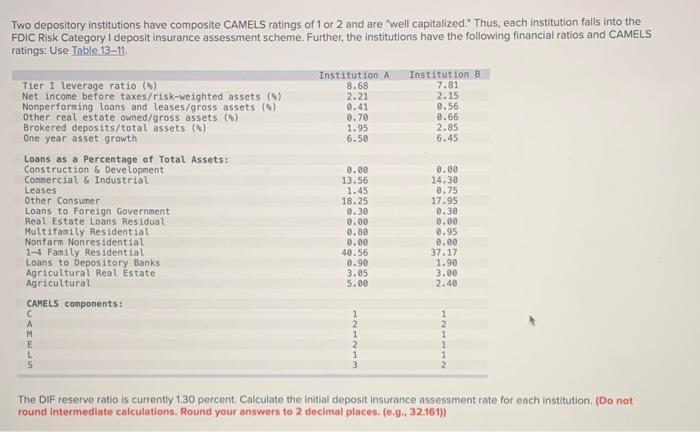

Two depository institutions have composite CAMELS ratings of 1 or 2 and are well capitalized." Thus, each institution falls into the FDIC Risk Category I deposit insurance assessment scheme. Further, the institutions have the following financial ratios and CAMELS ratings: Use Table 13-11 Institution A 8.68 2.21 0.41 0.70 1.95 6.50 Institution B 7.81 2.15 0.56 0.66 2.85 6.45 Tier I leverage ratio (9) Net income before taxes/risk-weighted assets (*) Nonperforming loans and leases/gross assets (9) Other real estate owned/gross assets (1) Brokered deposits/total assets (8) One year asset growth Loans as a Percentage of Total Assets: Construction & Development Commercial & Industrial Leases Other Consumer Loans to Foreign Government Real Estate Loans Residual Multifamily Residential Nonfarm Nonresidential 1-4 Family Residential Loans to Depository Banks Agricultural Real Estate Agricultural CAMELS components: C M E L S 0.00 13.56 1.45 18.25 9.30 0.00 0.80 0.00 40.56 0.90 3.05 5.00 0.00 14.30 0.75 17.95 0.30 0.00 2.95 0.00 37.17 1.90 3.00 2.40 The DIF reserve ratio is currently 130 percent. Calculate the initial deposit Insurance assessment rate for each institution. (Do not round Intermediate calculations. Round your answers to 2 decimal places. (e.g.. 32.1611) Two depository institutions have composite CAMELS ratings of 1 or 2 and are well capitalized." Thus, each institution falls into the FDIC Risk Category I deposit insurance assessment scheme. Further, the institutions have the following financial ratios and CAMELS ratings: Use Table 13-11 Institution A 8.68 2.21 0.41 0.70 1.95 6.50 Institution B 7.81 2.15 0.56 0.66 2.85 6.45 Tier I leverage ratio (9) Net income before taxes/risk-weighted assets (*) Nonperforming loans and leases/gross assets (9) Other real estate owned/gross assets (1) Brokered deposits/total assets (8) One year asset growth Loans as a Percentage of Total Assets: Construction & Development Commercial & Industrial Leases Other Consumer Loans to Foreign Government Real Estate Loans Residual Multifamily Residential Nonfarm Nonresidential 1-4 Family Residential Loans to Depository Banks Agricultural Real Estate Agricultural CAMELS components: C M E L S 0.00 13.56 1.45 18.25 9.30 0.00 0.80 0.00 40.56 0.90 3.05 5.00 0.00 14.30 0.75 17.95 0.30 0.00 2.95 0.00 37.17 1.90 3.00 2.40 The DIF reserve ratio is currently 130 percent. Calculate the initial deposit Insurance assessment rate for each institution. (Do not round Intermediate calculations. Round your answers to 2 decimal places. (e.g.. 32.1611)