Answered step by step

Verified Expert Solution

Question

1 Approved Answer

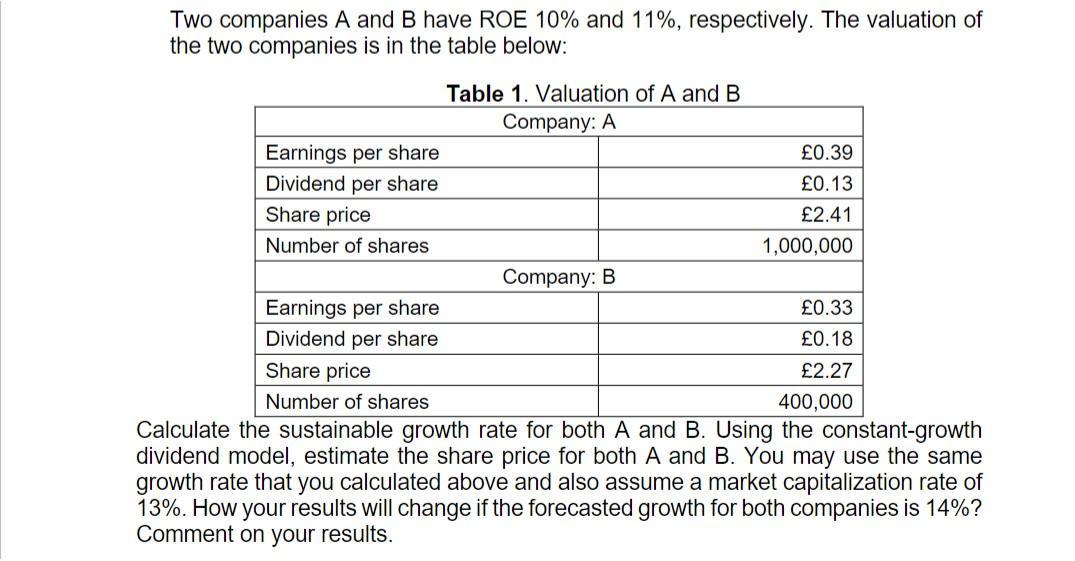

Two companies A and B have ROE 10% and 11%, respectively. The valuation of the two companies is in the table below: Earnings per

Two companies A and B have ROE 10% and 11%, respectively. The valuation of the two companies is in the table below: Earnings per share Dividend per share Share price Number of shares Earnings per share Dividend per share Table 1. Valuation of A and B Company: A Share price Number of shares Company: B 0.39 0.13 2.41 1,000,000 0.33 0.18 2.27 400,000 Calculate the sustainable growth rate for both A and B. Using the constant-growth dividend model, estimate the share price for both A and B. You may use the same growth rate that you calculated above and also assume a market capitalization rate of 13%. How your results will change if the forecasted growth for both companies is 14%? Comment on your results.

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Sustainable Growth Rate for A Sustainable Growth Rate Return on Equity x 1 Dividend Payout Ratio 10 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started