Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to complete this. What formulas do you use to get the calculations? Blue Hamster Manufacturing Inc.'s income statement reports data for its first year

How to complete this. What formulas do you use to get the calculations?

How to complete this. What formulas do you use to get the calculations?

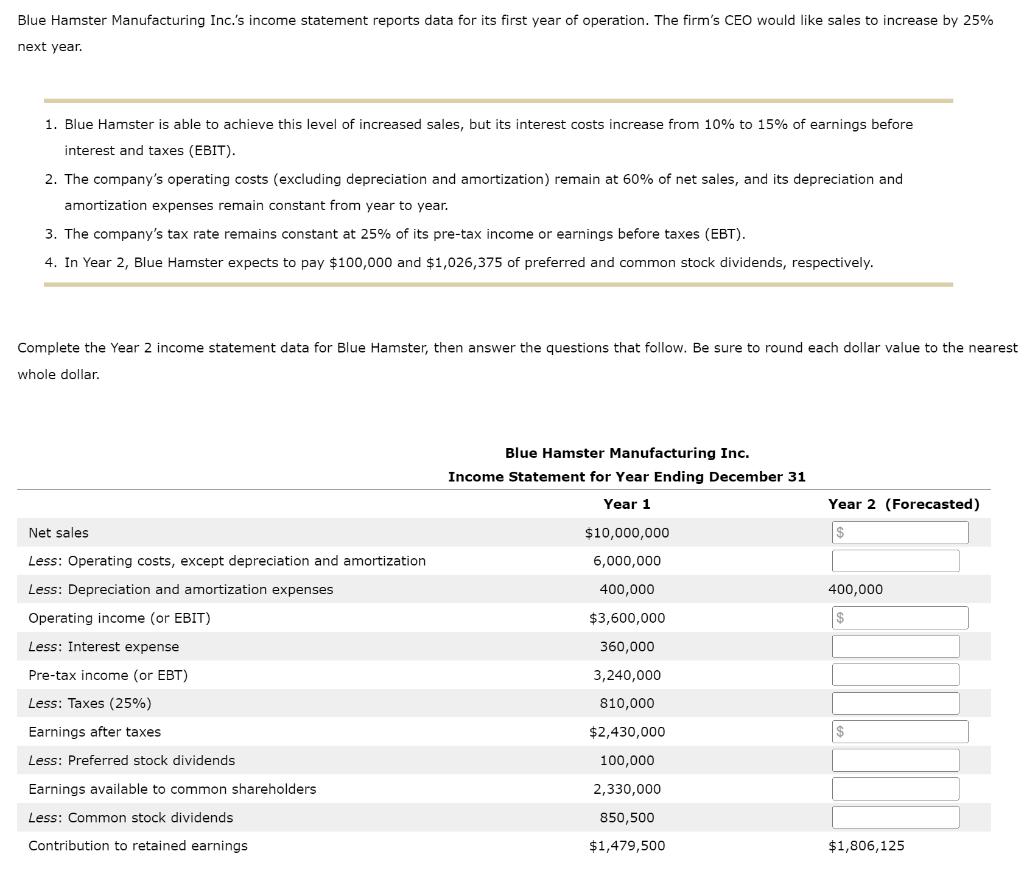

Blue Hamster Manufacturing Inc.'s income statement reports data for its first year of operation. The firm's CEO would like sales to increase by 25% next year. 1. Blue Hamster is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before interest and taxes (EBIT). 2. The company's operating costs (excluding depreciation and amortization) remain at 60% of net sales, and its depreciation and amortization expenses remain constant from year to year. 3. The company's tax rate remains constant at 25% of its pre-tax income or earnings before taxes (EBT). 4. In Year 2, Blue Hamster expects to pay $100,000 and $1,026,375 of preferred and common stock dividends, respectively. Complete the Year 2 income statement data for Blue Hamster, then answer the questions that follow. Be sure to round each dollar value to the nearest whole dollar. Net sales Less: Operating costs, except depreciation and amortization Less: Depreciation and amortization expenses Operating income (or EBIT) Less: Interest expense Pre-tax income (or EBT) Less: Taxes (25%) Earnings after taxes Less: Preferred stock dividends Earnings available to common shareholders Less: Common stock dividends Contribution to retained earnings Blue Hamster Manufacturing Inc. Income Statement for Year Ending December 31 Year 1 $10,000,000 6,000,000 400,000 $3,600,000 360,000 3,240,000 810,000 $2,430,000 100,000 2,330,000 850,500 $1,479,500 Year 2 (Forecasted) $ 400,000 $ $ $1,806,125

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Required details are given below Blue Hamster Manufacturing Inc Incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started