Question

Twelve company is a GST registrant operating in British Columbia. BC does not participate in the HST program. It has 7 percent non-refundable provincial sales

Twelve company is a GST registrant operating in British Columbia. BC does not participate in the HST program. It has 7 percent non-refundable provincial sales tax (PST). During the current calendar quarter, the following sales and expenditures were recorded. All sales were cash sales and all expenditures were invoiced for and paid in the quarter. All capital equipment is used 100% for taxable supplies.

Amount GST PST TOTAL

Sales 24,000 1,200 1,680 26,880

Expenditures

Capital Equipment 14,000 700 980 15,680

Interest 1,000 Nil Nil 1,000

Purchases of Inventory 6,000 300 420 6720

Rent (GST, but no PST) 4,000 200 Nil 4,200

Salaries 4,000 Nil Nil 4,000

Supplies 2,000 100 140 2,240

Total Expenditures 31,000 1,300 1,540 33,840

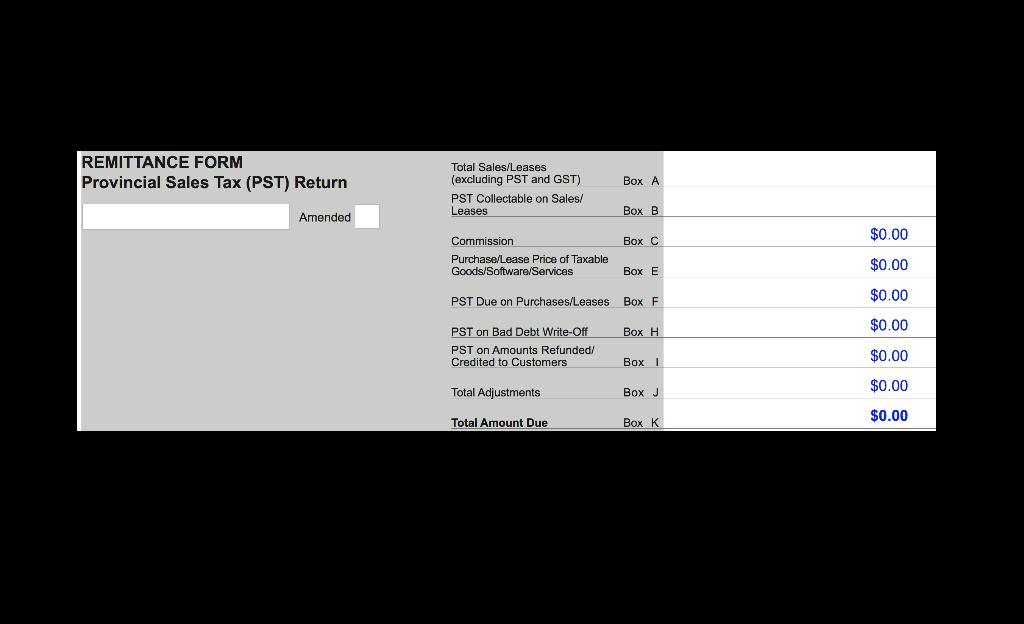

Question: Under the PST rules for B.C. what is the “total amount due” to be included in the box “K” of the PST tax return form?

REMITTANCE FORM Provincial Sales Tax (PST) Return Amended Total Sales/Leases (excluding PST and GST) PST Collectable on Sales/ Leases Commission Purchase/Lease Price of Taxable Goods/Software/Services Box A Total Adjustments Total Amount Due Box B Box C Box E PST Due on Purchases/Leases Box F PST on Bad Debt Write-Off PST on Amounts Refunded/ Credited to Customers Box H Box I Box J Box K $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the total amount due Box K on the PST tax return form for T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started