Question

Two very close publicly traded competitive companies are home depot and Lowes. Home depot stock is currently up 11% for the year while Lowes is

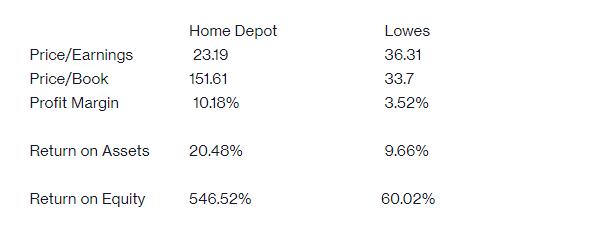

Two very close publicly traded competitive companies are home depot and Lowes. Home depot stock is currently up 11% for the year while Lowes is up 3%.

Why do you think this has occurred?

Price/Earnings Price/Book Profit Margin Return on Assets Return on Equity Home Depot 23.19 151.61 10.18% 20.48% 546.52% Lowes 36.31 33.7 3.52% 9.66% 60.02%

Step by Step Solution

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The difference in stock performance and financial ratios between Home Depot and Lowes can be attributed to various factors Here are some possible expl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Accounting

Authors: Fred Phillips, Robert Libby, Patricia Libby

5th edition

78025915, 978-1259115400, 1259115402, 978-0078025914

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App