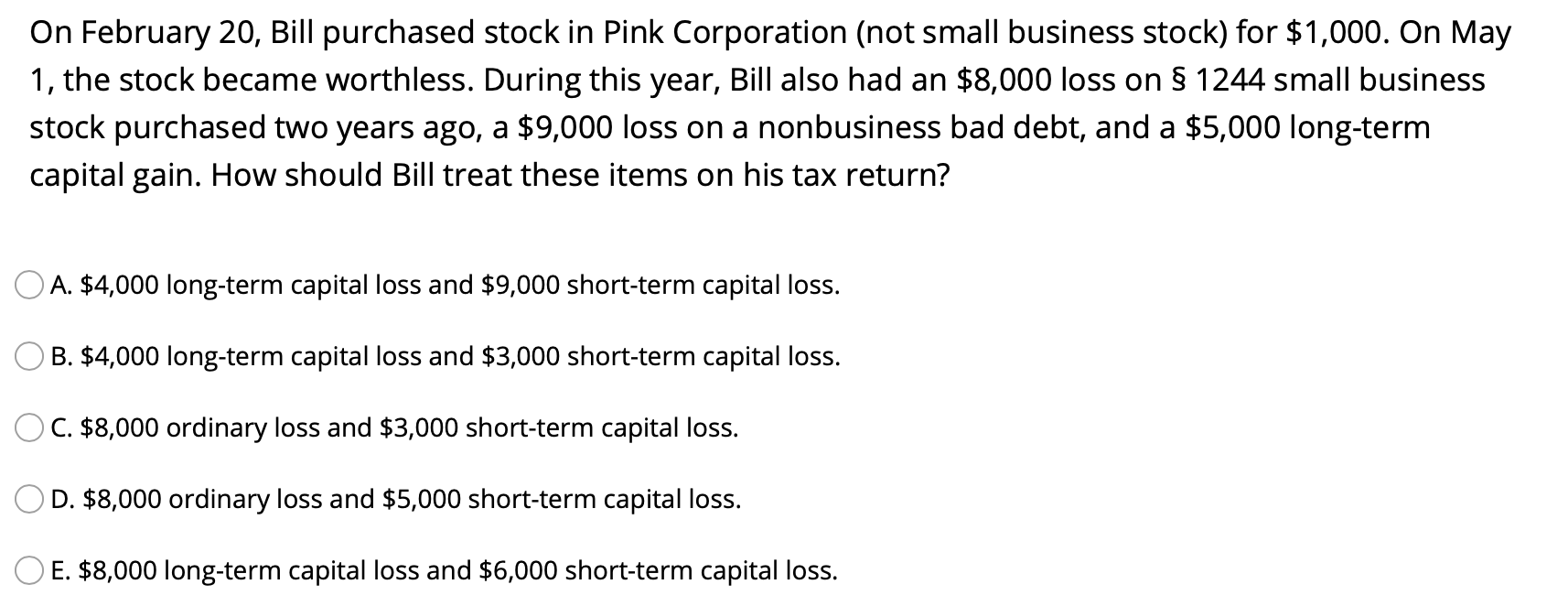

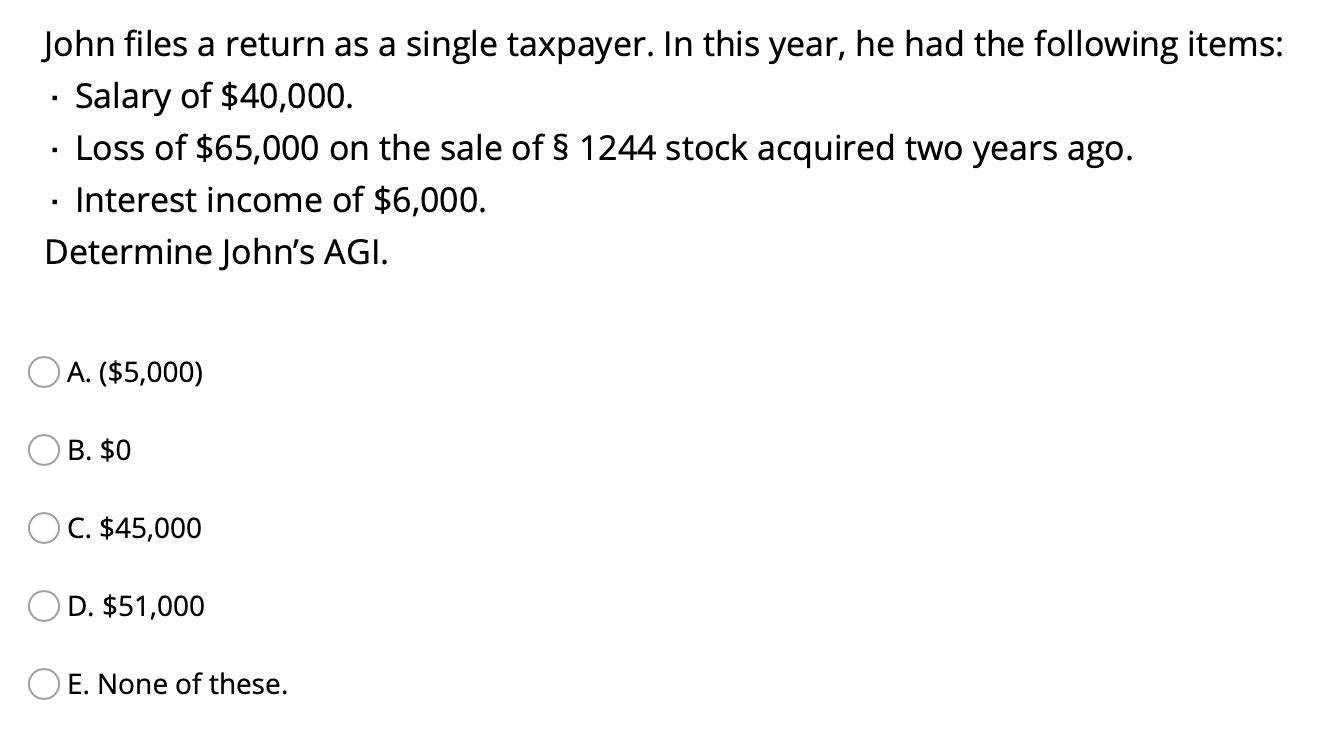

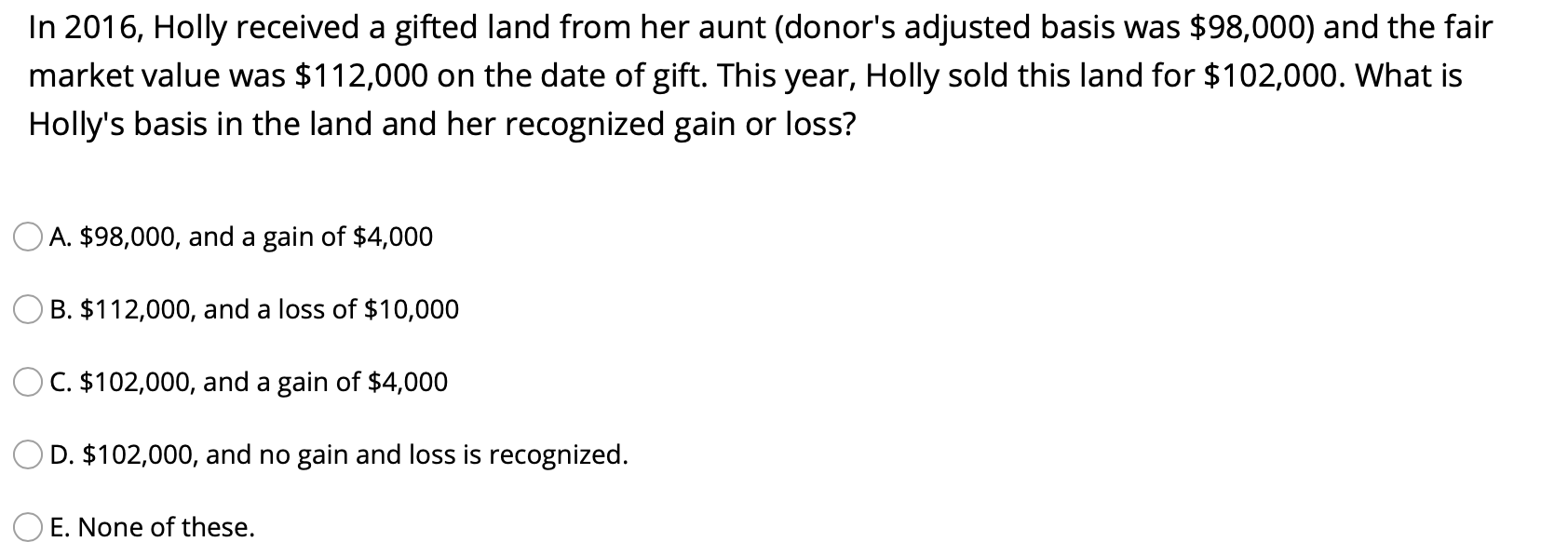

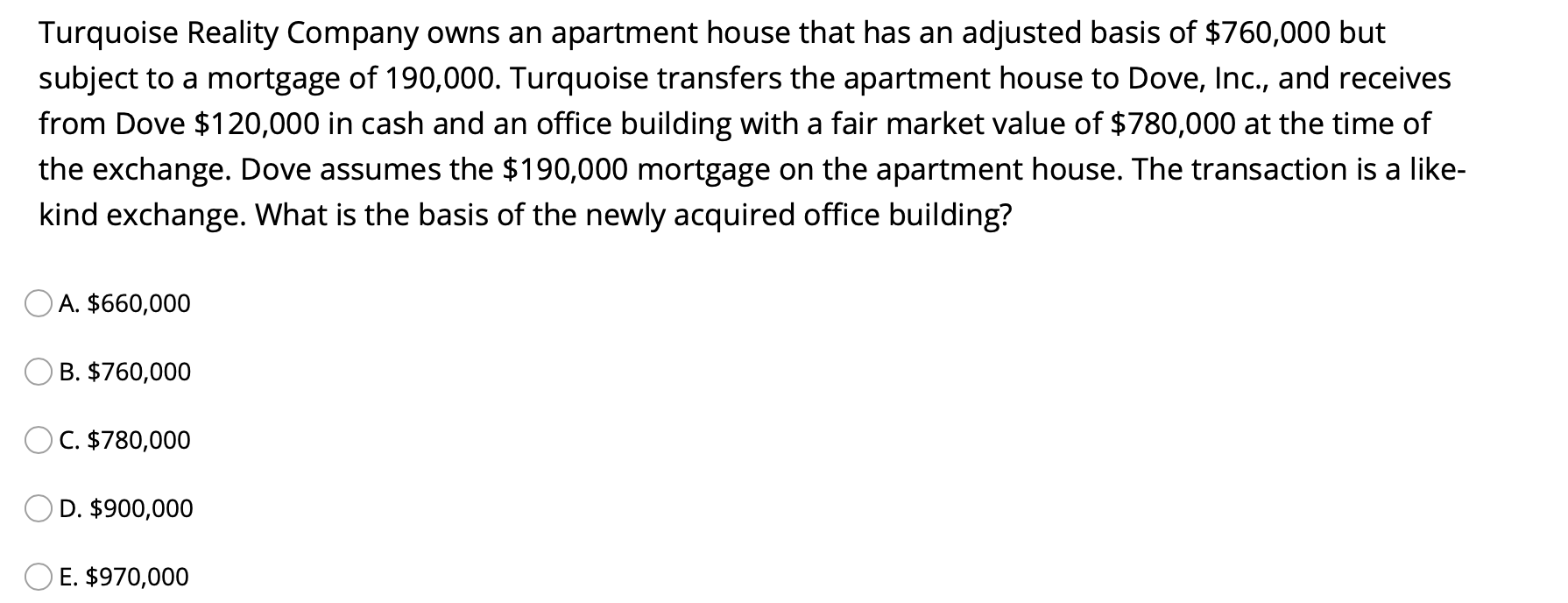

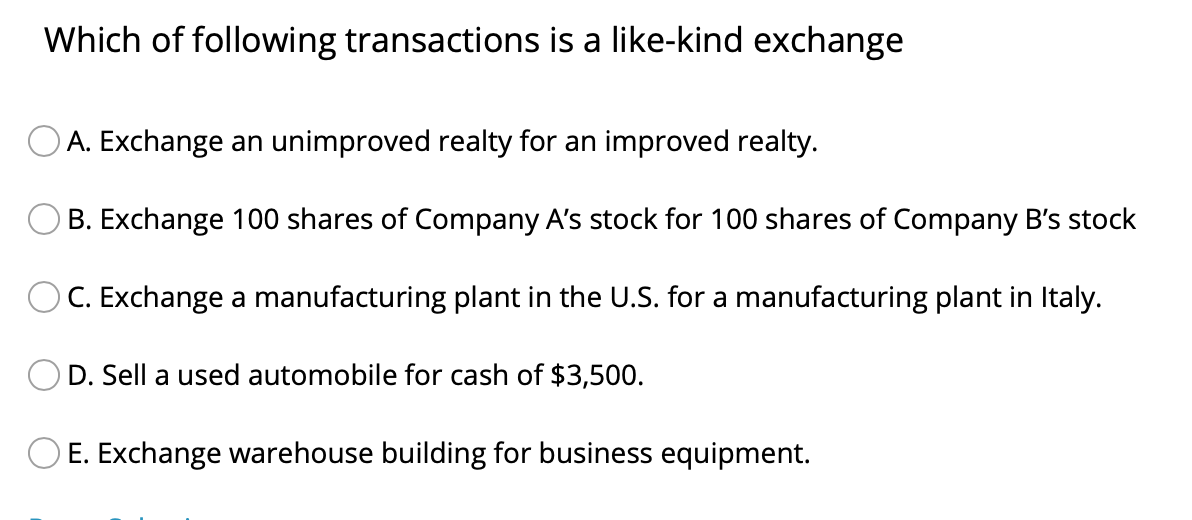

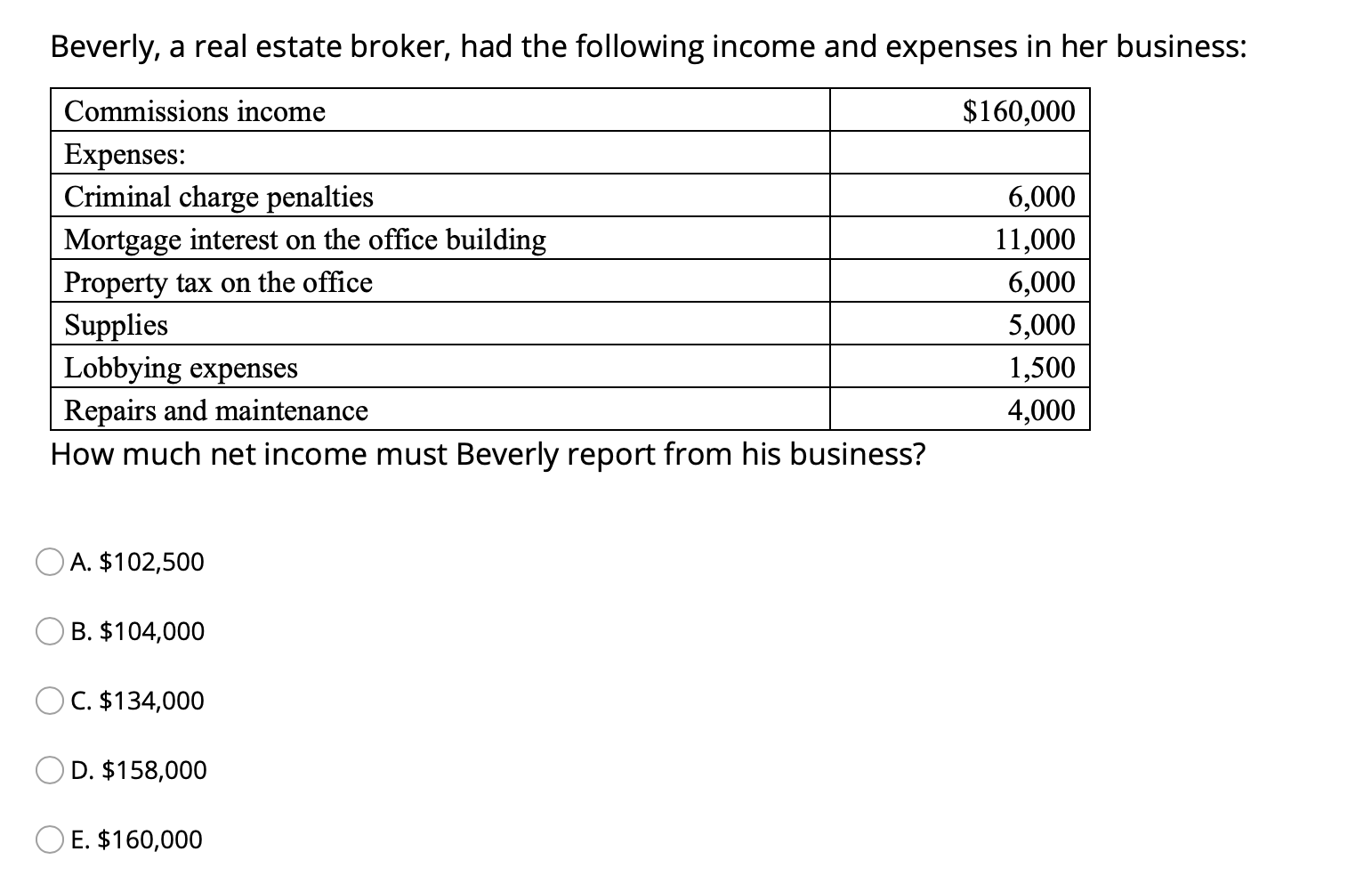

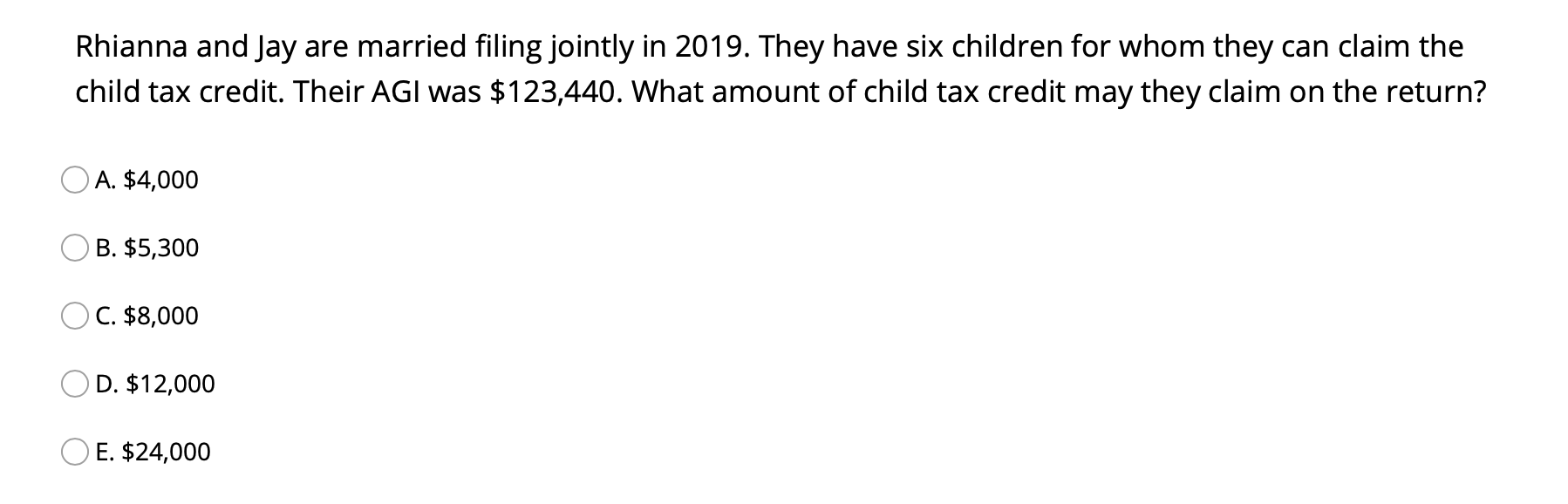

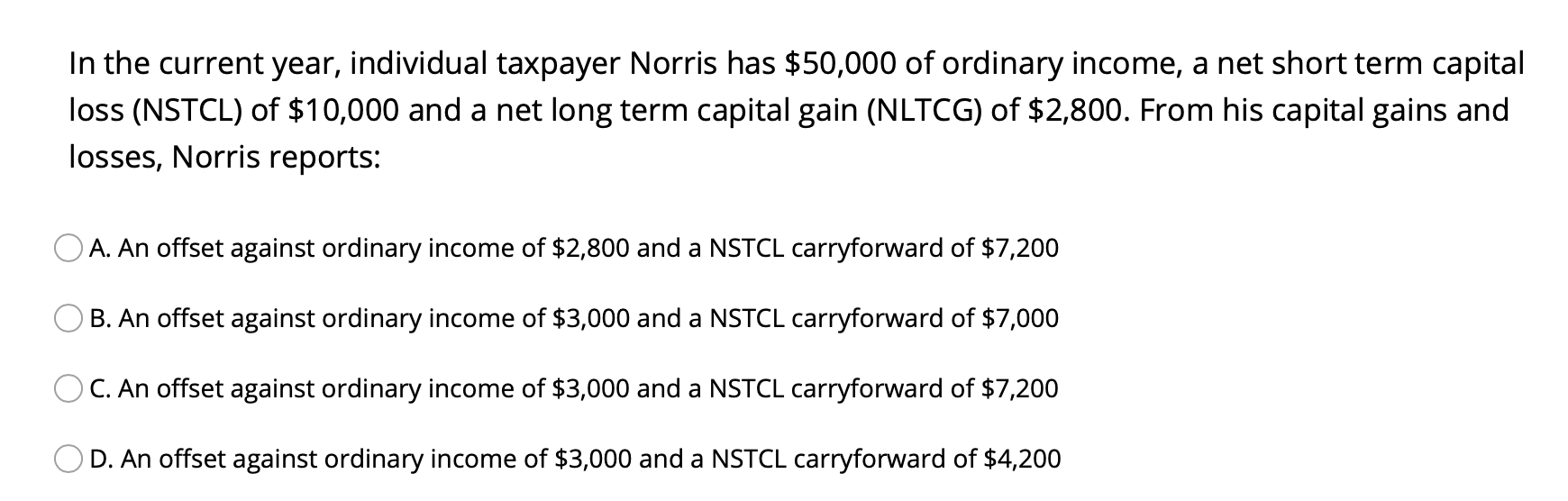

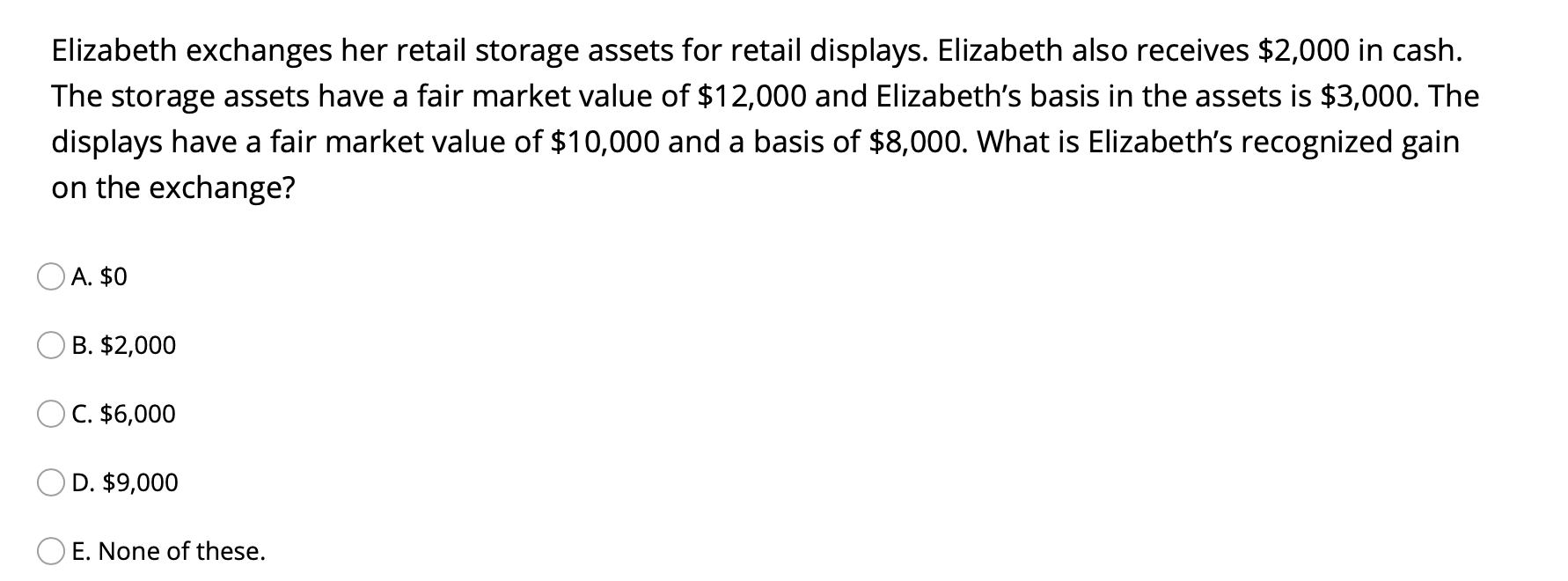

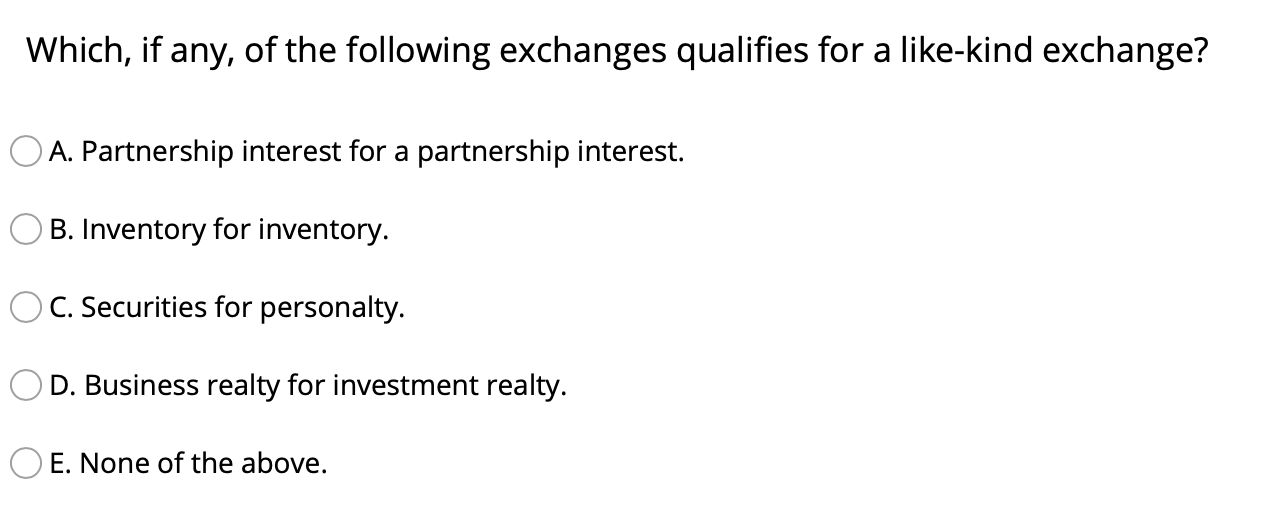

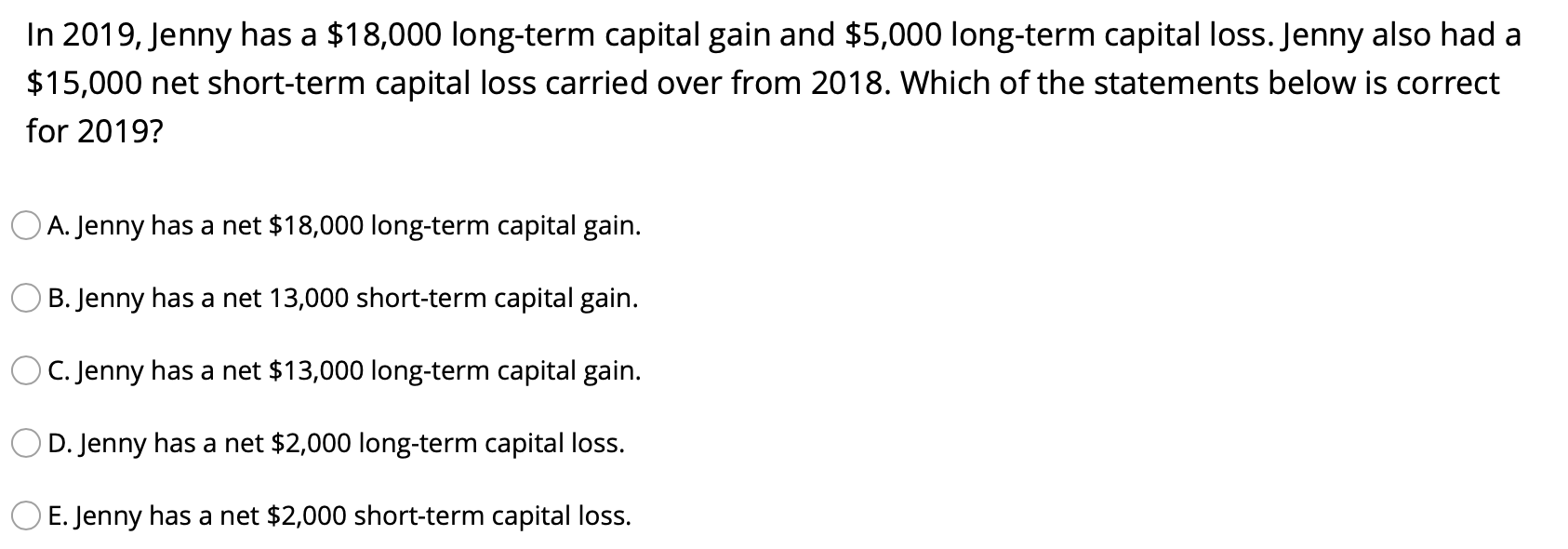

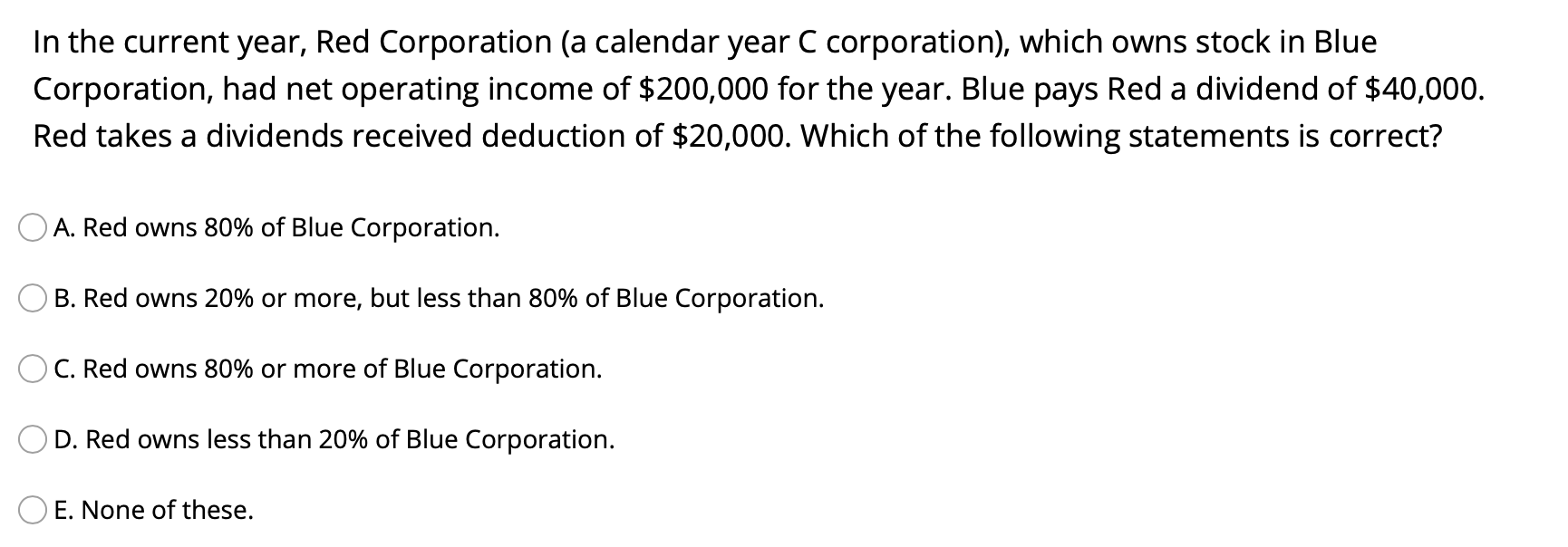

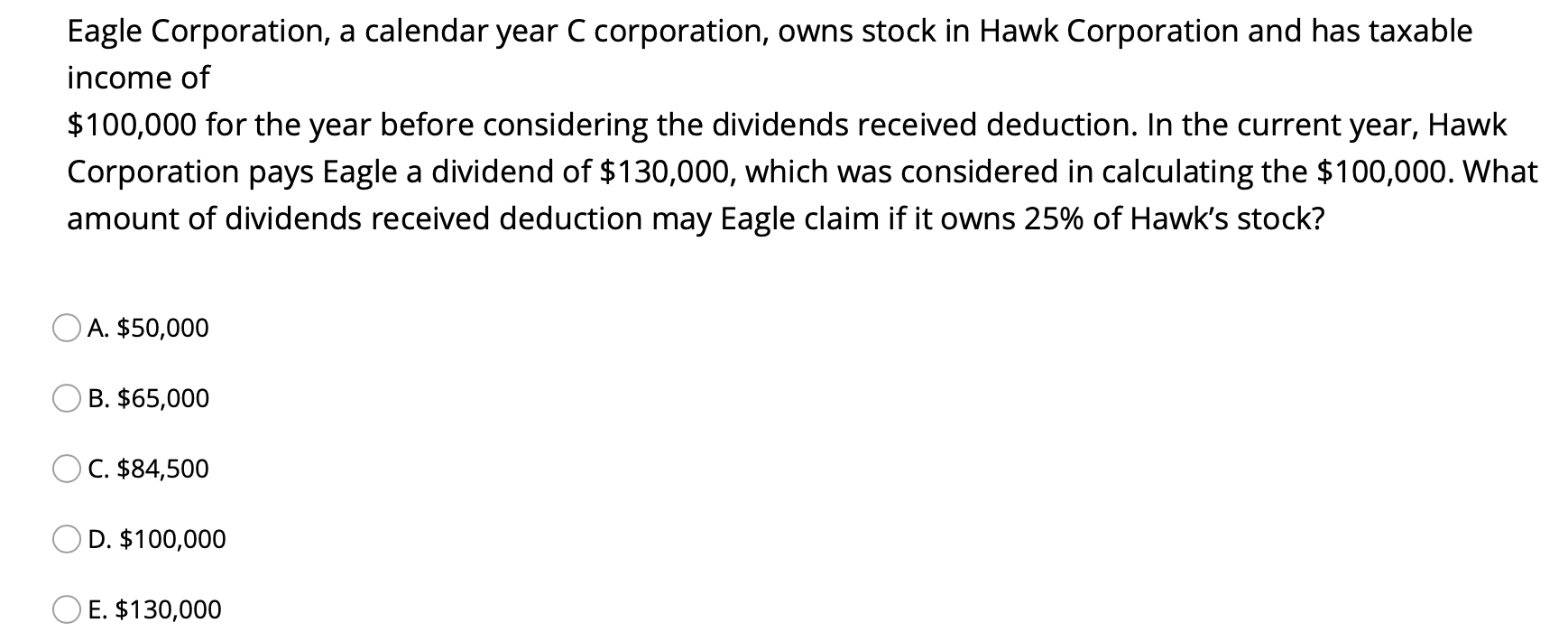

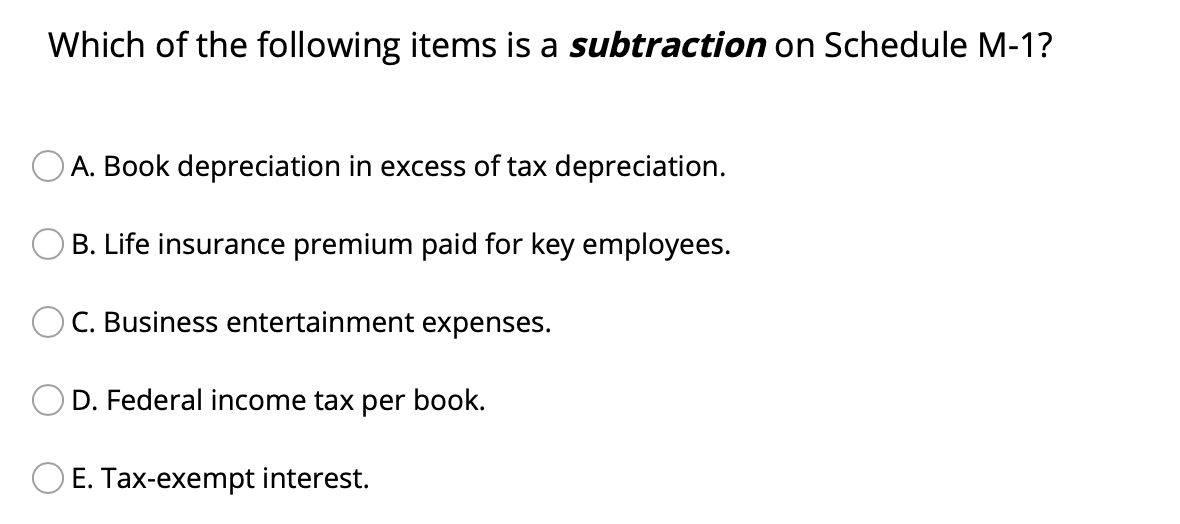

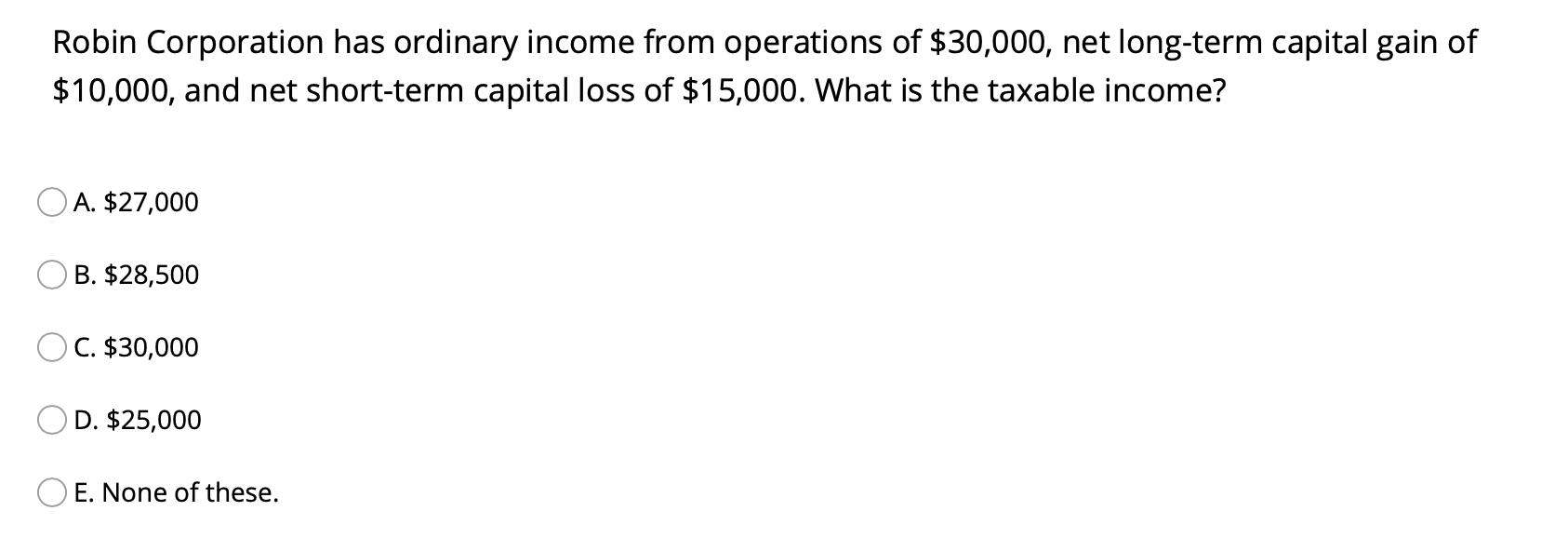

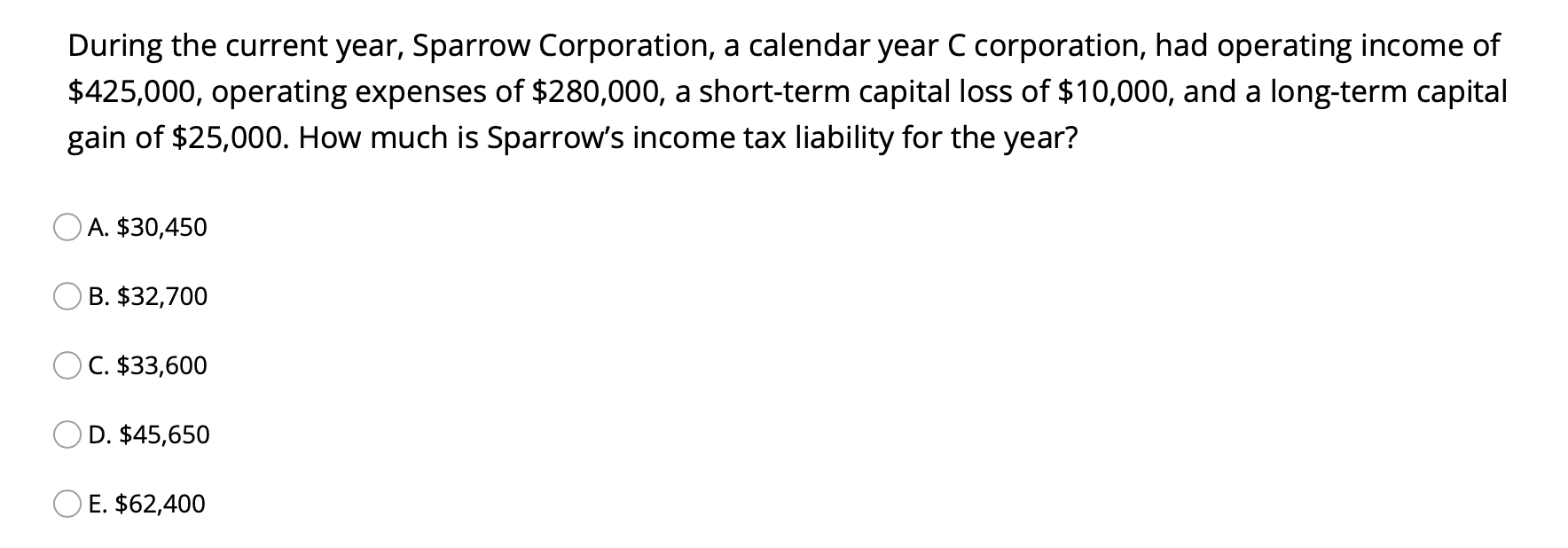

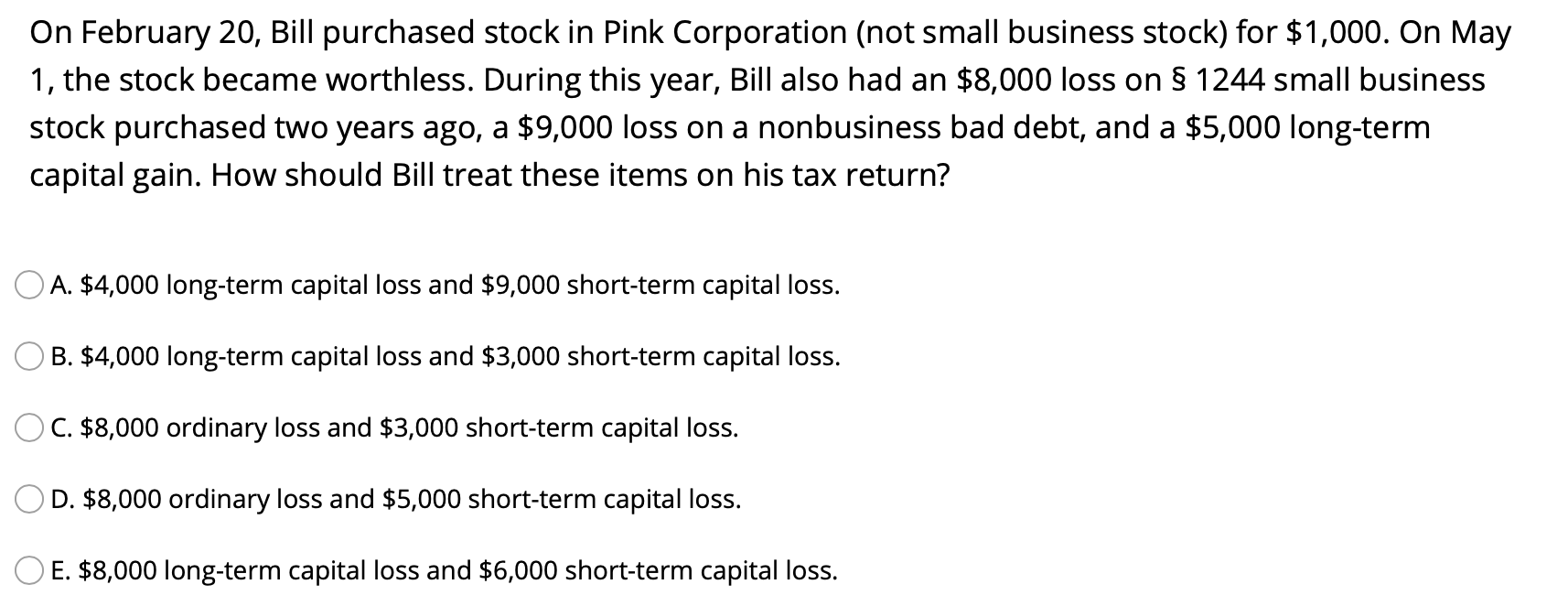

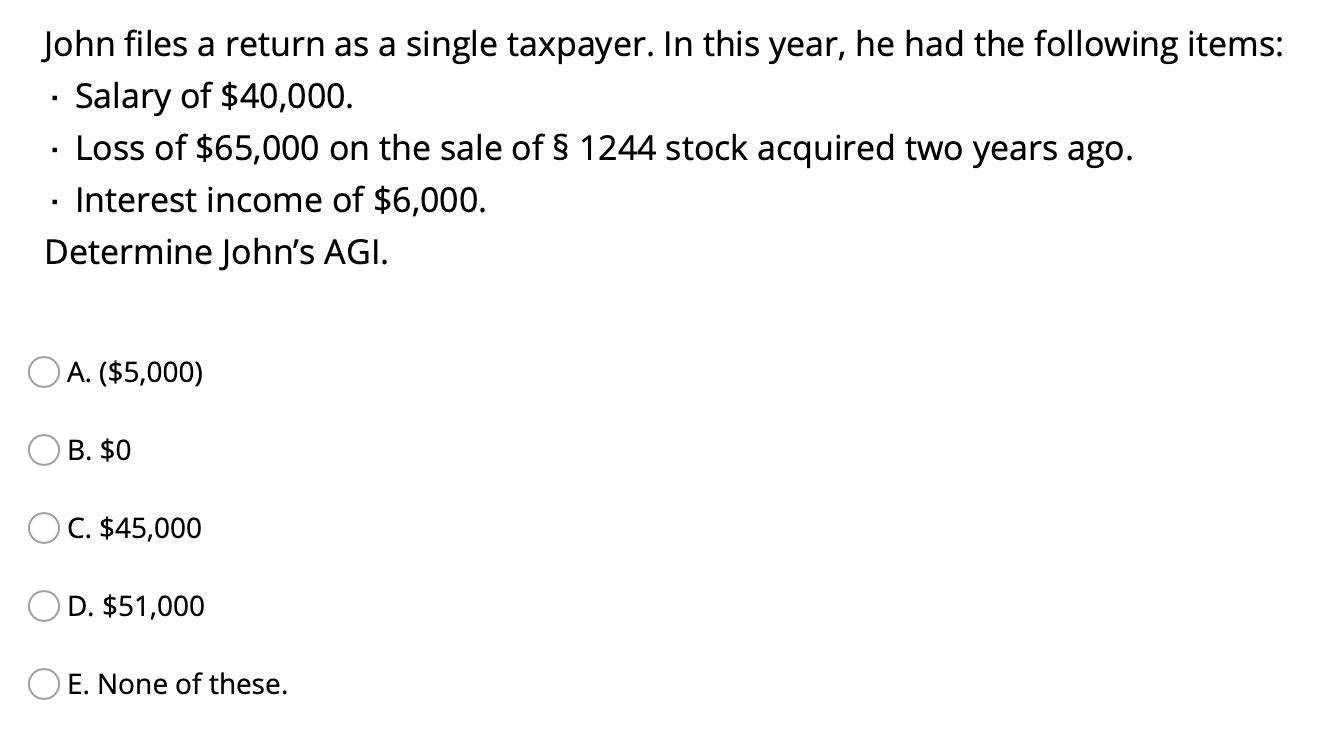

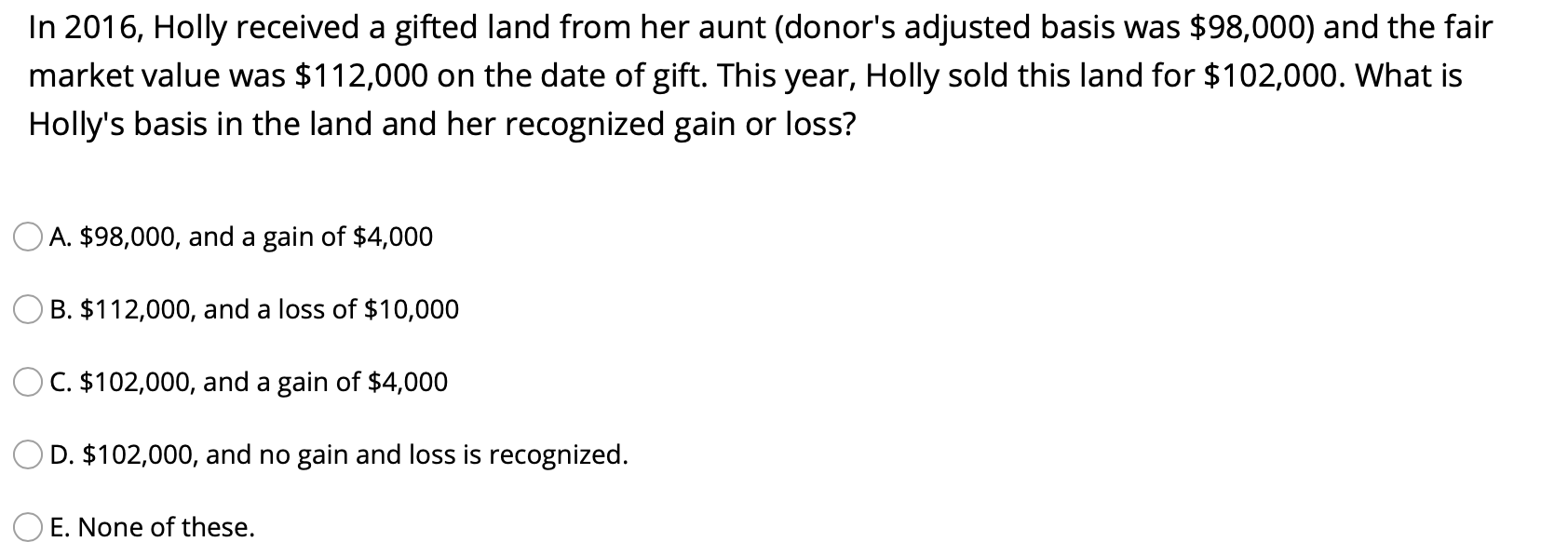

Turquoise Reality Company owns an apartment house that has an adjusted basis of $760,000 but subject to a mortgage of 190,000. Turquoise transfers the apartment house to Dove, Inc., and receives from Dove $120,000 in cash and an office building with a fair market value of $780,000 at the time of the exchange. Dove assumes the $190,000 mortgage on the apartment house. The transaction is a like- kind exchange. What is the basis of the newly acquired office building? O A. $660,000 B. $760,000 OC. $780,000 D. $900,000 E. $970,000 Which of following transactions is a like-kind exchange A. Exchange an unimproved realty for an improved realty. B. Exchange 100 shares of Company A's stock for 100 shares of Company B's stock C. Exchange a manufacturing plant in the U.S. for a manufacturing plant in Italy. D. Sell a used automobile for cash of $3,500. OE. Exchange warehouse building for business equipment. Beverly, a real estate broker, had the following income and expenses in her business: $160,000 Commissions income Expenses: Criminal charge penalties Mortgage interest on the office building Property tax on the office Supplies Lobbying expenses Repairs and maintenance How much net income must Beverly report from his business? 6,000 11,000 6,000 5,000 1,500 4,000 A. $102,500 B. $104,000 OC. $134,000 OD. $158,000 E. $160,000 Rhianna and Jay are married filing jointly in 2019. They have six children for whom they can claim the child tax credit. Their AGI was $123,440. What amount of child tax credit may they claim on the return? A. $4,000 B. $5,300 OC. $8,000 D. $12,000 O E. $24,000 In the current year, individual taxpayer Norris has $50,000 of ordinary income, a net short term capital loss (NSTCL) of $10,000 and a net long term capital gain (NLTCG) of $2,800. From his capital gains and losses, Norris reports: A. An offset against ordinary income of $2,800 and a NSTCL carryforward of $7,200 B. An offset against ordinary income of $3,000 and a NSTCL carryforward of $7,000 C. An offset against ordinary income of $3,000 and a NSTCL carryforward of $7,200 D. An offset against ordinary income of $3,000 and a NSTCL carryforward of $4,200 Elizabeth exchanges her retail storage assets for retail displays. Elizabeth also receives $2,000 in cash. The storage assets have a fair market value of $12,000 and Elizabeth's basis in the assets is $3,000. The displays have a fair market value of $10,000 and a basis of $8,000. What is Elizabeth's recognized gain on the exchange? A. $0 B. $2,000 C. $6,000 D. $9,000 E. None of these. Which, if any, of the following exchanges qualifies for a like-kind exchange? A. Partnership interest for a partnership interest. B. Inventory for inventory. C. Securities for personalty. D. Business realty for investment realty. E. None of the above. In 2019, Jenny has a $18,000 long-term capital gain and $5,000 long-term capital loss. Jenny also had a $15,000 net short-term capital loss carried over from 2018. Which of the statements below is correct for 2019? O A. Jenny has a net $18,000 long-term capital gain. B. Jenny has a net 13,000 short-term capital gain. C. Jenny has a net $13,000 long-term capital gain. D. Jenny has a net $2,000 long-term capital loss. E. Jenny has a net $2,000 short-term capital loss. In the current year, Red Corporation (a calendar year C corporation), which owns stock in Blue Corporation, had net operating income of $200,000 for the year. Blue pays Red a dividend of $40,000. Red takes a dividends received deduction of $20,000. Which of the following statements is correct? A. Red owns 80% of Blue Corporation. B. Red owns 20% or more, but less than 80% of Blue Corporation. C. Red owns 80% or more of Blue Corporation. D. Red owns less than 20% of Blue Corporation. E. None of these. Eagle Corporation, a calendar year C corporation, owns stock in Hawk Corporation and has taxable income of $100,000 for the year before considering the dividends received deduction. In the current year, Hawk Corporation pays Eagle a dividend of $130,000, which was considered in calculating the $100,000. What amount of dividends received deduction may Eagle claim if it owns 25% of Hawk's stock? A. $50,000 B. $65,000 C. $84,500 D. $100,000 E. $130,000 Which of the following items is a subtraction on Schedule M-1? O A. Book depreciation in excess of tax depreciation. B. Life insurance premium paid for key employees. C. Business entertainment expenses. D. Federal income tax per book. O E. Tax-exempt interest. Robin Corporation has ordinary income from operations of $30,000, net long-term capital gain of $10,000, and net short-term capital loss of $15,000. What is the taxable income? A. $27,000 B. $28,500 C. $30,000 D. $25,000 E. None of these. During the current year, Sparrow Corporation, a calendar year C corporation, had operating income of $425,000, operating expenses of $280,000, a short-term capital loss of $10,000, and a long-term capital gain of $25,000. How much is Sparrow's income tax liability for the year? A. $30,450 B. $32,700 C. $33,600 D. $45,650 O E. $62,400 On February 20, Bill purchased stock in Pink Corporation (not small business stock) for $1,000. On May 1, the stock became worthless. During this year, Bill also had an $8,000 loss on 1244 small business stock purchased two years ago, a $9,000 loss on a nonbusiness bad debt, and a $5,000 long-term capital gain. How should Bill treat these items on his tax return? O A. $4,000 long-term capital loss and $9,000 short-term capital loss. B. $4,000 long-term capital loss and $3,000 short-term capital loss. O C. $8,000 ordinary loss and $3,000 short-term capital loss. OD. $8,000 ordinary loss and $5,000 short-term capital loss. OE. $8,000 long-term capital loss and $6,000 short-term capital loss. John files a return as a single taxpayer. In this year, he had the following items: Salary of $40,000. Loss of $65,000 on the sale of $ 1244 stock acquired two years ago. Interest income of $6,000. Determine John's AGI. . O A. ($5,000) B. $0 C. $45,000 D. $51,000 E. None of these. In 2016, Holly received a gifted land from her aunt (donor's adjusted basis was $98,000) and the fair market value was $112,000 on the date of gift. This year, Holly sold this land for $102,000. What is Holly's basis in the land and her recognized gain or loss? O A. $98,000, and a gain of $4,000 B. $112,000, and a loss of $10,000 OC. $102,000, and a gain of $4,000 OD. $102,000, and no gain and loss is recognized. E. None of these