Question

Tushita Milk Ltd has an operation that processes milk into milk-based products such as yogurt, butter, and custard, for domestic and export markets. Its production

Tushita Milk Ltd has an operation that processes milk into milk-based products such as yogurt, butter, and custard, for domestic and export markets. Its production and packing facilities and head office are located in Wagga Wagga. In addition to buying milk for processing from various sources, the company operates 10 farms of its own, all located within 50 kilometers of Wagga Wagga. All milk produced by the livestock raised on the farms is used by Tushita in its milk-processing operations, that is, there are no external sales. The 10 farms provide Tushita with approximately 40% of its milk input. The 10 farms share a pool of four staff and equipment. Staff spend approximately 80% of their time working on the 10 farms and 20% at the central Wagga Wagga operations. One staff member acts as a supervisor but all decisions relating to the farms are made by a head office manager.

Required: Would the 10 farms represent ten separate cash-generating units or one?

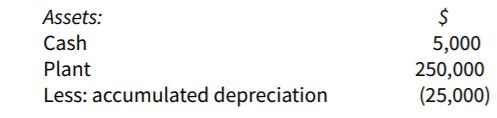

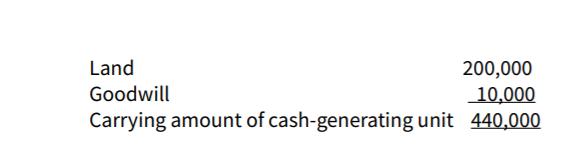

Part B: Naga Ltd has an operation that is regarded as a separate cash-generating unit (CGU). At 30 June 2019, the carrying amounts of the assets, valued pursuant to the cost model, are as follows:

The directors estimate that, as at 30 June 2019, the fair value less costs to sell of the CGU amounts to $405,000, while the value in use of the CGU is $422,500. The land had a fair value less costs to sell of $195,000.

Required: For the year ended 30 June 2019, determine how Naga Ltd should account for the results of the impairment test and advise Mark on how to prepare the necessary journal entries.

Assets: Cash Plant Less: accumulated depreciation $ 5,000 250,000 (25,000)

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep workings 1 Determine the carrying amount of the CGU Carrying amount of cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started