Answered step by step

Verified Expert Solution

Question

1 Approved Answer

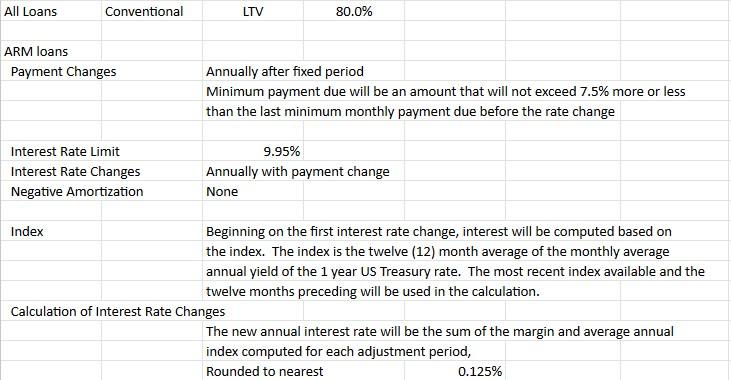

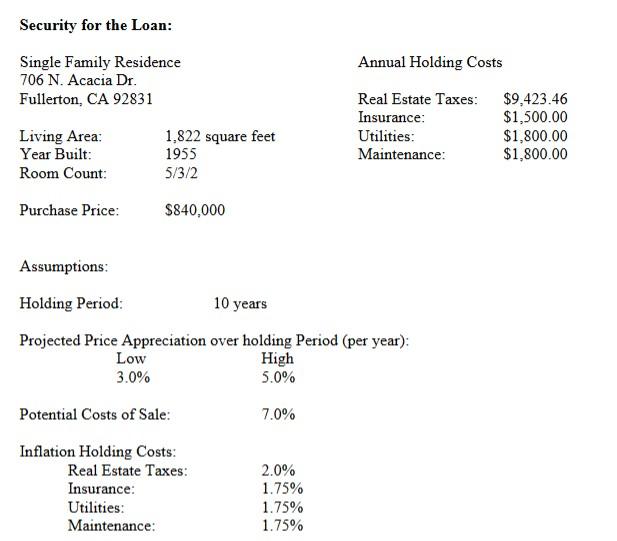

Type Term Rate Amortization Points Origination Fees Index Margin Fixed 30 6.250% Monthly 0.000% $995 0 0.00% Compute and Describe the following: 1. Payment over

| Type | Term | Rate | Amortization | Points | Origination Fees | Index | Margin |

| Fixed | 30 | 6.250% | Monthly | 0.000% | $995 | 0 | 0.00% |

Compute and Describe the following: 1. Payment over term of the loan 2. Nominal Interest Rate 3. Effective Interest Rate held to term 4. Effective Interest Rate held through holding period 5. Loan balance at end of holding period 6. Annual holding costs 7. Equity Return of Sale 8. Internal Rate of Return on Equity before taxes 9. Gross Income Needed to Qualify for Loan

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started