Question

Two employees have been hired, at a monthly salary of $2,300 each. One will start Jan 1, the second will start Jan 16. Theres Parts

Two employees have been hired, at a monthly salary of $2,300 each. One will start Jan 1, the second will start Jan 16. Theres Parts A and B, did part A, and need help with Part B.

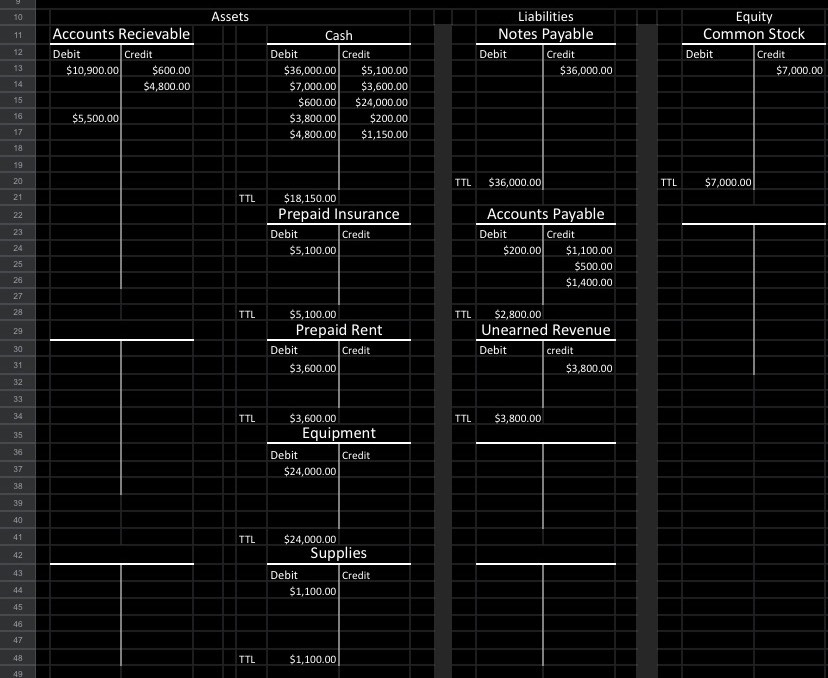

Here are the T-accounts from part A:

PART B REQUIREMENTS:

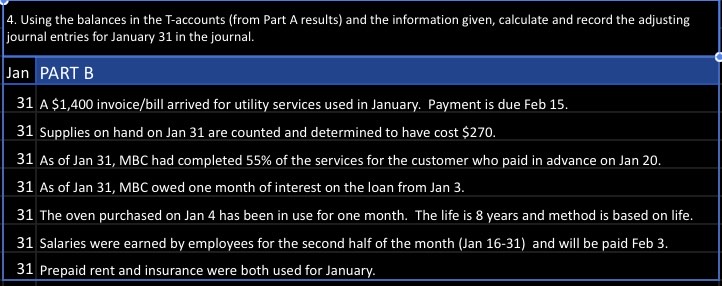

1. Using the balances in the T-accounts (from Part A) and the information given, calculate and record the adjusting journal entries for Jan 31 in the journal.

2. Post each of the adjusting entries to the T-accounts (after previous subtotals for Part A) using the linking/referencing functionality.

3. Using the math functionality in Excel/Sheets, calculate the correct final balance for each T-account on the correct side. The T-account should have the unadjusted total, the adjusting journal entries, then a new seperate final total.

4. Prepare the 3 financial statements in good form using the final ending T-account balances as of January 31, current year. (below) add these to a journal entry, then add it to the T-accounts as i posted above.

Add these to a Journal entry, then add it to the T-accounts that are posted above.

This is the last of the requirements:

1. Prepare Financial Statements in good form using the final ending T-account balances as of January 31, current year.

need help, struggling with it. thank you.

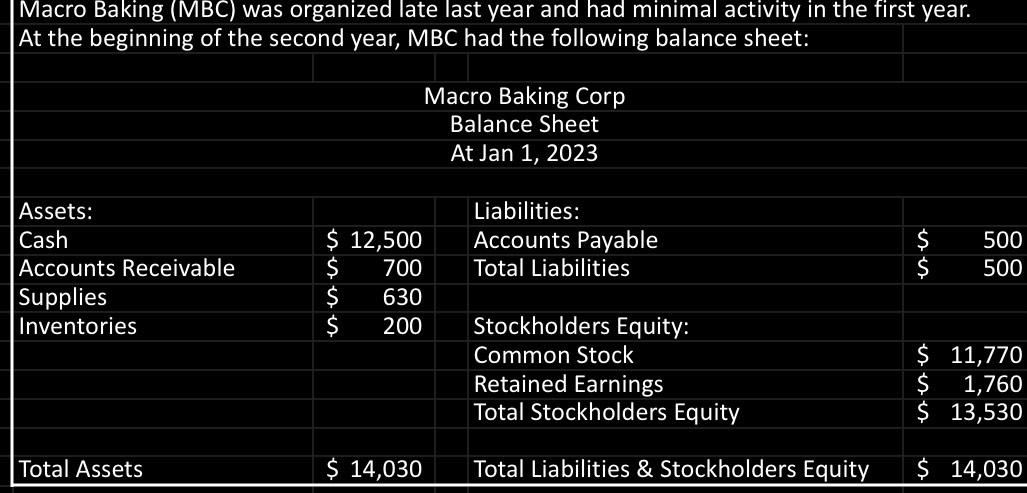

Macro Baking (MBC) was organized late last year and had minimal activity in the first year. At the beginning of the second year, MBC had the following balance sheet: Macro Baking Corp Balance Sheet At Jan 1, 2023 \begin{tabular}{|c|c|c|c|c|} \hline Assets: & & Liabilities: & & \\ \hline Cash & $12,500 & Accounts Payable & $ & 500 \\ \hline Accounts Receivable & 700 & Total Liabilities & $ & 500 \\ \hline Supplies & 630 & & & \\ \hline \multirow[t]{4}{*}{ Inventories } & 200 & Stockholders Equity: & & \\ \hline & & Common Stock & $ & 11,770 \\ \hline & & Retained Earnings & $ & 1,760 \\ \hline & & Total Stockholders Equity & $ & 13,530 \\ \hline Total Assets & $14,030 & Total Liabilities \& Stockholders Equity & $ & 14,030 \\ \hline \end{tabular} 4. Using the balances in the T-accounts (from Part A results) and the information given, calculate and record the adjusting journal entries for January 31 in the journal. Jan PART B 31 A $1,400 invoice/bill arrived for utility services used in January. Payment is due Feb 15. 31 Supplies on hand on Jan 31 are counted and determined to have cost $270. 31 As of Jan 31, MBC had completed 55\% of the services for the customer who paid in advance on Jan 20. 31 As of Jan 31, MBC owed one month of interest on the loan from Jan 3. 31 The oven purchased on Jan 4 has been in use for one month. The life is 8 years and method is based on life. 31 Salaries were earned by employees for the second half of the month (Jan 16-31) and will be paid Feb 3. 31 Prepaid rent and insurance were both used for January. Macro Baking (MBC) was organized late last year and had minimal activity in the first year. At the beginning of the second year, MBC had the following balance sheet: Macro Baking Corp Balance Sheet At Jan 1, 2023 \begin{tabular}{|c|c|c|c|c|} \hline Assets: & & Liabilities: & & \\ \hline Cash & $12,500 & Accounts Payable & $ & 500 \\ \hline Accounts Receivable & 700 & Total Liabilities & $ & 500 \\ \hline Supplies & 630 & & & \\ \hline \multirow[t]{4}{*}{ Inventories } & 200 & Stockholders Equity: & & \\ \hline & & Common Stock & $ & 11,770 \\ \hline & & Retained Earnings & $ & 1,760 \\ \hline & & Total Stockholders Equity & $ & 13,530 \\ \hline Total Assets & $14,030 & Total Liabilities \& Stockholders Equity & $ & 14,030 \\ \hline \end{tabular} 4. Using the balances in the T-accounts (from Part A results) and the information given, calculate and record the adjusting journal entries for January 31 in the journal. Jan PART B 31 A $1,400 invoice/bill arrived for utility services used in January. Payment is due Feb 15. 31 Supplies on hand on Jan 31 are counted and determined to have cost $270. 31 As of Jan 31, MBC had completed 55\% of the services for the customer who paid in advance on Jan 20. 31 As of Jan 31, MBC owed one month of interest on the loan from Jan 3. 31 The oven purchased on Jan 4 has been in use for one month. The life is 8 years and method is based on life. 31 Salaries were earned by employees for the second half of the month (Jan 16-31) and will be paid Feb 3. 31 Prepaid rent and insurance were both used for January

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started