Question

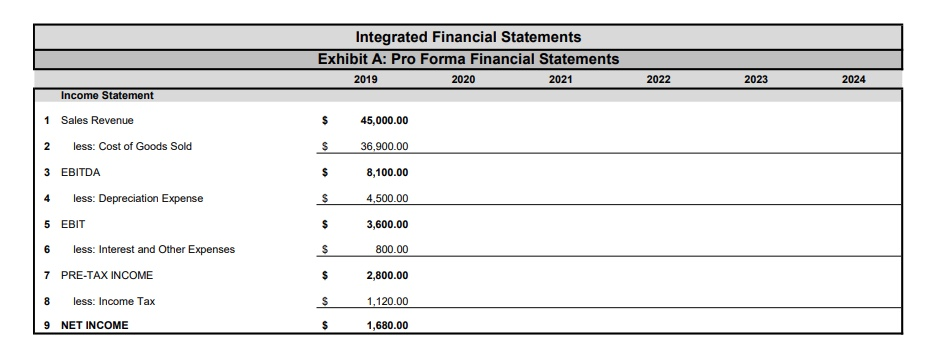

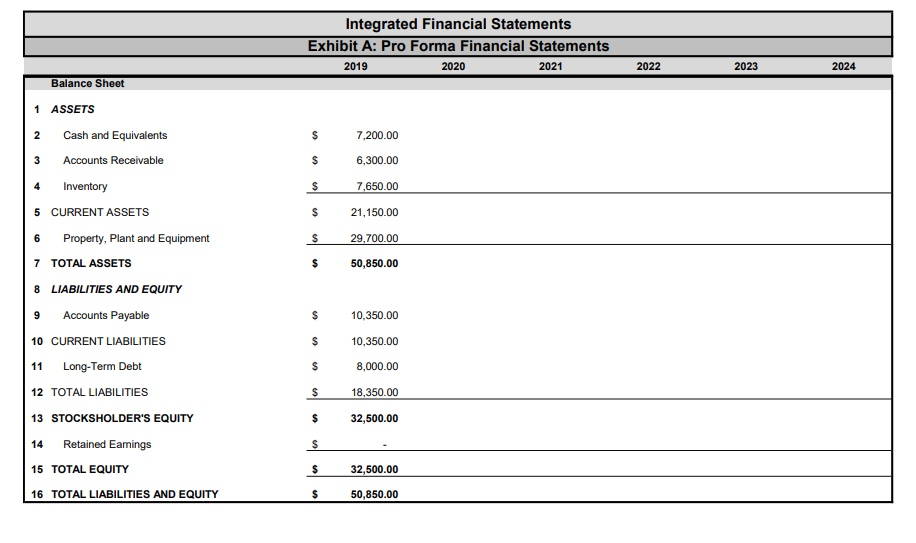

3) For the following problems, use Exhibit A. For exhibit A, the amount of sales depends on the production volume shown below. a. What will

3) For the following problems, use Exhibit A. For exhibit A, the amount of sales depends on

the production volume shown below.

a. What will be the depreciation for 2024?

NOTE: Provide your answers in dollars. E.G. for 100M you must

enter 100000000.0000, for 20M you must enter 20000000.000, etc.

b. What will be the cash and equivalents for 2022?

NOTE: Provide your answers in dollars. E.G. for 100M you must

enter 100000000.0000, for 20M you must enter 20000000.000, etc.

c. What will be the accounts payable for 2023?

NOTE: Provide your answers in dollars. E.G. for 100M you must

enter 100000000.0000, for 20M you must enter 20000000.000, etc.

d. Imagine that the corporation decides to use debt for any external financing, what

would be the amount of debt in 2020?

NOTE: Provide your answers in dollars. E.G. for 100M you must

enter 100000000.0000, for 20M you must enter 20000000.000, etc.

| Production volume (000s units) |

| |||||||||

| 1. 1 | Market Size | $ 10,000.00 | $ 10,500.00 | $ 11,025.00 | $ 11,576.25 | $ 12,155.06 | $ 12,762.82 2 | |||

| 2 | Market Share | 10.00% | 15.5% | 46% | 51.5% | 57% | 62.5% | |||

| 3 | Production Volume (Market Size X Market Share) | 1000.00 |

|

|

|

|

| |||

| 4 | Average Sales Price | $45.00 | 45.90 | $46.82 | $47.75 | $48.71 | $49.68 | |||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started