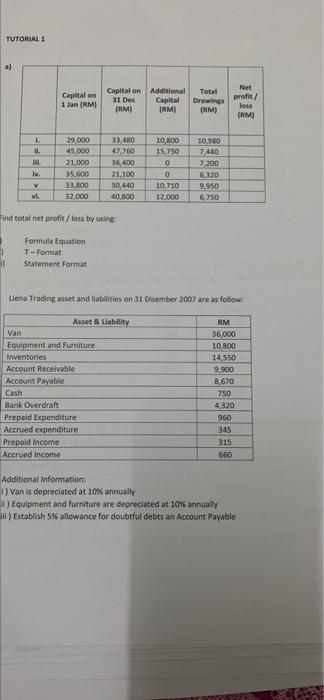

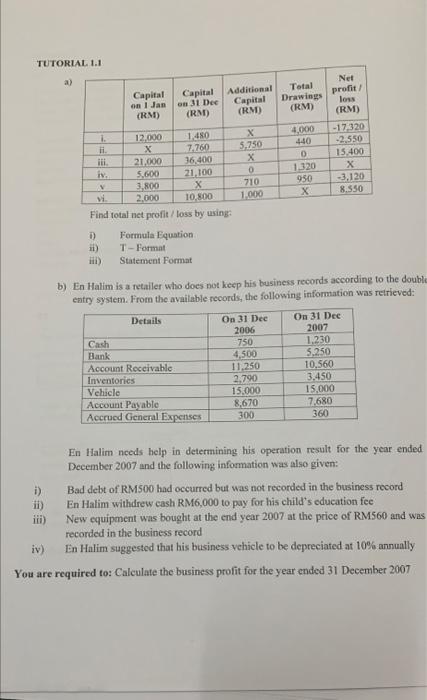

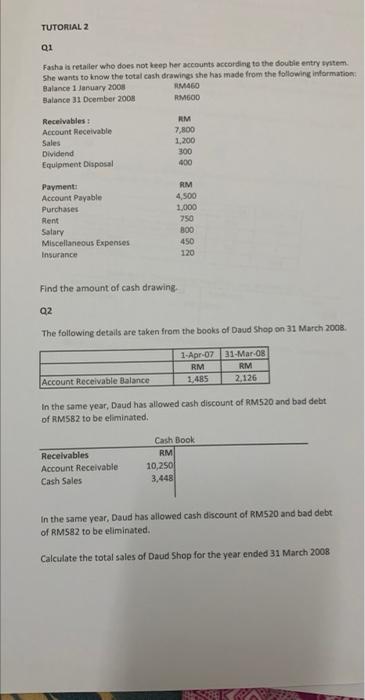

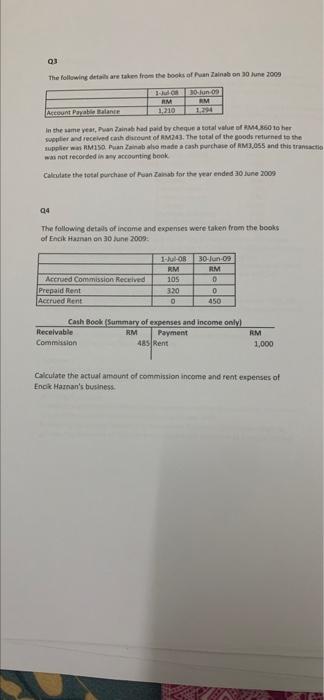

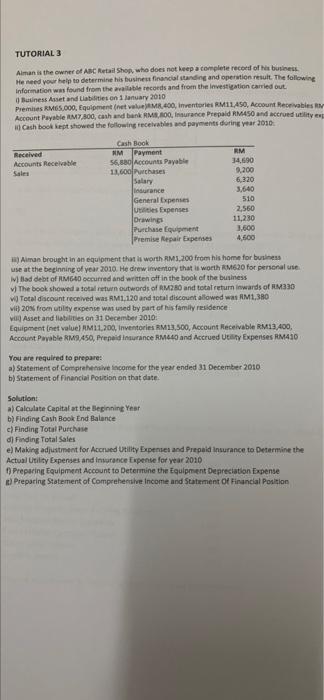

TUTORIAL 1 a) Capital on 1 Jan (RM) Capital on 31 Dec (RM) Additional Capital (RM) Total Drawings PRM) Net profit loss (RM) 1 il. 10,800 15.750 0 29.000 45.000 21,000 35,600 33,800 32,000 33.480 47,760 36.400 21,100 30,440 40.800 10.900 7,440 7,200 6.320 9,950 6,750 lv 0 10,710 12.000 vi. Find total net profit/loss by using 0 Formula Equation T-Format Statement Format Liena Trading asset and liabilities on 31 Disember 2007 are as follow! Asset & Liability Van Equipment and Furniture Inventories Account Receivable Account Payable Cash Bank Overdraft Prepaid Expenditure Accrued expenditure Prepaid income Accrued Income RM 36,000 10,800 14.550 9.900 8,670 750 4320 960 345 315 660 Additional Information: 1) Van is depreciated at 10% annually ) Equipment and furniture are depreciated at 10% annually ii) Establish allowance for doubtful debts an Account Payable TUTORIAL 1.1 a) Capital on 1 Jan (RM) Capital 31 Dec (RM) Additional Capital (RM) Total Drawings (RM) Net profit loss (RM) 4.000 440 0 1320 950 X 5,750 0 710 1.000 -17320 -2.550 15.400 X -3,120 8.550 1. 12.000 1.480 fi 7.760 iii. 21.000 36.400 iv. 5.600 21.100 3,800 X vi 2.000 10.800 Find total net profit/loss by using D) Formula Equation ii) T-Format ) Statement Format b) En Halim is a retailer who does not keep his business records according to the double entry system. From the available records, the following information was retrieved: Details On 31 Dec On 31 Dec 2006 2007 Cash 750 1.230 Bank 4.500 5.250 Account Receivable 11.250 10.560 Inventories 2,790 3.450 Vehicle 15.000 15,000 Account Payable 8,670 7,680 Accrued General Expenses 300 360 En Halim needs help in determining his operation result for the year ended December 2007 and the following information was also given: i) Bad debt of RM500 had occurred but was not recorded in the business record ii) En Halim withdrew cash RM6,000 to pay for his child's education fee iii) New equipment was bought at the end year 2007 at the price of RM560 and was recorded in the business record iv) En Halim suggested that his business vehicle to be depreciated at 10% annually You are required to: Calculate the business profit for the year ended 31 December 2007 TUTORIAL 2 Q1 Fasha is retailer who does not keep her accounts according to the double entry system She wants to know the total cash drawings she has made from the following information Balance 1 January 2008 MAGO Balance 31 Dcember 2008 RM600 RM 7,800 Receivables: Account Receivable Sales Dividend Equipment Disposal 1200 300 400 Payment: Account Payable Purchases Rent Salary Miscellaneous Expenses Insurance RM 4,500 1.000 750 800 450 120 Find the amount of cash drawing. Q2 The following details are taken from the books of Daud Shop on 31 March 2008 1-Apr-07 RM 1.485 31-Mar-08 RM 2.126 Account Receivable Balance In the same year, Daud has allowed cash discount of RM520 and bad debt of RM582 to be eliminated. Receivables Account Receivable Cash Sales Cash Book RM 10,250 3,448 In the same year, Daud has allowed cash discount of RM520 and bad debt of RM582 to be eliminated Calculate the total sales of Daud Shop for the year ended 31 March 2008 Q3 The following are taken from the books of Zainab on 30 June 2009 G 30 kn 00 RM EM Account Payable 1:20 in the same year, Pan Zainab had paid by cheque a total value of RM60 10 her supplier and received canh dicunt of M241. The total of the goods returned to the suppliers AMISO Pannab alio made a cash purchase of RM3.055 and this transactio was not recorded in any accounting book Calculate the total purchase of an asab for the year ended 30 June 2009 04 The following details of income and expenses were taken from the books of Encik Haman on 30 June 2009 Accrued Commission Received Prepaid Rent Accrued Rent 1-O RM 105 320 0 30-Jun-09 RM 0 0 450 Cash Book Summary of expenses and income only Receivable RM Payment Commission 485 Rent EM 1,000 Calculate the actual amount of commission income and rent expenses of Enok Harnan's business TUTORIAL 3 Alman is the owner of ABC Retail Shop, who does not keep a complete record of this business He need your help to determine his business financial standing and operation result. The following Information was found from the wall records and from the investigation carried out. Business Asset and abilities on 1 January 2010 Premies MGS.000, Equipment (net MR, 400, inventories RM11450, Account Receivables Account Payable RM7,800, cash and bank RM100. Insurance Prepaid RM450 und scued utility Cash booklet showed the following receivables and payments during year 2010 Received Accounts Receivable Sales Cash Book HM Payment 56,880 Accounts Payable 11,600 Phases Salary surance General Expenses utiles Expenses Drawings Purchase Equipment Premise Repair Expenses RM 34.690 9.200 6.320 3,640 510 2.560 11,230 3,600 4300 1) Aiman brought in an equipment that is worth RM3.200 from his home for business use at the beginning of year 2010. He drew inventory that is worth RM620 for personal use W lad debt of RM640 occurred and written off in the book of the business v] The book showed a total return outwords of RM20 and total return inwards of RM330 Total discount received was RM1. 120 and total discount allowed was RM1,30 wi) 20% from utility expense was used by part of his family residence Asset and abilities on 31 December 2010 Equipment inet value RM1,200, inventories RM13,500, Account Receivable RM13,400, Account Payable RM9,450, Prepaid insurance RM440 and Accrued Utility Expenses RM410 You are required to prepare: a) Statement of Comprehensive income for the year ended 31 December 2010 b) Statement of Financial Position on that date. Solution: a) Calculate Capital at the Beginning Year b) Finding Cash Book End Balance c) Finding Total Purchase dinding Total Sales e Making adjustment for Accrued Utility Expenses and Prepaid insurance to Determine the Actual Utility Expenses and insurance Expense for year 2010 Preparing Equipment Account to Determine the Equipment Depreciation Expense Preparing Statement of Comprehensive Income and Statement of Financial Position