Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tycoon and Company Ltd is considering the following two options. Refurbish and keep the existing machine Replace the existing machine with a new one.

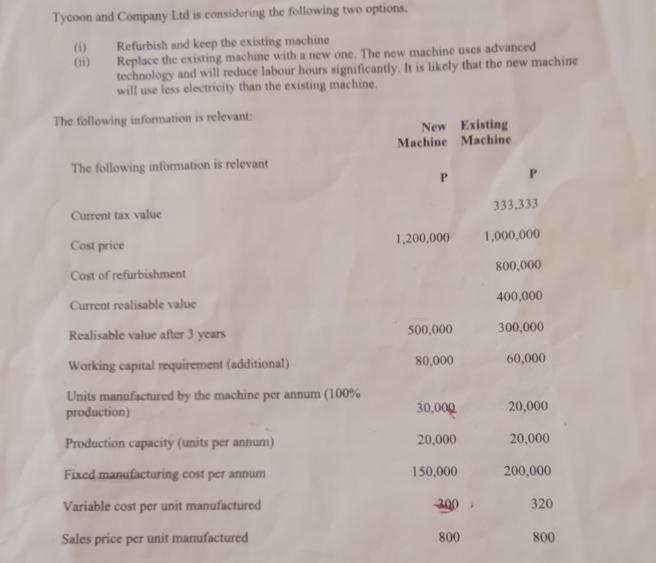

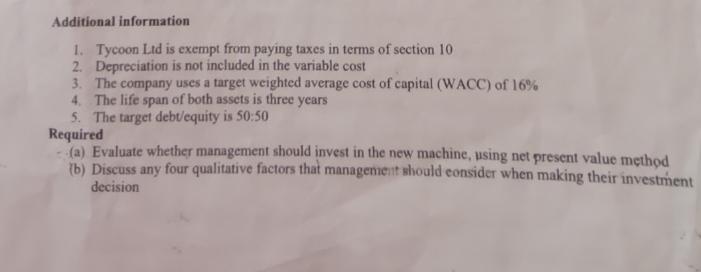

Tycoon and Company Ltd is considering the following two options. Refurbish and keep the existing machine Replace the existing machine with a new one. The new machine uses advanced technology and will reduce labour hours significantly. It is likely that the new machine will use less electricity than the existing machine. (i) (ii) The following information is relevant: The following information is relevant Current tax value Cost price Cost of refurbishment Current realisable value Realisable value after 3 years Working capital requirement (additional) Units manufactured by the machine per annum (100% production) Production capacity (units per annum) Fixed manufacturing cost per annum Variable cost per unit manufactured Sales price per unit manufactured Existing New Machine Machine 1,200,000 500,000 80,000 30,000 20,000 150,000 800 333,333 1,000,000 800,000 400,000 300,000 60,000 20,000 20,000 200,000 320 800 Additional information 1. Tycoon Ltd is exempt from paying taxes in terms of section 10 2. Depreciation is not included in the variable cost 3. The company uses a target weighted average cost of capital (WACC) of 16% 4. The life span of both assets is three years 5. The target debt/equity is 50:50 Required (a) Evaluate whether management should invest in the new machine, using net present value method (b) Discuss any four qualitative factors that management should consider when making their investment decision

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Net Present Value NPV Evaluation To evaluate whether management should invest in the new machine w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started