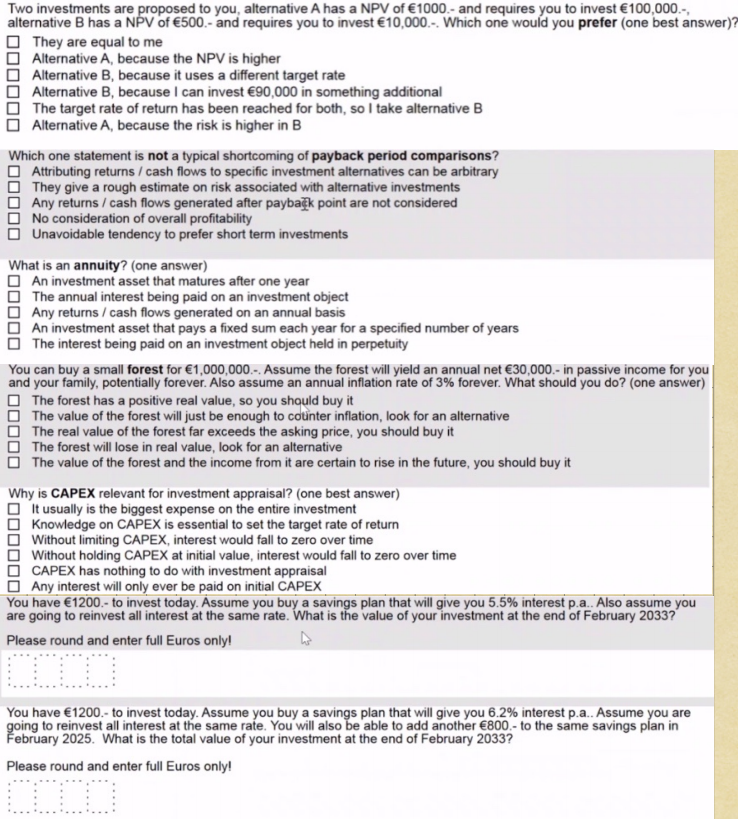

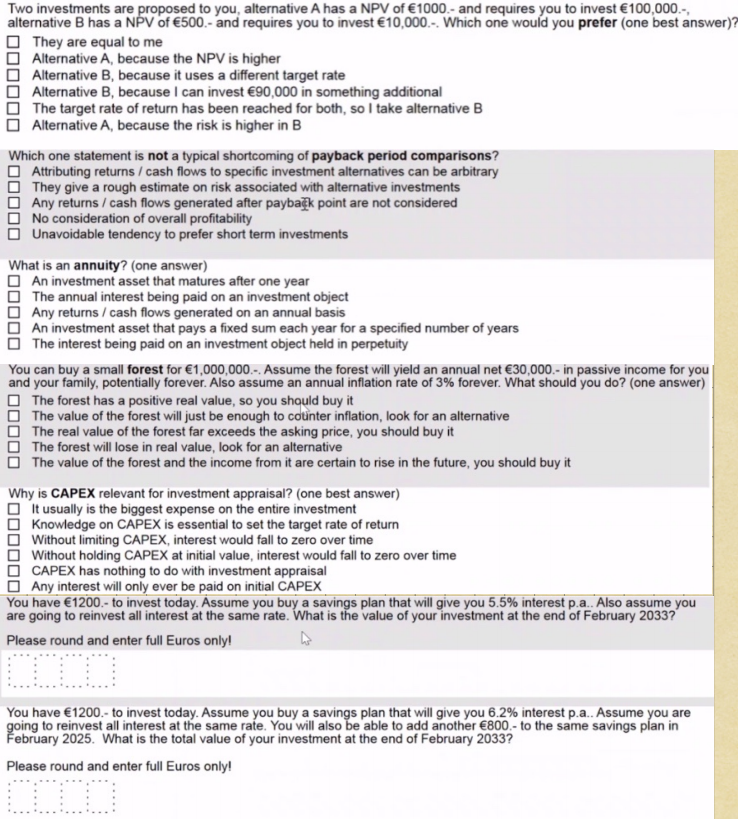

Two investments are proposed to you, alternative A has a NPV of 1000.- and requires you to invest 100,000.- alternative B has a NPV of 500.- and requires you to invest 10,000.-. Which one would you prefer (one best answer)? They are equal to me Alternative A, because the NPV is higher Alternative B, because it uses a different target rate Alternative B, because I can invest 90,000 in something additional The target rate of return has been reached for both, so I take alternative B Alternative A, because the risk is higher in B Which one statement is not a typical shortcoming of payback period comparisons? Attributing returns / cash flows to specific investment alternatives can be arbitrary They give a rough estimate on risk associated with alternative investments Any returns / cash flows generated after paybak point are not considered No consideration of overall profitability Unavoidable tendency to prefer short term investments What is an annuity? (one answer) An investment asset that matures after one year The annual interest being paid on an investment object Any returns / cash flows generated on an annual basis An investment asset that pays a fixed sum each year for a specified number of years The interest being paid on an investment object held in perpetuity You can buy a small forest for 1,000,000.-. Assume the forest will yield an annual net 30,000.- in passive income for you and your family, potentially forever. Also assume an annual inflation rate of 3% forever. What should you do? (one answer) The forest has a positive real value, so you should buy it The value of the forest will just be enough to counter inflation, look for an alternative The real value of the forest far exceeds the asking price, you should buy it The forest will lose in real value, look for an alternative The value of the forest and the income from it are certain to rise in the future, you should buy it Why is CAPEX relevant for investment appraisal? (one best answer) It usually is the biggest expense on the entire investment Knowledge on CAPEX is essential to set the target rate of return Without limiting CAPEX, interest would fall to zero over time Without holding CAPEX at initial value, interest would fall to zero over time CAPEX has nothing to do with investment appraisal Any interest will only ever be paid on initial CAPEX You have 1200.- to invest today. Assume you buy a savings plan that will give you 5.5% interest p.a. Also assume you are going to reinvest all interest at the same rate. What is the value of your investment at the end of February 20337 Please round and enter full Euros only! You have 1200.- to invest today. Assume you buy a savings plan that will give you 6.2% interest p.a.. Assume you are going to reinvest all interest at the same rate. You will also be able to add another 800,- to the same savings plan in February 2025. What is the total value of your investment at the end of February 2033? Please round and enter full Euros only! Two investments are proposed to you, alternative A has a NPV of 1000.- and requires you to invest 100,000.- alternative B has a NPV of 500.- and requires you to invest 10,000.-. Which one would you prefer (one best answer)? They are equal to me Alternative A, because the NPV is higher Alternative B, because it uses a different target rate Alternative B, because I can invest 90,000 in something additional The target rate of return has been reached for both, so I take alternative B Alternative A, because the risk is higher in B Which one statement is not a typical shortcoming of payback period comparisons? Attributing returns / cash flows to specific investment alternatives can be arbitrary They give a rough estimate on risk associated with alternative investments Any returns / cash flows generated after paybak point are not considered No consideration of overall profitability Unavoidable tendency to prefer short term investments What is an annuity? (one answer) An investment asset that matures after one year The annual interest being paid on an investment object Any returns / cash flows generated on an annual basis An investment asset that pays a fixed sum each year for a specified number of years The interest being paid on an investment object held in perpetuity You can buy a small forest for 1,000,000.-. Assume the forest will yield an annual net 30,000.- in passive income for you and your family, potentially forever. Also assume an annual inflation rate of 3% forever. What should you do? (one answer) The forest has a positive real value, so you should buy it The value of the forest will just be enough to counter inflation, look for an alternative The real value of the forest far exceeds the asking price, you should buy it The forest will lose in real value, look for an alternative The value of the forest and the income from it are certain to rise in the future, you should buy it Why is CAPEX relevant for investment appraisal? (one best answer) It usually is the biggest expense on the entire investment Knowledge on CAPEX is essential to set the target rate of return Without limiting CAPEX, interest would fall to zero over time Without holding CAPEX at initial value, interest would fall to zero over time CAPEX has nothing to do with investment appraisal Any interest will only ever be paid on initial CAPEX You have 1200.- to invest today. Assume you buy a savings plan that will give you 5.5% interest p.a. Also assume you are going to reinvest all interest at the same rate. What is the value of your investment at the end of February 20337 Please round and enter full Euros only! You have 1200.- to invest today. Assume you buy a savings plan that will give you 6.2% interest p.a.. Assume you are going to reinvest all interest at the same rate. You will also be able to add another 800,- to the same savings plan in February 2025. What is the total value of your investment at the end of February 2033? Please round and enter full Euros only