TYPE THE ANSWER

TYPE THE ANSWER

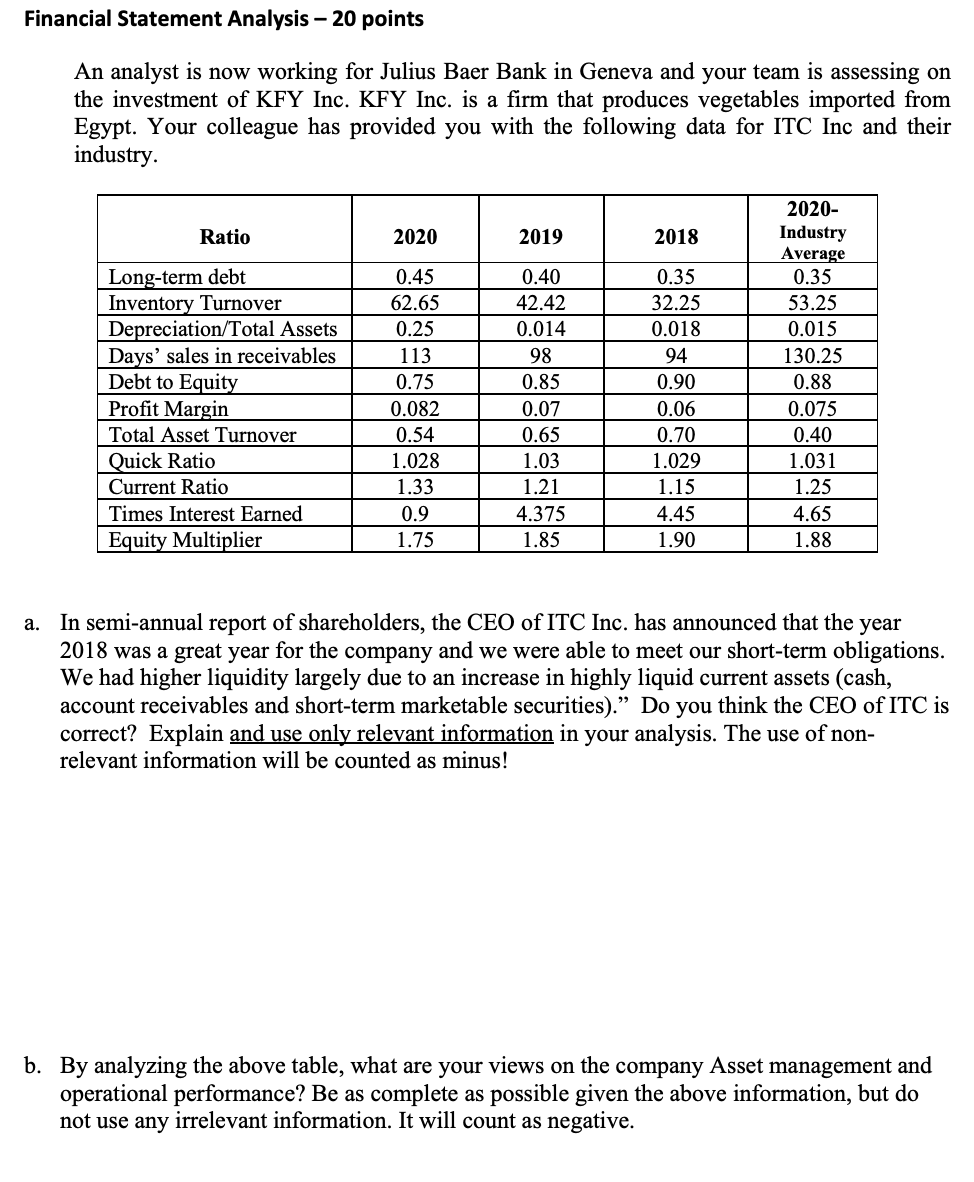

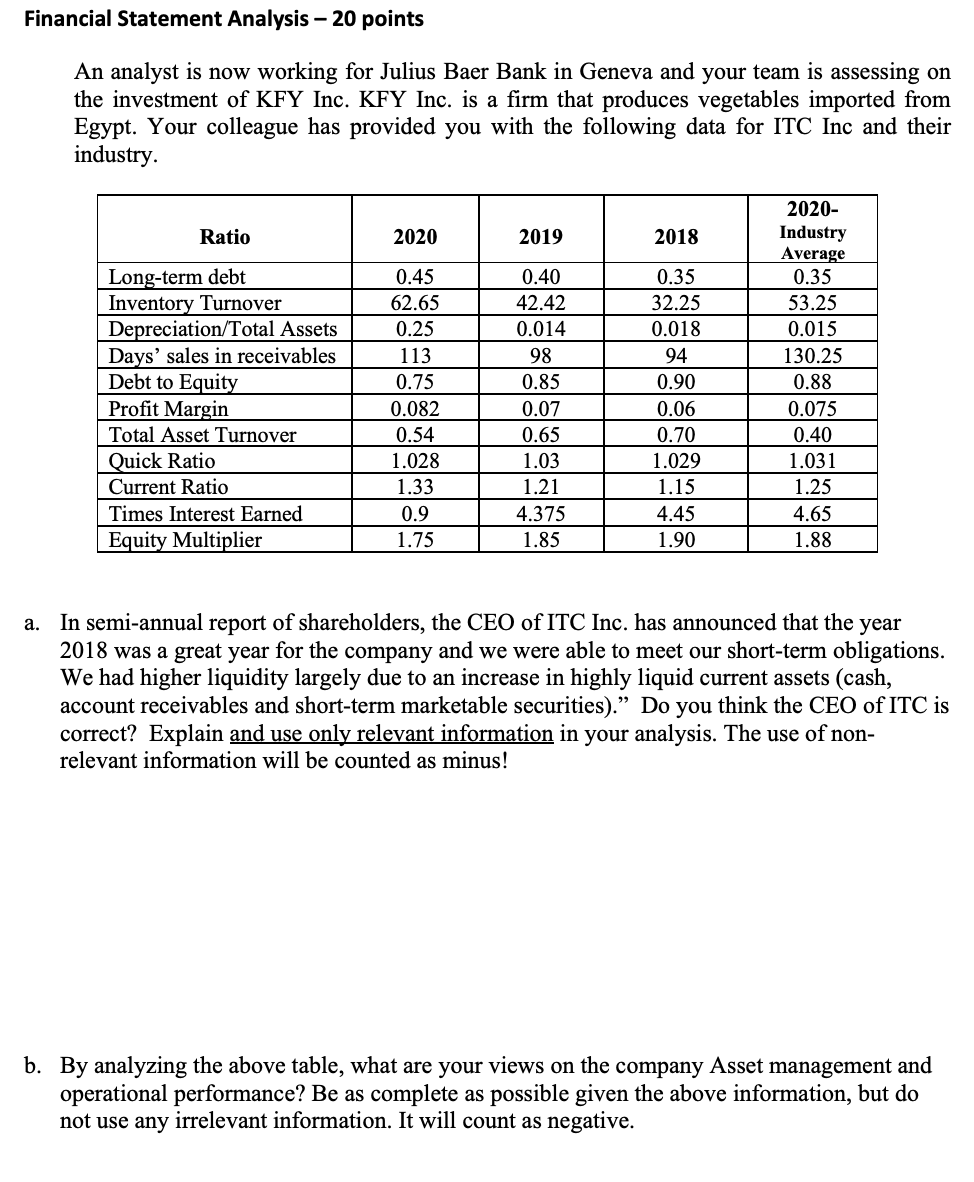

Financial Statement Analysis - 20 points An analyst is now working for Julius Baer Bank in Geneva and your team is assessing on the investment of KFY Inc. KFY Inc. is a firm that produces vegetables imported from Egypt. Your colleague has provided you with the following data for ITC Inc and their industry. Ratio 2020 2019 2018 VIII Long-term debt Inventory Turnover Depreciation/Total Assets Days' sales in receivables Debt to Equity Profit Margin Total Asset Turnover Quick Ratio Current Ratio Times Interest Earned Equity Multiplier 0.45 62.65 0.25 113 0.75 0.082 0.54 1.028 1.33 0.9 1.75 0.40 42.42 0.014 98 0.85 0.07 0.65 1.03 1.21 4.375 1.85 0.35 32.25 0.018 94 0.90 0.06 0.70 1.029 1.15 4.45 1.90 2020- Industry Average 0.35 53.25 0.015 130.25 0.88 0.075 0.40 1.031 1.25 4.65 1.88 a. In semi-annual report of shareholders, the CEO of ITC Inc. has announced that the year 2018 was a great year for the company and we were able to meet our short-term obligations. We had higher liquidity largely due to an increase in highly liquid current assets (cash, account receivables and short-term marketable securities). Do you think the CEO of ITC is correct? Explain and use only relevant information in your analysis. The use of non- relevant information will be counted as minus! b. By analyzing the above table, what are your views on the company Asset management and operational performance? Be as complete as possible given the above information, but do not use any irrelevant information. It will count as negative. Financial Statement Analysis - 20 points An analyst is now working for Julius Baer Bank in Geneva and your team is assessing on the investment of KFY Inc. KFY Inc. is a firm that produces vegetables imported from Egypt. Your colleague has provided you with the following data for ITC Inc and their industry. Ratio 2020 2019 2018 VIII Long-term debt Inventory Turnover Depreciation/Total Assets Days' sales in receivables Debt to Equity Profit Margin Total Asset Turnover Quick Ratio Current Ratio Times Interest Earned Equity Multiplier 0.45 62.65 0.25 113 0.75 0.082 0.54 1.028 1.33 0.9 1.75 0.40 42.42 0.014 98 0.85 0.07 0.65 1.03 1.21 4.375 1.85 0.35 32.25 0.018 94 0.90 0.06 0.70 1.029 1.15 4.45 1.90 2020- Industry Average 0.35 53.25 0.015 130.25 0.88 0.075 0.40 1.031 1.25 4.65 1.88 a. In semi-annual report of shareholders, the CEO of ITC Inc. has announced that the year 2018 was a great year for the company and we were able to meet our short-term obligations. We had higher liquidity largely due to an increase in highly liquid current assets (cash, account receivables and short-term marketable securities). Do you think the CEO of ITC is correct? Explain and use only relevant information in your analysis. The use of non- relevant information will be counted as minus! b. By analyzing the above table, what are your views on the company Asset management and operational performance? Be as complete as possible given the above information, but do not use any irrelevant information. It will count as negative

TYPE THE ANSWER

TYPE THE ANSWER