Answered step by step

Verified Expert Solution

Question

1 Approved Answer

two years ago the orice of a bond was 958, and one year ago thr price of the bond was 971.over the past year the

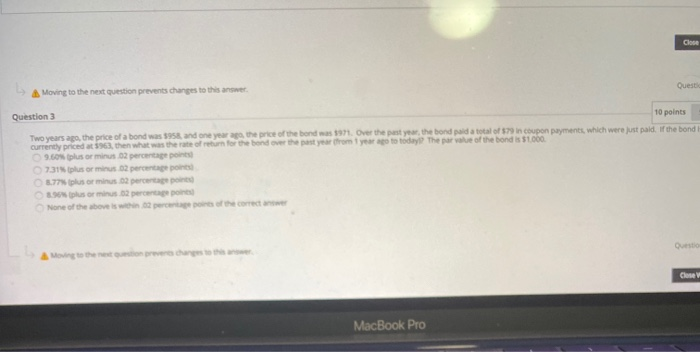

two years ago the orice of a bond was 958, and one year ago thr price of the bond was 971.over the past year the bind paid a total of $79 in coupon payments which were nust paid. if the bond is chrrently lriced at $963, then what was fhe rate of return for the bond over the past year (from 1 year sgo today)? the par value of thr bond is $1000

Close Quest Moving to the next question prevents changes to this answer Question 3 10 points Two years ago, the price of a bond was 5958, and one year ago, the price of the bond was 1971. Over the past year, the bond paid a total of 579 in coupon payments, which were just paid of the bond currently priced at 5963, then what was the rate of return for the bond over the past year from year ago to today? The part of the bond is $1.000 9.60 plus or minus 2 percentage points 731 plus or minus 2 percentageport 6.77 plus minus 2 percentage plus minus 52 percent None of the above is in the correct Close MacBook Pro Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started