Answered step by step

Verified Expert Solution

Question

1 Approved Answer

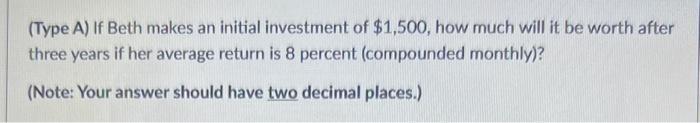

(Type A) If Beth makes an initial investment of $1,500, how much will it be worth after three years if her average return is

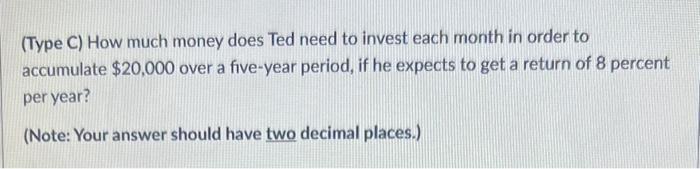

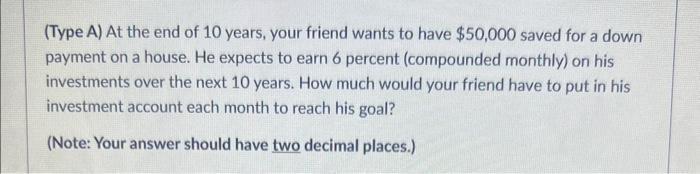

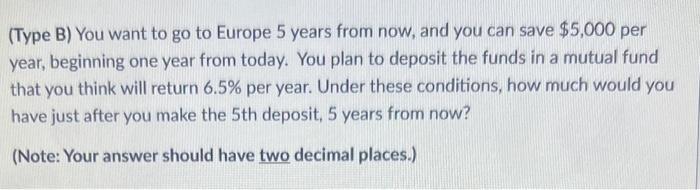

(Type A) If Beth makes an initial investment of $1,500, how much will it be worth after three years if her average return is 8 percent (compounded monthly)? (Note: Your answer should have two decimal places.) (Type C) How much money does Ted need to invest each month in order to accumulate $20,000 over a five-year period, if he expects to get a return of 8 percent per year? (Note: Your answer should have two decimal places.) (Type A) At the end of 10 years, your friend wants to have $50,000 saved for a down payment on a house. He expects to earn 6 percent (compounded monthly) on his investments over the next 10 years. How much would your friend have to put in his investment account each month to reach his goal? (Note: Your answer should have two decimal places.) (Type B) You want to go to Europe 5 years from now, and you can save $5,000 per year, beginning one year from today. You plan to deposit the funds in a mutual fund that you think will return 6.5% per year. Under these conditions, how much would you have just after you make the 5th deposit, 5 years from now? (Note: Your answer should have two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The questions found on the images provided are asking for calculations related to personal finance and investments using compound interest for a lump sum investment and ordinary annuity calculations f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started