Question

Two Books Accounting Services has three employees who, in 2020, are paid weekly as follows: Gross pay Philo Kvetch 4,650.00 . ezle Dicky Debit

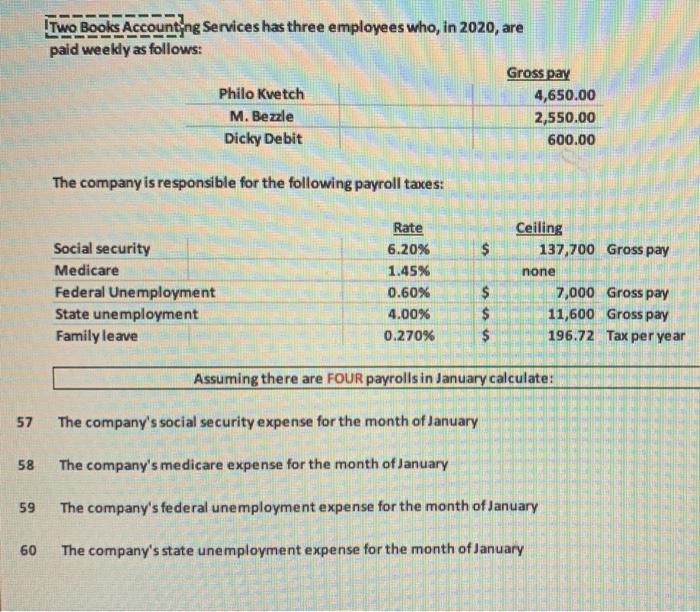

Two Books Accounting Services has three employees who, in 2020, are paid weekly as follows: Gross pay Philo Kvetch 4,650.00 . ezle Dicky Debit 2,550.00 600.00 The company is responsible for the following payroll taxes: Rate Ceiling Social security 6.20% 137,700 Gross pay Medicare 1.45% none Federal Unemployment State unemployment 0.60% $4 7,000 Gross pay 4.00% 11,600 Gross pay Family leave 0.270% 2$ 196.72 Tax per year Assuming there are FOUR payrolls in January calculate: 57 The company's social security expense for the month of January 58 The company's medicare expense for the month of January 59 The company's federal unemployment expense for the month of January 60 The company's state unemployment expense for the month of January %24

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles Of Risk Management And Insurance

Authors: George E. Rejda, Michael McNamara

12th Edition

132992914, 978-0132992916

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App