Two parts attached.

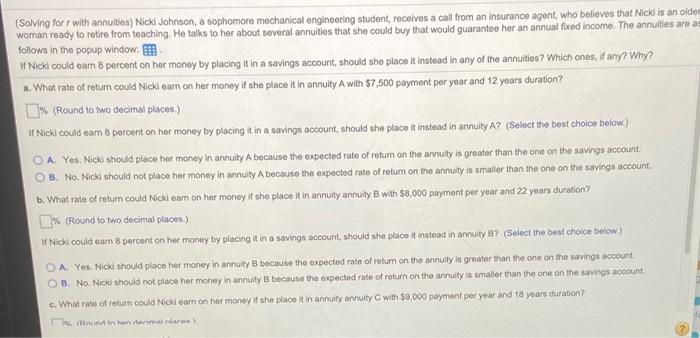

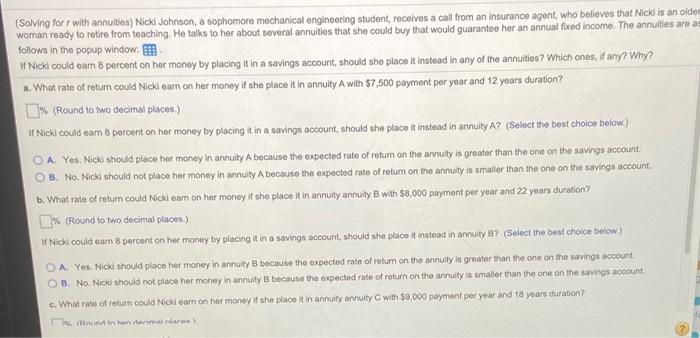

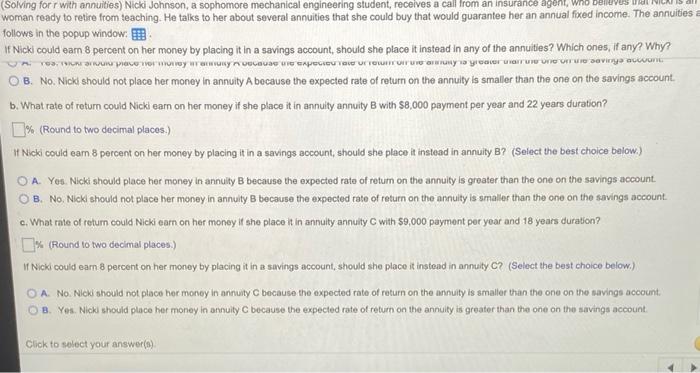

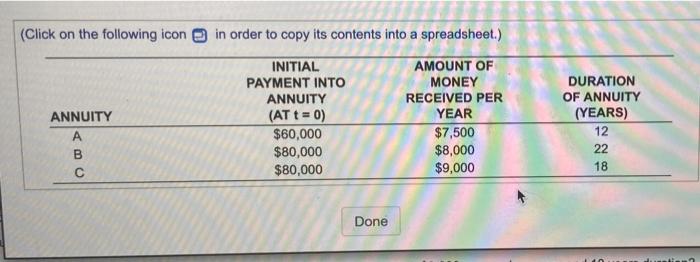

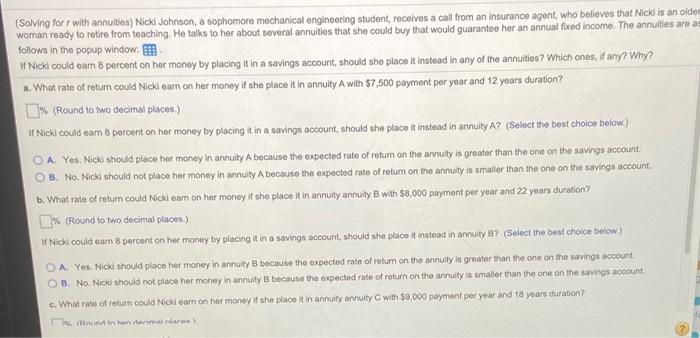

(Solving for with annuities) Nicki Johnson, a sophomore mechanical engineering student, receives a call from an insurance agent, who believes that Nicki is an older woman ready to retire from teaching. He talks to her about several annuities that she could buy that would guarantee her an annual fixed income. The annuities are a follows in the popup window it Nicki could earn 8 percent on her money by placing it in a savings account, should she place it instead in any of the annuities? Which ones, if any? Why? a. What rate of retum could Nicki eam on her money if she place it in annuity A with $7,500 payment per year and 12 years duration? [ % (Round to two decimal places) u Nicki could eam 8 percent on her money by placing it in a savings account, should she place it instead in annulty A? (Select the best choice below) O A Yes. Nicki should place her money in annully A because the expected rato of return on the annuity is greater than the one on the savings account OB. No. Nicki should not place her money in annuity A because the expected rate of return on the annuity is smaller than the one on the savings account b. What rate of return could Nicki cam on her money if she place it in annuity annuity B with $8,000 payment per year and 22 years duration? % (Round to two decimal places) If Nicki could earn 8 percent on her money by placing it in a savings account, should she place it instead in annuity B? (Select the best choice below) OA Yes. Nicki should place her money in annuity B because the expected rate of return on the annuity is greater than the one on the savings account OB, No. Nicid should not place her money in annuity because the expected rate of return on the annuity is smaller than the one on the savings account c. What rate of return could Nicki cam on her money if the place it in annuity annuity with $9.000 payment per year and 18 years duration? Wind in warmware (Solving for r with annuities) Nicki Johnson, a sophomore mechanical engineering student, receives a call from an insurance agent, Wro bent vs NILA woman ready to retire from teaching. He talks to her about several annuities that she could buy that would guarantee her an annual fixed income. The annuities = follows in the popup window: ? of Nicki could eam 8 percent on her money by placing it in a savings account, should she place it instead in any of the annuities? Which ones, if any? Why? . , O B. No. Nicky should not place her money in annuity A because the expected rate of return on the annulty is smaller than the one on the savings account b. What rate of return could Nicki earn on her money if she place it in annuity annuity B with $8,000 payment per year and 22 years duration? 1% (Round to two decimal places.) Nicki could eam 8 percent on her money by placing it in a savings account, should she place it instead in annuity B? (Select the best choice below.) O A. Yes. Nicki should place her money in annuity B because the expected rate of return on the annuity is greater than the one on the savings account OB. No, Nickl should not place her money in annuity B because the expected rate of return on the annuity is smaller than the one on the savings account. c. What rate of return could Nicklearn on her money if she place it in annuity annuity with $9,000 payment per year and 18 years duration? % (Round to two decimal places.) i Nicki could earn 8 percent on her money by placing it in a savings account, should she place it instead in annuty C? (Select the best choice below.) O A No. Nich should not ploco hor money in annuity because the expected rate of return on the annuity is smaller than the one on the savings account OB. Yel. Nicki should place hat money in annuity C because the expected rate of return on the annuity is greater than the one on the savings account Click to select your answer(s) (Click on the following icon in order to copy its contents into a spreadsheet.) INITIAL PAYMENT INTO ANNUITY (AT t = 0) $60,000 $80,000 $80,000 ANNUITY AMOUNT OF MONEY RECEIVED PER YEAR $7,500 $8,000 $9,000 DURATION OF ANNUITY (YEARS) 12 22 B 18 Done