Question

You manage a large portfolio of Australian companies, composed of mining and manufacturing stocks. The mining stocks have an expected return of 5% and

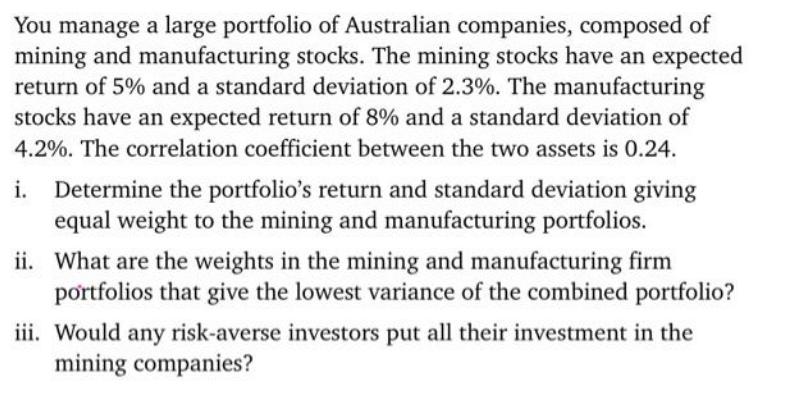

You manage a large portfolio of Australian companies, composed of mining and manufacturing stocks. The mining stocks have an expected return of 5% and a standard deviation of 2.3%. The manufacturing stocks have an expected return of 8% and a standard deviation of 4.2%. The correlation coefficient between the two assets is 0.24. i. Determine the portfolio's return and standard deviation giving equal weight to the mining and manufacturing portfolios. ii. What are the weights in the mining and manufacturing firm portfolios that give the lowest variance of the combined portfolio? iii. Would any risk-averse investors put all their investment in the mining companies?

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION i Equal weights portfolio Mining stocks Expected return 5 Sta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial management theory and practice

Authors: Eugene F. Brigham and Michael C. Ehrhardt

13th edition

1439078106, 111197375X, 9781439078105, 9781111973759, 978-1439078099

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App